It might if you were reading Philstockworld on September 18th, the day of the previous Fed meeting when, despite all expectations being for a "taper" that day, the markets were rocketing to new highs – albeit on suspiciously low volume. That low volume and the overbought conditions on the McClellen Oscillator kept us cautious ahead of the Fed and that caution paid off in spades as 11 out of the next 14 days were down days for the market and the S&P fell from it's all-time high of 1,729.06 to 1,646.47 (4.8%) in 3 weeks.

As we expected, it was a "healthy" 5% correction and it did indeed lead us to new highs. In fact, here we are, on the morning of the next Fed announcement and the S&P is at 1,771.95 – another all-time high – but this time the anticipation is that the Fed will not taper. In fact, a lot of people seem to think the Fed will ease more than they already have. That's keeping the Dollar down (79.60) and the markets up – for the moment.

Here's yesterday's chart by Dave Fry of the S&P's intraday activity. What a fantastic example of what a BS, bot-driven market we have when you see an almost identical move, right down to the day's volume! There were no earnings during the last Fed meeting, so you can imagine where the noise came from but, as usual, 90% of the trading is still done by computers – so why would we expect different results?

Here's yesterday's chart by Dave Fry of the S&P's intraday activity. What a fantastic example of what a BS, bot-driven market we have when you see an almost identical move, right down to the day's volume! There were no earnings during the last Fed meeting, so you can imagine where the noise came from but, as usual, 90% of the trading is still done by computers – so why would we expect different results?

What really matters is which switch the masters throw AFTER the Fed this afternoon. We already know what the bear switch does – 14 days of darkess at least. The bull switch is a possiblity but it would seem kind of ridiculous to move even higher, after we just jumped from 1,646 to 1,771 (7.6%) over the last 15 sessions.

14 sessions down, 15 sessions up and we're right back to a Fed meeting. The only people getting rich in this kind of market are your brokers (and you can tell from their earnings reports!). Sure we picked plenty of winners (see our September Trade Reviews) along the way but it's a frustrating way to play and has wrecked havok with our short-term trading. as we tend to rely on Fudamentals which have clearly been tossed out the window this year.

BlackRock CEO, Larry Fink, warns: "The Fed's policy is contributing to "bubble-like markets." He said it is "imperative" that the Fed begins to taper its $85 billion monthly asset purchase program. "We've seen real bubble-like markets again. We’ve had a huge increase in the equity market. We’ve seen corporate-debt spreads narrow dramatically."

BlackRock CEO, Larry Fink, warns: "The Fed's policy is contributing to "bubble-like markets." He said it is "imperative" that the Fed begins to taper its $85 billion monthly asset purchase program. "We've seen real bubble-like markets again. We’ve had a huge increase in the equity market. We’ve seen corporate-debt spreads narrow dramatically."

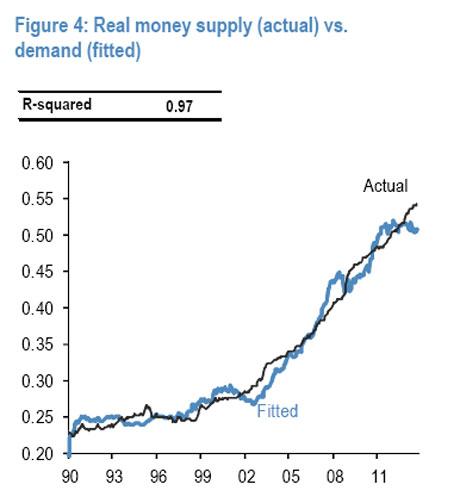

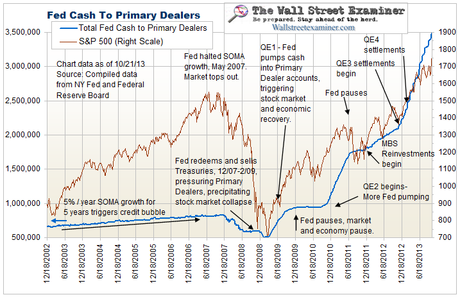

JPM has just issued a report stating: "The current episode of excess liquidity, which began in May 2012, appears to have been the most extreme ever in terms of its magnitude." They said the latest surge is far beyond anything seen in the last three episodes of excess liquidity: 1993-1995, 2001-2006, and during the Lehman emergency response from October 2008 to September 2010, all of which set off a blistering rise in asset prices.

This is not a problem right now. The bank says there is enough juice to keep the boom going for several more months, but it stores up bigger problems for later. "It could be a warning if fundamentals are out of whack. Markets could be vulnerable next year if that liquidity starts to disappear."

Per Ambrose Pritchart: Determining levels of excess money is no easy task. The devil is in the detail. JP Morgan measures "broad liquidity" held by firms, pension funds, households (etc) as well as banks. They say correctly (a crucial point often missed) that QE bond purchases from banks do not necessarily boost the broad money supply. You have to buy outside the banks. In very crude terms, excess liquidity is the gap between "money demand and money supply". When confidence returns, demand for money falls, so it finds a home elsewhere in stocks, property, and such.

If JP Morgan is right, you can see why the BIS, the IMF, and Fed hawks are biting their fingernails worrying about the next train wreck. There is clearly a huge problem with the way QE has been conducted. The wash of money has set off another asset boom, yet the world economy has failed to achieve "escape velocity", and is arguably still in a contained depression. Global trade volumes contracted by 0.8% in August. (It would have been a lot worse without QE of course, though we can never prove it).

The head of the IMF in Asia is already asking the BOJ to take their foot off the gas, but they can't do it if we don't do it! "We currently don't see a need for further monetary easing," said Anoop Singh, director of the IMF's Asia and Pacific Department, in a media roundtable.

The head of the IMF in Asia is already asking the BOJ to take their foot off the gas, but they can't do it if we don't do it! "We currently don't see a need for further monetary easing," said Anoop Singh, director of the IMF's Asia and Pacific Department, in a media roundtable.

"Rather, the priority now is to advance growth reforms. For Abenomics to work, Japan's long-term economic problems need to be tackled. Based on IMF calculations, additional fiscal savings of around 5% of GDP are needed beyond 2015 to bring down debt," he said.

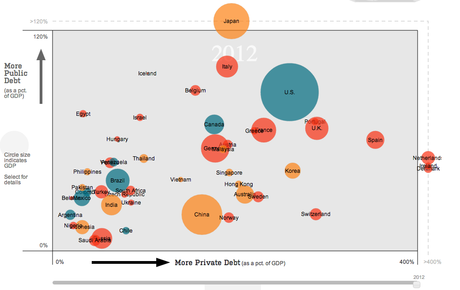

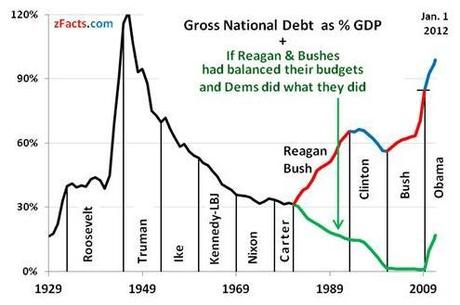

As you can see from the chart above, Japan's debt to GDP has gone off the charts and is, by some measures, now 240% of their GDP. The US is well over 100% of GDP now and, as you can see, the sheer size of our debt (more than all of Europe combined) makes this a very hard bubble to sustain.

Yet sustaining the debt bubble is job one at the Fed, who are buying up $85Bn worth of debt every month – essentially all of it! This is like paying your bills by writing a check to your wife to cover the bills and she then deposits it and pays the bills and then you write her another check next month but no outside money comes in – you just keep writing new checks (and increasing debt) to pay off new bills and pretend your budget is "balanced."

As you can see from the chart above, Japan's debt to GDP has gone off the charts and is, by some measures, now 240% of their GDP. The US is well over 100% of GDP now and, as you can see, the sheer size of our debt (more than all of Europe combined) makes this a very hard bubble to sustain.

Yet sustaining the debt bubble is job one at the Fed, who are buying up $85Bn worth of debt every month – essentially all of it! This is like paying your bills by writing a check to your wife to cover the bills and she then deposits it and pays the bills and then you write her another check next month but no outside money comes in – you just keep writing new checks (and increasing debt) to pay off new bills and pretend your budget is "balanced."

We have gone from a nation that pays it's bills and has outstanding credit to one that threatens not to pay it's bills and is pushing it's credit to the limits we hit while fighting both a Depression at home and a World War.

We have gone from a nation that pays it's bills and has outstanding credit to one that threatens not to pay it's bills and is pushing it's credit to the limits we hit while fighting both a Depression at home and a World War.

It was that constant REDUCTION of debt, from 1947- 1981, that made the Dollar the World's reserve currency but we have since taken that PRIVILEGED position and squandered it, and our currency has fallen 5% in value this year alone.

5% in a year is worthless in 20 years – seriously? No one cares? Seriously?

We'll see if the Fed cares later today.