TODAY is the day!

TODAY is the day!

I blame Econoday, which had Powell speaking yesterday on Monday's Economic Calendar but it turned out he is speaking today and tomorrow to Congress so the market just drifted along for the most part – continuing the boring trend for the month as we attempt to get over the 3,000 line on the S&P 500 (/ES).

We did the math for the 5% Rule™ in yesterday's Live Member Chat Room and decided that 2,976 would be the inflection point and we closed a bit over the line yesterday but we're right back on the line this morning.

Powell's testimony begins at 10am and goes on for a couple of hours but his official statement being released at 8:30 so we'll see a quick reaction (not necessarily the right one) ahead of the bell. Oil and Gasoline are up 2% off a strong API Report and the EIA Report confirms or denies those numbers at 10:30 – so that's another market-mover to watch this morning AND we have the Atlanta Fed's Business Expectations Report, also at 10 am and, just in case Powell doesn't get us over 3,000, Bullard has a speech lined up at 1:30 – just ahead of the Fed minutes.

8:30 update: So much for waiting for Powell as his statement has popped the Dow 100 points already and here are the key points from his statement:

- Since June, uncertainty continues to weigh on the outlook

- Inflation pressures remain muted

- Uncertainty over trade, global growth

- Business investment slowed ‘notably’

- Brexit, debt ceiling are unresolved

- ‘Crosscurrents have reemerged’

- Fed will ‘act as appropriate’ to sustain expansion

- Baseline is still solid economic growth

- Economy performing ‘reasonably well’

- Inflation to move back over time to 2% objective

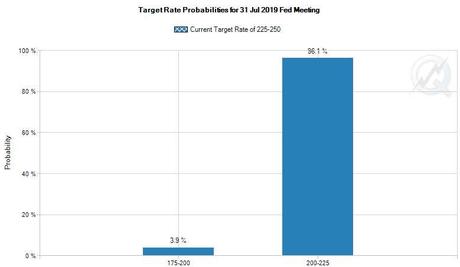

Traders are keying off "Fed will act as appropriate to sustain expansion" which indicates they are 100% behind this rally but it's a bit of cherry-picking as Powell is also saying we are on track to hit the inflation target (so easing makes no sense) and the "worries" he has for the economy are still Trade and Brexit (and their effect on…

Traders are keying off "Fed will act as appropriate to sustain expansion" which indicates they are 100% behind this rally but it's a bit of cherry-picking as Powell is also saying we are on track to hit the inflation target (so easing makes no sense) and the "worries" he has for the economy are still Trade and Brexit (and their effect on…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!