Check out this chart:

Check out this chart:

That's the NYSE McClellen Oscillator, which hasn't been this high (overbought) since July of 2011, when the S&P plunged from 1,345 to 1,123 (16.5%) in 4 terrifying weeks. Yesteday's rally was a very low-volume affair 101.3M on SPY (about 60% of normal) and we were goosed by Peter Schiff on CNBC at 1:10 pm, claiming QE4 was right around the corner:

Ahead of tomorrow's decision by the FOMC, Peter Schiff ventured on to CNBC to discuss the economy, the fed, and gold… among other things. Schiff rightly fears that while the Fed may well stop QE3 tomorrow, QE4 will not be too long behind it as he notes, rather eloquently, that "an economy that lives by QE, will die by QE" as the Fed's total lack of willingness to allow stocks to fall (see Bullard 2 weeks ago) or a 'cleansing' recession leaves the nation's economy in far worse shape than it was before the Fed's intervention. Schiff calmly replies to the anchor's questions (as she proclaims "I am not on the side of the Fed but…"), gently explains his view on gold when challenged about his 'wrongness', but when a guest starts hounding him for being dangerous to CNBC viewers wealth… Schiff (rightly) loses it – must watch!

As noted by Dave Fry:

As noted by Dave Fry:

It seems bulls are confident the Fed will end QE on schedule and at the same time give bulls dovish comments about conditions (“don’t mess with us”!) going forward. Many pundits are discussing interest rates remaining unchanged for several years and longer.

That means companies like IBM can continue (another $5 billion share buyback announced today) their financial engineering to lessen float making it easy to report better earnings at the price of future innovation and company growth. But bulls don’t care about future growth, only what takes place now. Besides, this is the season when bulls make their year, so let’s ignore anything beyond current tape action.

The S&P's 350-point (35%) run in 2011 began and ended with QE2 and our current 400-point run (25%) began with the extension of "Operation Twist", which is expected to end today.

Here's what happened next in 2011:

Now, there's nothing wrong with a good, old-fashioned sell-off. We'll be thrilled to get a buying opportunity if the S&P drops 200-250 points after the Fed stops easing. After all, it was the announcement of Operation Twist in October of 2011 that saved us from that collapse and led to the current rally – why should we not expect QE4 – Santa Claus will ALWAYS come down our chimney forevermore – Poppa Schiff said so!

Now, there's nothing wrong with a good, old-fashioned sell-off. We'll be thrilled to get a buying opportunity if the S&P drops 200-250 points after the Fed stops easing. After all, it was the announcement of Operation Twist in October of 2011 that saved us from that collapse and led to the current rally – why should we not expect QE4 – Santa Claus will ALWAYS come down our chimney forevermore – Poppa Schiff said so!

Just in case he doesn't though, we added another hedge in yesterday's Live Member Chat and we sent it out as a Top Trade Alert to our subscribers, along with a well-timed bullish trade idea for AAPL, who led the markets higher with a 1.5% move on the day. We also found a nice, bullish hedge to play possible QInfinity by simply buying the TNA Nov $75/80 bull call spreads at $1.20, which pay $5 (up 316%) at 1,173 on the Russell – which would only require a move equal to yesterday's over the next 3.5 weeks.

As it stands now, the market is expecting QE to be extended or the end of QE to be delayed in today's Fed announcement (2pm) though I'm pretty sure they are wrong and, with the market just 2% from all-time highs – I just don't see the Fed wanting to use more firepower just so the IBanks can have a good finish to 2014.

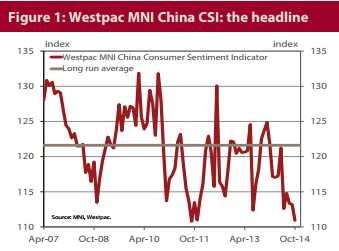

Meanwhile, we talked about China data that "does not make sense" in yesterday's post and today, Australia's Westpac Bank is backing me up with a report that shows China's Consumer Sentiment Indicator taking a nose-dive along with Industrial Production numbers that show a 30% decline in the past year.

Meanwhile, we talked about China data that "does not make sense" in yesterday's post and today, Australia's Westpac Bank is backing me up with a report that shows China's Consumer Sentiment Indicator taking a nose-dive along with Industrial Production numbers that show a 30% decline in the past year.

Sadly, these numbers do make perfect sense and they line up a lot more clearly with the data we get from Europe and the rest of Asia than does the "official" Chinese data.

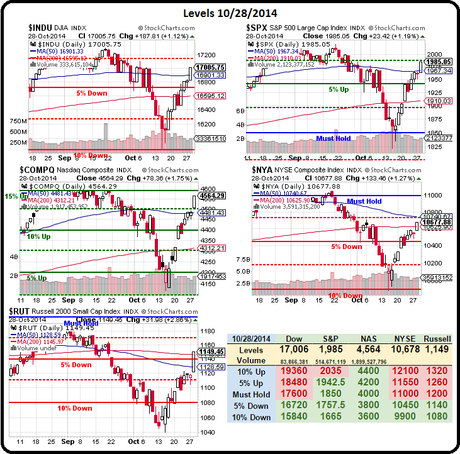

It's going to be another crazy day today. If the Fed doesn't wave it's magic wand at 2pm, expect a market temper-tantrum that wipes out yesterday's gains by tomorrow. Frankly, I'm really not sure what the Fed can say to justify the Nasdaq's 10% run in the past two weeks or the 5%+ runs put up by the other indexes:

So please – be careful out there!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!