Brother can you spare 410Bn dimes?

Brother can you spare 410Bn dimes?

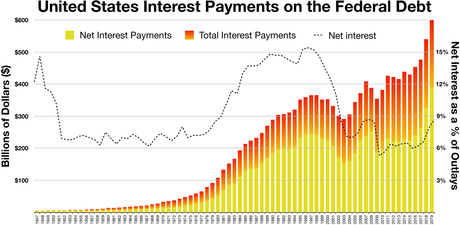

That's what we need to sell in today's 10-Year Note Auction and, if you have $41Bn to spare for 10-years, our Government will be happy to pay you almost (but not quite) 1% interest for holding your money. Needless to say, these auctions have been attracting less and less interest and, if it is perceived that the US has trouble borrowing money, that could put upward pressure on rates and we certainly can't afford that since we are $27Tn in debt – soon to be $30Tn in debt when Biden passes his $1.9Tn Stimulus Bill.

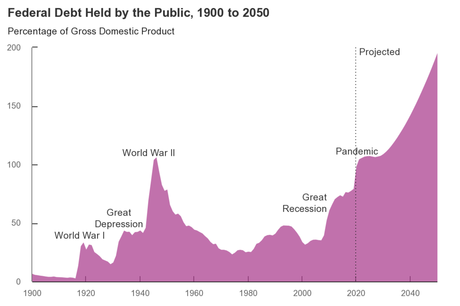

That's why Fed Chair, Jerome Powell is jumping in to make a speech at 2pm – we may need him to spin those auction results to calm the markets if the auction doesn't go well. We are only in the early stages of the debt crisis that began in 2008 and has essentially kept going since – the pandemic is only the latest excuse to prop up our economy by printing more money and it won't be the last as our debt burden is projected to grow another 100% over the next 20 years:

After World War II, our Government initiated higher, progressive taxes to pay down our debt. This Government doesn't have the stomach to ask the people to make sacrifices, so we force the sacrifices on our children and our grandchildren – who will one day have to deal with the mess we are making.

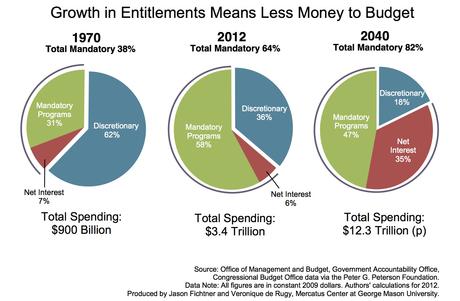

Here's the real kille, even at 1%, the interest on our debt is $400Bn a year yet, NORMALLY, the government pays around 4.5%, which would be $1.8Tn so, if rates ever do normalize, we would have to find $1.8Tn (1/2 the entire budget and double the entire discretionary budget) just to pay the interest on the debt we already have and, since we would have to borrow that too, we'll quickly be in a cycle of ever-escalting debt until we finally have to default.

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!