You've got to short the Nasdaq at the 10,000 line!

You've got to short the Nasdaq at the 10,000 line!

The first time we hit 5,000 on the Nasdaq was back in 2,000 – and we all know what happened then! It took us 17 years to get back to 5,000 and that was good consolidation and we popped right over it and stayed there. Well, we didn't stay there – the Nasdaq took off like a banshee and gained another 50% in 18 months and now, another 18 months later, another 33% move higher and we're at 10,000.

Even a small retracement from here can spell big money shorting the /NQ Futures, which pay $20 per point, per contract. At the moment, the Nasdaq is over 10,000 so we play it when it crosses back under and use the 10,000 line as a stop line. We're just looking for psychological resistance or profit-taking at this point – there's no particular Fundamentals behind shorting the Nasdaq – especially if Apple (AAPL), which makes up 15% of the index, is heading towards $350/share.

Without taking into account a very slow 2nd quarter, which winds down this month, the price/earnings ratio on the Nasdaq is now over 30 times earnings vs 23 times earnings last year so, even without the damage done by the virus, the Nasdaq has gotten 30% more expensive to buy now. Oddly enough, that's nothing compared to the Russell 2000, which is trading at a whopping 55 times earnings at 1,500 vs "just" 36 times earnings last year. So, if the Russell can blast 50% higher from 35 times earnings – why can't the Nasdaq?

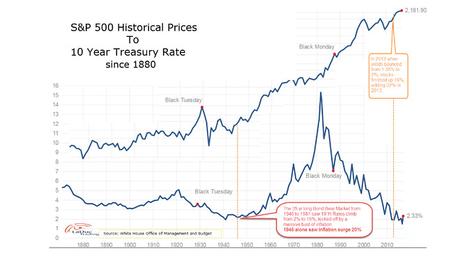

Housing hasn't been a good investment since 2007 despite the low rates and that's because property taxes are eating into the gains in property value – forcing the monthly cost of the homes to rise more rapidly than they can appreciate in price. Gold and Silver have gone up in price as has Bitcoin but, on the whole, there's really no good place to put your money other than US equities and the Fed is now buying ETFs and boosting the market as are other Central Banks around the World plus there is all that FREE MONEY the Government is tossing around.

Today is the Fed Meeting (2pm) and we'll see what they have to say about things. Until then, it's a watch and wait kind of day…

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!