I already did a full rundown on GDP.

I already did a full rundown on GDP.

We tweeted it out from our Live Member Chat Room this morning and you can read all about it here, so I'm not going to waste time going over it all again as there are lots of other important things to talk about.

First on my list is Lumber Liquidators (LL), which was one of the 3 Top Trades we featured on Monday at Seeking Alpha to show people how clever we are at picking stocks. We're not looking so clever this morning as LL had their earnings report and the stock is down 17%, to $27.65, on news of a $7.78M loss for Q1 (0.29/share) vs a $13.7M profit (0.49/share) in last year's Q1. $2.3M of that loss came from Home Test Kits the company sent to it's customers to verify that their floorboards weren't killing them and legal costs pretty much made up the rest.

Same-Store Sales, surprisingly, were only down 1.8% despite all the negative publicity but the company also announced that Federal Charges were pending under the Lacey Act, which is a 1907 law governing the import of plant products. There are also 100 class-action suits pending, so the legal issues aren't going away soon and will continue to hurt profits – even while the customers continue shopping. While it will be a long turnaround, we stand by our trade idea, which was:

Same-Store Sales, surprisingly, were only down 1.8% despite all the negative publicity but the company also announced that Federal Charges were pending under the Lacey Act, which is a 1907 law governing the import of plant products. There are also 100 class-action suits pending, so the legal issues aren't going away soon and will continue to hurt profits – even while the customers continue shopping. While it will be a long turnaround, we stand by our trade idea, which was:

Our trade idea for LL consists of selling 5 of the 2017 28 puts for $6.90 ($3,450), which obligates you to buy 500 shares of LL at $28 ($14,000 total potential risk on the trade if LL goes BK). We can then use the money collected to buy 10 of the 2017 $30/40 bull call spreads at $3.46 ($3,460) for net $10 on $10,000 worth of spreads.

With any luck, we'll have an opportunity today to position this trade more aggressively as LL drops back below $30 but I'll tell you right now that this is a ridiculous over-reaction to news that has already been out and is well-priced into the deeply discounted shares. Obviously, this is not an unfixable problem – they ALLEGEDLY sold wood that was sub-standard and the stock is now trading at 60% off. I'm done trying to convince you at this point.

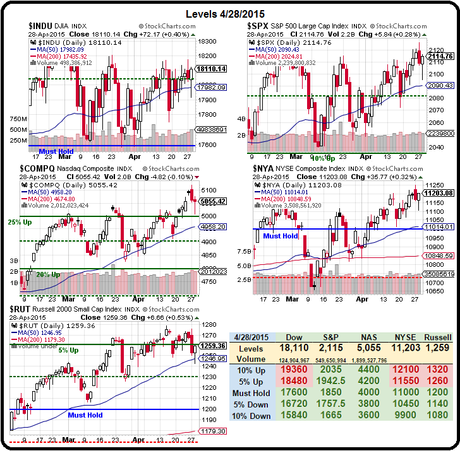

Hopefully we were more convincing about our reasons for shorting /TF (Russell Futures) and /ES (S&P Futures) in our Morning Alert to our Members (same Tweet) as we already got a lovely $500 drop in the Russell (1,260 to 1,255) and a $250 drop in the S&P (2,110 to 2,105). We demonstrated our Futures Trading Techniques in yesterday's live Webinar, where we were shorting at the same levels.

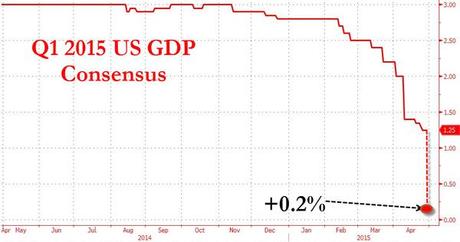

8:30 Update: GDP up just 0.2% in Q1 – below the low end of expectations and just a hair above contraction! The Futures actually moved UP a bit on this because it's the kind of bad news that could be good news and keep the Fed at the table for another few months because we're on the edge of Recession – not overheating the economy by any measure. This will be great for our index shorts, nonetheless.

8:30 Update: GDP up just 0.2% in Q1 – below the low end of expectations and just a hair above contraction! The Futures actually moved UP a bit on this because it's the kind of bad news that could be good news and keep the Fed at the table for another few months because we're on the edge of Recession – not overheating the economy by any measure. This will be great for our index shorts, nonetheless.

As we noted yesterday, we'll have to watch that 2,100 line on the S&P very closely, as it would be a critical failure if we can't hold that line – along with Nasdaq 5,000 (tested yesterday), Russell 1,250 (tested), Dow 18,000 (tested) and NYSE 11,000 (safe so far).

I know I sure as hell would be selling positions based on that GDP report but we already dumped our positions and went to CASH!!! and we have plenty of bear position in our Short-Term Portfolio, not to mention our BRILLIANT! index shorts. Our GDP was so bad, in fact, that the Dollar is dropping back to 95.50, down almost 1% on the day, which is masking the pullback in the indexes and commodities at the moment (though still down half a point on the indexes).

We discussed how the Government and the MSM lie to you this week and it was only 2 weeks ago, on Tax Day, that Treasury Secretary Jacob Lew said on CNBC:

We discussed how the Government and the MSM lie to you this week and it was only 2 weeks ago, on Tax Day, that Treasury Secretary Jacob Lew said on CNBC:

All of the forecasts that I see show for the remainder of the year to be pretty strong. And, if you look at the trajectory of economic data over the last year, year and a half, it has been consistently trending in the in the upward direction. And confidence is still high. I feel pretty confident that the economy will do well for the rest of the year.

That was literally 2.2 GDP percentage points ago. Since then, GDP growth has dropped 91.6% – do you really think he didn't see that coming at the time? As I said yesterday: "If the Government can suppress dissent and control the political messages then CERTAINLY they are also controlling what you THINK you know about the economy." I also said QE wasn't fixing anything and I don't think I need any more evidence to make that case than this TERRIBLE GDP report.

That was literally 2.2 GDP percentage points ago. Since then, GDP growth has dropped 91.6% – do you really think he didn't see that coming at the time? As I said yesterday: "If the Government can suppress dissent and control the political messages then CERTAINLY they are also controlling what you THINK you know about the economy." I also said QE wasn't fixing anything and I don't think I need any more evidence to make that case than this TERRIBLE GDP report.

Either way, I'm very glad we are in CASH!!! Yes, our Members were the ones selling to you as you chased the top of the markets and now, if you are very, very nice to us – we will consider taking some of your LL shares off your hands at about $28. We'll have to wait and see what the Fed says before making any other buys (but oil is a short at $57 on /CL Futures) but they will now need a definitive statement indicating more easing to prevent what could be a 5-10% correction (S&P 2,000 or lower).

Have I mentioned how much I like CASH!!! lately?

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!