Williams, Yellen, George and Kocherlakota.

Williams, Yellen, George and Kocherlakota.

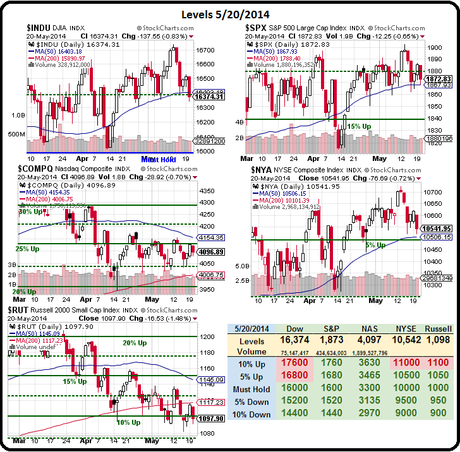

It's the "murderer's row" of economic BS today as, starting at 10am, we have 4 consecutive hours of Fed speeches ahead of the release, at 2pm, of the minutes of the last meeting (4/30), whose statement led to a bit of a sell-off the following week – knocking us down to the mid-April lows. With the Russell already failing those lows and the Dow again failing the 50 dma - the Fed is pulling out all the stops to spin things back to bullish.

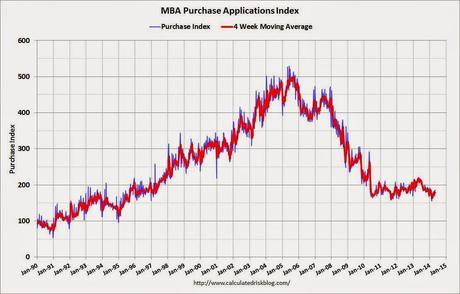

Even this morning, MBA Mortgage Applications were down 3% on purchases. That's 3% lower than last month, when they used the weather as an excuse for that crappy performance. 6 years and $6,500,000,000,0000 worth of stimulus later, we're barely above the level of housing purchases we had after the first S&L crisis in the early 90s and we're still over 60% below our peak housing levels.

Keep in mind that this is the number of home that are sold in the US, so it's a number that should always be rising as the number of homes expands over time. In 1990, there were 35M less homes (97M) than there are now (132M) but between 1990 and 2010, we built 34M homes or about 1.7M per year. In the last 4 years, however, we have built only 720,000 homes or just 180,000 homes per year!

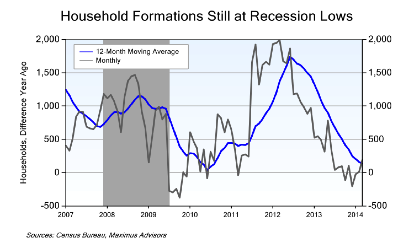

As you can see from the chart above, we are NOT forming a lot of new households and last yeare we actually dipped back into negative territory. If we assume that one home for 2.57 citizens is a "correct" number (and that really is skewed for a more prosperous time), then 314M of us should have 122M homes, not 132M homes – there are simply 10M too many homes in the US to be supported by the population.

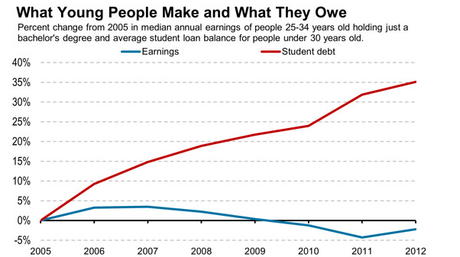

Student loan debt has exploded over the past 10 years while earnings for people aged 25-34 have declined which means, very simply, that they are unable to afford to form new households. Economics is not that complicated folks – the Corporate Media just pretends it is so they can justify the anti-American actions of the Oligarchy, who refuse to pay their fair share of taxes and drive our children into lifetimes of debt so they can transfer more wealth to the top 0.01%.

IN PROGRESS

This entry was posted on Wednesday, May 21st, 2014 at 8:31 am and is filed under Immediately available to public, Uncategorized. You can leave a response, or trackback from your own site.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!