Below 0 on the Small Business Optimism Index indicates how far below, as a percentage, things are going below expectations. At the moment, the economy is ACTUALLY performing at 30% below expectations for small businesses. 30%, for those of you without advanced degrees in Economics - is A LOT!

Below 0 on the Small Business Optimism Index indicates how far below, as a percentage, things are going below expectations. At the moment, the economy is ACTUALLY performing at 30% below expectations for small businesses. 30%, for those of you without advanced degrees in Economics - is A LOT!  Boy, we are getting A LOT of data that says the Economy sucks but, at the same time, the S&P is crawling back to it's all-time high - the one we were at on April Fool's Day (5,300), before we fell back 5.6% to 5,000 on the 19th.

Boy, we are getting A LOT of data that says the Economy sucks but, at the same time, the S&P is crawling back to it's all-time high - the one we were at on April Fool's Day (5,300), before we fell back 5.6% to 5,000 on the 19th.

That's all over now and we're back to happy, happy land at 5,272 and most of the big caps have reported so, unless Wal-Mart really screws things up tomorrow - we should at least grind out a re-test this week or next.

Yesterday, Jerome Powell told us to ignore the 66.6% hotter-than-expected PPI - despite the fact that it's the Fed's 2nd most important data point and this morning I guess we'll be told to ignore the CPI Report - which is THE MOST IMPORTANT data point the Fed is supposed to rely on.

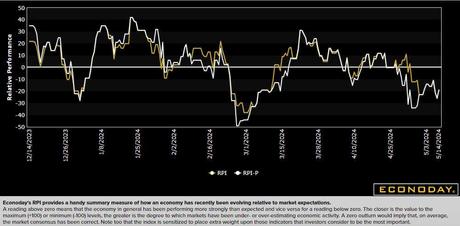

As you can see from the chart, March CPI was up 0.4% and that's an annualized 4.8% rate of inflation, which is 140% over the Fed's supposed 2% annual target. Today, CPI is expected to be down to 0.3% in April and I'm no Leading Economoron but Oil, for example, started March at $78 and started April at $88 so there's 12.8% right there.

- Cocoa was $6,000 to start March and $10,000 to start April - that's up 66.6%

- Sugar went from $21 in March to $23 in April - up 9.5%

- Gold, which many consider an inflation measure, went from $2,050 in March to $2,400 in April - that's up 17%

- Silver started March at $22.25 and hit $29 in April - up 30%

- Copper was $3.85 in March and hit $4.70 at the end of April (now $5!) - up 22%

- Beef prices fell from $185 in March to $172 in April - down 13%

- Hog prices rose from $85 to $105 - up 23%

- Corn went from $425 to $460 - up 8.2%

- Wheat went from $565 to $620 (now $685!) - up 9.7%

So I suppose Leading Economorons think we ate A LOT of beef in April? We'll find out at 8:30 (45 mins) but I have a funny feeling CPI may be higher than expected. The copper ETF, which began trading in March, sums things up quite nicely:

In addition to dividend hikes, share buybacks are also at an all-time high. Goldman Sachs reports that firms announced ¥1.2Tn ($7.7Bn) in share buybacks in April alone, setting a record for the first month of the fiscal year. Bruce Kirk, Goldman's chief Japan equity strategist, believes this bodes well for the prospects of another record year for buyback announcements.

8:30 Update: CPI did come in at 0.3% but the long-term readings are still hot. Retail Sales are flat to last month vs up 0.2% that was hoped for, so more signs of consumer weakness and, worst of all, Empire State Manufacturing is down 15.6% vs -7.5% expected so, as noted by Small Business Optimism - things are going worse than expected on many fronts.

Let's be careful out there...