![When China Stops Buying Gold [courtesy Google Images]](https://m5.paperblog.com/i/92/924411/when-china-stops-buying-gold-L-XWFcJr.png)

[courtesy Google Images]

StreetAuthority“Chinese officials are quietly building the world’s largest national reserves of gold bullion . . . and within the next year, the Chinese government reportedly wants to shock the markets with a surprise announcement of their pumped-up holdings.

“Over the past 12 months the Chinese government has been stockpiling gold, with unprecedented quantities being bought and sold through markets in Beijing, Hong Kong and Shanghai.

“Some of this buying is being reported… but the majority of it is not. Because of this secrecy, few know that China (already by far the world’s largest gold producer) has surpassed India as the world’s largest gold importer for the first time in recent history.”

To understand the significance of China being both the world’s largest gold producer and the world’s largest gold importer, suppose that I were a billionaire and I spent $100 million purchasing some gold. Would that prove I viewed gold as the ultimate investment? Or might it merely mean I had more money than I knew what to do with and spent $100 million on gold the same month I spent $100 million on a yacht for my gorgeous mistress?

But suppose I were a billionaire who not only spent $100 million purchasing physical gold, but also abandoned my mistress and took to the mountains with a pan, shovel and mule to prospect for more gold. The fact that I wasn’t merely buying more gold, but was actually devoting my time and energy to prospect for more gold would be much stronger evidence of my conviction that gold is a tremendous investment.

Likewise, we might ignore China’s determination to buy more gold on the international market as simply evidence that China that has huge savings and a desire to get rid of its $1.2 trillion US fiat dollars.

But China isn’t only the world’s largest importer of gold. It’s also the world’s largest producer of gold. China isn’t simply trading fiat dollars for gold. China is spending enormous sums to mine more gold than any other nation on earth.

More, China isn’t merely mining that gold and immediately selling it. China is holding every ounce that it buys or mines for some time in the future. China is investing in gold. Big time.

China is the world’s “black hole” of gold. Gold goes into China and it does not come out. China buys gold. China mines gold. But China doesn’t currently sell gold.

Implication? China seems convinced that owning gold is vital to the future prosperity and possible survival both nations and, perhaps, individuals.

Further, China seems convinced that the value of gold will rise dramatically in the foreseeable future. If that weren’t true, China would be selling gold now to make a fast profit, rather than holding gold for some future time or events.

China is probably also convinced that the political power associated with gold will also rise dramatically in the foreseeable future.

I won’t argue that China’s convictions are infallible, but they’re a good indicator that the price, value and power of gold will rise dramatically over the next several years.

• One more implication: If China is about to announce that it has, say, 8,000 tons of gold, we might ask Why would they make that announcement?

Why wouldn’t the secretive Chinese conceal the true size of their gold treasury?

It seems unlikely that China would merely want to brag about their supply of gold.

But it might be that they believe that they’ve acquired all the “cheap,” underpriced gold that is available for easy acquisition. It might be that China recognizes that the international supply of gold available on the commodities markets is about exhausted. It might be that China would want to signal that the US Treasury’s supply of gold is nearly depleted—and therefore, the price of gold is about to skyrocket.

Y’ see, China has delighted in the incredibly low price of gold over the past two years. Those low prices made acquisition of thousands of tons of gold more affordable. But once the world supply is largely depleted and it’s no longer possible to acquire massive amounts of gold at cheap prices, then whoever holds gold will want the price to rise.

In other words, while China is buying, say, 8,000 tons of gold, China would want the price of gold to stay as low as possible. But once China: 1) has acquired 8,000 tons; 2) can’t find much more gold that’s easily acquired; and 3) holds the world’s biggest treasury of gold—then China will use its influence to cause the price of gold to rise. A lot.

If China figures that it can’t acquire much more gold, would China rather have 8,000 tons of gold be priced at $1,300/ounce? Or would it rather have 8,000 tons priced at $5,000 per ounce? Or even $25,000 per ounce? The answer’s obvious.

Why would China figure that it can’t acquire much more gold? Maybe, because it knows the US Treasury is exhausted. There is a growing suspicion that the US Treasury has been secretly selling off the US Treasury’s supply of gold. These secret sales are presumably intended to support the fiat dollar by reducing the price of gold on US commodity markets.

Thus, China’s possible announcement that it holds the world’s largest supply of gold could be their way of saying “Game over—we won!” (and by implication, the West, and especially the United States, has lost).

The implications for the US financial system might be disastrous.

The implications for the fiat dollar might be disastrous.

The implications for the price of gold and for those holding gold might be fantastic.

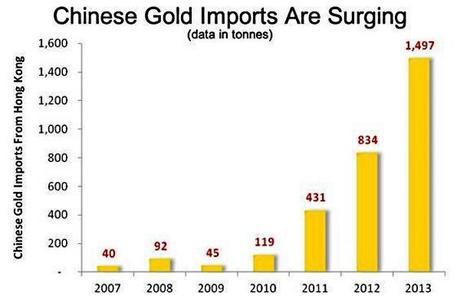

- You can see some evidence of what I mean in the chart below. It shows Chinese gold imports over the past seven years and the record increases over the last three years.

From A.D. 2007 to 2012 (six years), China imported a total of 1,561 tons of gold. But, in A.D. 2013 (one year), China imported 1,497 tons. Thus, they almost doubled their gold supply in A.D. 2013 alone and now hold a reported 3,000 tons of gold.

But those imports are almost certainly under-stated. China’s real holding in gold could be somewhere between 5,000 and 8,000 tons. Maybe more.

These reports can be viewed in relation to the US Treasury which reportedly holds about 8,200 tons of gold—but hasn’t produced a public inventory since A.D. 1953 (sixty-one years ago).

It’s a good bet that if China announces the true size of its gold treasury within the next year, that size will probably be the largest (more than 8,200 tons) in the world.

But, even if China currently holds only 3,000 tons of gold, if China continues to acquire more gold at last year’s reported rate (1,500 tons), it will exceed the reported size of the US gold treasury in just three more years.

• More importantly, if China is acquiring gold at the rate of 1,500 tons per year, where’s that gold coming from?

A lot of people believe that some significant percentage of those 1,500 tons are being secretly sold to China by the US Treasury. If so, the US Treasury no longer holds 8,200 tons of gold—and, according to some sources, may already be virtually depleted.

Thus, it’s conceivable that China already owns more gold than remains in the US Treasury.

So, suppose China announces how much gold it really has. Suppose that sum is several thousand tons more than the 3,000 tons that’s currently admitted. People will do the math and wonder where the extra several thousand tons came from. Most of the rest of the world will provide reasonably honest statements of how much gold they have. If so, it won’t be hard to figure that the only remaining source of what may be an “extra” several thousand tons of Chinese gold was probably the US Treasury.

I.e., if China holds 5,000 tons more gold than most people currently suppose, it’ll be pretty good evidence that the US Treasury holds 5,000 tons less than is currently claimed.

An announcement that China holds much more gold than is currently supposed might spawn a political furor in the US that might compel the US Treasury to provide an honest accounting of how much gold really remains at Fort Knox West Point and New York Federal Reserve vaults. (China might even open its treasury to an independent audit to prove how much gold it has and thereby “shame” the US into also conducting an independent audit of the US Treasury’s supply of gold.)

If it turns out that the supply of US gold is several thousand tons less than currently claimed, that will be deemed a reduced global supply of gold available to markets. That reduction in supply available to markets should drive the price of gold higher.

• A couple of simple truths are these:

1) The market supply of physical gold is shrinking fast;

2) The full impact of China’s unprecedented purchases of gold has not yet fully affected global markets.

A strong probability is this:

Within the next year or two we could be looking back on gold priced at $1,900 per ounce as “the time when gold was cheap.”

Implication: If China stops buying 1,000 or more tons of gold per year, it may signal that there’s no more easy gold to be found and the US Treasury is empty—and then the price of gold will rise. Big time.

Contrary to popular “logic,” it may be that that China’s incredible buying spree over the past two years did not raise the price of gold. But once that buying ends, the forces favoring higher gold prices may become ascendant and the price of gold may skyrocket.