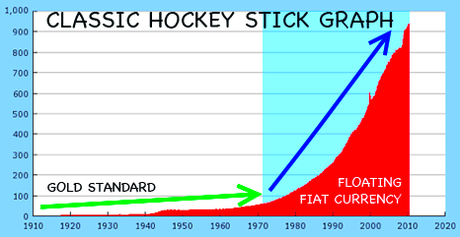

The original trend (green line) is fairly flat. Something happens around A.D. 1971 to cause the second trend line (blue) to accelerate upwards. That change in trend “velocity” marks the “Hockey-Stick Moment” where something unexpected and powerful suddenly took place. In this example, President Nixon severed gold’s relationship to the dollar.

GATA love it

According to the “About” page at Gold Anti-Trust Action committee’s website (www.gata.org),

“The Gold Anti-Trust Action Committee [GATA] was organized in the fall of 1998 to expose, oppose, and litigate against collusion to control the price and supply of gold and related financial instruments. The committee arose from essays by Bill Murphy, a financial commentator on the Internet (LeMetropoleCafe.com), and by Chris Powell, a newspaper editor in Connecticut.

Imagine that! GATA—and all that flows from it—started from just couple of “essays”.

As you’ll read, maybe the pen really is mightier than the sword.

“Murphy’s essays reported evidence of collusion among financial institutions to suppress the price of gold. . . .

“GATA financed the federal anti-trust lawsuit of its consultant, Reginald H. Howe—Howe vs. Bank for International Settlements et al. While the Howe suit was dismissed on a jurisdictional technicality, it yielded valuable information . . . and became the model for Blanchard Coin and Bullion’s anti-trust lawsuit brought the following year against Barrick Gold and J.P. Morgan Chase & Co. in U.S. District Court in New Orleans, whose settlement appears to have included Barrick Gold’s decision to stop selling gold in advance.

“[I]n December, 2009, GATA sued the Fed in U.S. District Court for the District of Columbia. In February 2011 the court ruled that most of the Fed’s gold records could remain secret but that one had to be disclosed: minutes of the April 1997 meeting of the G-10 Committee on Gold and Foreign Exchange. The minutes, released by the Fed . . , showed G-10 member treasury and central bank officials secretly discussing the coordination of their policies toward the gold market. The court ordered the Fed to pay court costs to GATA.”

Secret “coordination” = “conspiracy”.

“GATA has collected and published dozens of documents showing Western treasury and central bank efforts to intervene both openly and surreptitiously against a free market in gold.”

Today—18 years after GATA was first incorporated—it appears that GATA’s extraordinary efforts and persistence are about to bear fruit and free the gold markets from criminal manipulation and price suppression. The free (unmanipulated) market in gold may be about to return.

Deutsche Bank

Recently, ZeroHedge.com published an article entitled “Deutsche Bank Trader Admits To Rigging Precious Metals Markets.” According to that article,

“After months of ‘smoking guns’ and conspiracy theory dismissals, a Singapore-based Deutsche Bank trader finally confirmed (by admitting guilt) what many have suspected—the biggest banks in the world have conspired to rig precious metals markets.

“The Deutsche Bank trader, David Liew, pleaded guilty in federal court in Chicago to conspiring to spoof gold, silver, platinum and palladium futures, according to court papers. Bloomberg notes that spoofing involves traders placing orders that they never intend to fill, in an attempt to manipulate the price.”

“Spoofing” works like this. Suppose the current price of gold is $1,280. As gold market officers or employees, you and I might conspire to place a phony order for gold. Even though I have no gold, I might agree to sell 10,000 ounces of gold go you for, say, $1,270 per ounce. Even though you don’t have any currency, you might agree to pay the $1,270/ounce. Before that order was actually executed, the order’s financial elements (volume and price) would be reported and included in the gold price determination posted by the LBMA. Thus, that unexecuted order, priced at $1,270 per ounce, could cause the current price of gold to fall from $1,280 to $1,270.

But, later, you and I would simply cancel the order. No gold would change hands. No currency would change hands. But the price of gold would be manipulated downward by means of “spoofing” to fall by $10/ounce.

Tomorrow, or the next day, we could place another “spoof” order and cause the price to fall another $5 or $10 or $20. Because these spoof orders required no actual gold or actual currency, we could manipulate the market prices without actually spending or risking a dime. All we’d have to do is betray the public’s trust by placing orders we never intended to actually execute.

“Defendant Liew and other precious metals traders, including traders at Bank A, engaged in a conspiracy to commit wire fraud affecting a financial institution and spoofing, in the trading of precious metals futures contracts traded on the CME.

“Defendant Liew placed, and conspired to place, hundreds of orders to buy or to sell precious metals futures contracts that he intended to cancel and not to execute at the time he placed the orders (the ‘Spoof Orders’).”

There can be little doubt that GATA’s persistent investigations and associated lawsuits had helped generate increasing legal and political pressures on Deutsche Bank. These pressures helped to expose and stop market manipulation caused by Deutsche Bank officers and employees. It took nearly 20 years for GATA to reach their goal of proving that major financial institutions around the world were conspiring to manipulate the prices of gold—but that conspiracy is now confessed and undeniable. GATA won.

It’s the “Code of the West”

SGTreport recently published “London Bullion Market Association Launches Code of Conduct.”

According to that article,

“The London Bullion Market Association (LBMA) has launched a code of conduct to boost confidence in the $5 trillion London gold market.”

With that announcement, the LBMA implicitly admitted that public confidence (trust) in the LBMA gold and silver markets has been falling. I’ll bet that fall was primarily caused by growing public awareness of the criminal manipulation of gold and silver prices in global markets.

That manipulation has been perpetrated by financial institutions like the LBMA. As a result of the manipulation being exposed, people are increasingly distrustful of the LBMA. As people became increasingly aware of gold price manipulation, they became increasingly unwilling to participate in corrupt gold markets.

It seems likely that at least part of the reason the Shanghai Gold Exchange (SGE) was created in A.D. 2008 (and began to compete with the LBMA) is that many Asians realized that the LBMA and other gold markets of the western world were manipulated and therefore corrupt.

According to the SGE, in A.D. 2016, it handled 17 trillion renminbi’s ($2.5 trillion) in gold transactions .

That’s $2.5 trillion in gold transactions that might formerly have gone through the LBMA. If we assume that the LBMA made only 1% income on those transactions, in A.D. 2016, the SGE may’ve cut the LBMA’s gross by $25 billion.

More, the SGE claims that its A.D. 2016 volume was up 60% over A.D. 2015. Clearly, the handwriting is on the wall. Business that might’ve been handled by the LBMA was flowing to the Shanghai Gold Exchange and rate of flow is accelerating. Next year, the flow from LBMA to SGE may grow even faster.

If gold transactions were moving from the LBMA to the SGE due to criminal market manipulation, the lesson would be clear. Big-time, institutionalized crime no longer pays in the internet age. There are no secrets on the internet. Criminal acts (especially big one) are bound to be uncovered then exposed. Crime can’t pay unless the crime can be concealed. No secrets on the internet points to less crime on the internet. Thus, criminal conduct (like market manipulation) is bad for business—especially, any business that depends on public trust.

This is no small matter. I doubt that any debt-based financial institution can last for long on the internet without public trust. If markets or institutions lose that trust, they’ll quickly die.

Increasing Apprehension

The LBMA’s new-and-improved code of ethics strikes me as evidence that the LBMA is scared. Big time. It seems certain that the LBMA—facing the growing threat of criminal exposure and loss of market share—is scared enough to change its manipulative ways.

Like Mafia dons, LBMA members want to maintain their image as “legitimate businessmen”. Therefore, they’ve reacted to the creation and success of the Shanghai Gold Exchange and to the Deutsche Bank market manipulation convictions by establishing a new “code of conduct” for bankers, dealers and institutions that are involved with the large-scale sales of gold and silver.

“The code sets out standards and best practices expected from participants in the global over-the-counter (OTC) wholesale market for precious metals. It focuses on four primary areas: ethics, governance, compliance and risk management, and information sharing and business conduct.”

The “global” application of the new code of conduct implicitly admits that the extent of market manipulation has also been “global”. So far as I know, not one nation or government in all of the world has previously acted effectively or unilaterally to end precious metal market manipulation. Thus, that manipulation was not an accident or aberration. It was persistent and institutionalized. It was intentional. It was systemic. It was organized crime at the highest levels of government and finance.

The new code’s reference to “Information sharing” means no insider trading based on secret, insider knowledge and, thus, no “secret” market manipulation.

References to “ethics” and “business conduct” means no more criminal manipulation. Given that there are no secrets in the internet age, criminal conduct can no longer be reliably concealed. What’s the point to committing crimes if your crimes can’t be concealed? Therefore, the only way to restore public confidence in western precious metals markets is to minimize criminal conduct among the officers and officials who operate those markets.

How odd, hmm? How unexpected. The internet and organizations like GATA are forcing people, even politicians and bankers, to become honest and ethical. Quite a miracle, hmm?

“This new Global Precious Metals Code is intended to promote a robust, fair, effective and appropriately transparent market in which diverse groups of market participants, supported by resilient infrastructure, are able to confidently and effectively transact at competitive prices that reflect available market information and in a manner that conforms to acceptable standards of behavior.”

“Appropriately transparent” means no more “secret” manipulation by secret groups of insiders.

“Diverse groups” of people who are not “connected” to the market fraud will be able to participate in honest/free markets for precious metals. That means that gold prices will soon reflect whatever the free market openly decides rather than whatever the elite insiders secretly decree.

“Confidently” again emphasizes that the LBMA is losing whatever trust it once enjoyed.

The phrase, “prices that reflect available market information” refers to information that’s available in the public arena and only in the public arena. That implies that prices will be determined by the free market based on information that’s available to all, rather than by market manipulators acting secretly based on motives and information that are hidden from the public

“Acceptable standards of behavior” means no more crooks

“Such codes are important contributors to developing and establishing the trust on which markets depend. This trust is critical to the maintenance of an effective, fair and transparent market where high standards of behavior are the norm.”

Ohh, please! The LBMA makes it sound as if they’re a bunch of high-minded Boy Scouts who are determined to earn your trust by swearing to live a “morally straight” life. Therefore, they’re voluntarily adopting a new code of ethics to protect you and me, the “little people”.

In fact, the LBMA is just a bunch of white-collar crooks whose crimes over the past 20 years have been exposed and, finally, proven. Now, in order to minimize the risk of future prosecutions and lawsuits against themselves, they’re using Public Relations strategies (a new code of ethics) to convince the public that they’re all just “legitimate businessmen”. (Sure, you are, Don Corleone.)

Their new code of conduct is less a tribute to the LBMA’s moral fiber than it is to their fear of criminal prosecution and loss of business. Paraphrasing former President Nixon, the LBMA assures us that, “The LMBA is not a crook.”

Bunk. Yes, it is. Yes, it has been. But maybe, it won’t be (at least not so much) in the future if it’s code of ethics is actually enforced.

The LBMA’s repeated references to “trust” again imply that the LBMA is deeply concerned that its market manipulation has already caused a loss of trust that won’t be easily regained. (As every con-artist knows, you can’t effectively “con” people unless they first have irrationally-high levels of confidence (trust) in you.)

“LMBA members will have 12 months to demonstrate compliance with the code. Failure to do so could result in suspension or withdrawal of membership.”

Or, they might even suffer the dreaded “slap on the wrist”.

OK, sarcasm aside, the important point is that the LBMA has implied that the rigging of gold and silver prices will end or at least be significantly reduced within the next 12 months. That implies that the gold markets will be increasingly unmanipulated over the next twelve months. That should cause the price of gold to rise steadily towards true, free market levels over the next 12 months. In fact, if the code is already in effect, market manipulation may have already begin to diminish.

That strikes me as extraordinarily good news for anyone who now holds or is purchasing gold or silver. If: 1) the new “code of ethics” will be enforced; then, 2) institutionalized manipulation and price fixing in the gold and silver markets is about to be dramatically reduced or even ended; and, therefore, 3) the prices of gold and silver should rise steadily, strongly and perhaps explosively for at least the next several years.

I don’t know what those free market prices will ultimately be. $3,000? $5,000? $50,000? Who can say?

But I do know that the coming free (unmanipulated) market prices for gold and silver must be much higher than they are today. More, I’m not predicting that we’ll reach the maximum, free-market prices for precious metals within the next 12 months. That’s theoretically possible, but it’s more likely to happen over the next two to five years.

However, I am predicting that, without widespread market manipulation of the sort we’ve seen over the past 20 years, over the next 12 to 24 months, we’ll see the onset of a long-term bull market in precious metals that will be virtually impossible to ignore or deny so long as we retain a fiat, debt-based monetary system.

“The LMBA is the largest global center for OTC gold and silver transactions in the world. The LMBA clears around 18 million ounces in gold transfers every day. The association has more than 140 members, including banks, refiners, traders, and manufacturers.”

If market manipulation ends for some or all of 18 million ounces of gold traded daily by the LBMA, then the prices of precious metals should rise by at least 20% per year during the next several years. If the 140 members of the LBMA are forced to stop market manipulation, the consequent increases in precious metal prices could be unprecedented. Freed from the tethers of market manipulation, the prices of gold and silver could skyrocket.

“The British Government’s Fair and Effective Markets Review (FEMR) of the fixed income, forex, and commodities markets found that previous informal codes of practice across these markets had often been misunderstood or disregarded, especially in bilateral over-the-counter (OTC) markets like gold. A lack of internal controls and personal accountability had meanwhile contributed to what it called ‘ethical drift’.”

Previous “informal” codes of ethics may have been “misunderstood”?!

Bunk.

LBMA members understood perfectly well that there’d be virtually no personal accountability for the criminal acts of price suppression over the past 20 years. There was no effective exposure of their crimes or effective enforcement mechanism. Market manipulation was not shunned—it was welcomed and even required.

Now, under the new code of ethics, there may be effective enforcement of high standards of conduct and personal accountability (ostracism as well as civil and criminal liability) for LBMA members who can’t resist the temptation to rig the markets. Once there’s a real penalty for market manipulation, that manipulation will be significantly curtailed and free market prices will prevail.

The phrase, “bilateral over-the-counter (OTC) markets like gold” refers to transactions that include only a buyer and a seller. “Bilateral” markets make “spoof” transactions, fraud and conspiracy much easier since there are no third-parties witnesses.

“Ethical drift” is a polite British term used to describe rich people engaging in a white-collar conspiracies to manipulate the prices of gold and silver. If the perpetrators were poor, they’d be labeled “gangsters”. However, since they’re rich hoping not to be prosecuted, they’re only described as “unethical”.

“With its size, the LBMA’s development of a formal code of conduct will likely influence the broader gold market. It should serve to boost and support confidence in gold and silver trading, not only in London, but around the world.”

Insofar as this new code of ethics has already been publicized, market manipulation may have already begun to diminish.

It’s too early to say for sure, but diminishing market manipulation might explain some of gold’s recent price rise. When gold broke through the $1,260 technical barrier last week, I expected the market manipulators to quickly slap gold back down below $1,250. But they didn’t. At least not yet. Is that “failure to manipulate” evidence that the new “code of ethics” is already having an effect?

If this new “code” is actually enforced with meaningful penalties, I’ll bet that diminishing market manipulation will allow the price of gold to rise by another 15% before the end of this year. Maybe more.

$1,450 gold by December 31st?

Could be—if the new code of ethics is sufficiently effective.

An Historic “Hockey-Stick” Moment?

As seen in the graph, the term “hockey-stick moment” describes a time when an “established” rate of change in say, price, suddenly changes obviously and dramatically. This is not just a market correction. The “hockey-stick moment” marks a significant and persistent change in the previous, fundamental trend.

That change could be up. It could be down. But the key point is that change in rate is significant. For example, the annual price of gold might be steadily falling by 5% per year for five years. Then, suddenly, the price of gold begins to rise by 20% per year.

There is an “inflection point” in the “hockey-stick” graph where the rate of change moves from -5% (in this hypothetical example) to, say, +20%. That inflection point usually happens slowly over the course of weeks or months or even years. On the graph, it may look more like a gentle curve than an abrupt, acute-angle change. We don’t usually see the inflection points at the time they’re happening.

It’s only later, when we look back at the graph of whatever subject we’re watching (price?), and the new, accelerated trend is established, that we’ll see the inflection point and realize that it marked a “hockey-stick moment”.

I suspect that, by the end of this year, when we look back at graphs of this year’s prices for gold, we’ll see a hockey-stick moment in the months of May and June. If we really do see that hockey-stick moment, it will mark the onset of a persistent, long-term, increase in the price of gold. That hockey-stick moment will mark the onset of bull market in gold and silver that could last for 5 to 10 years.

And why will we have that bull market?

Because precious metals market price manipulation is about to diminish or even end.

Why end?

Because precious metals market manipulation in the Western World:

1) Caused the public to lose confidence/trust in western markets;

2) Which caused Bill Murphy and Chris Powell to start GATA to expose and condemn market manipulation; and,

3) Helped cause China to create of the Shanghai Gold Exchange;

4) Caused Deutsche Bank (and soon other members of the LBMA) to face personal and corporate liability for criminal market manipulation;

5) Caused LBMA officers and employees to create a new code of ethics; which will presumably,

7) Diminish or end market manipulation.

(I just love happy endings, don’t you?)

Want another, deeper explanation of Why precious market price manipulation is ending and free market prices may be about to reign?

Look to the Gold Anti-Trust Action Committee (GATA) and to its founders—Bill Murphy and Chris Powell—whose intellect, talent and, most of all, determination exposed global market manipulation, helped cause the creation of the Shanghai Gold Exchange, pushed Deutsche Bank to confess to criminal activity, and helped cause the LBMA to devise a new “code of ethics” for the pathologically unethical.

The ripples from Murphy’s and Powell’s determination won’t end with the gold markets. As the world has slowly grown to understand the gold markets are truly manipulated, the world has also grown to see that other markets (in commodities, stocks or bonds) are similarly manipulated. Thanks to Murphy, Powell and GATA, those other manipulated markets may also soon be cleansed and supplanted by true free markets.

It’s even arguable that GATA’s Bill Murphy and Chris Powell may be the first real heroes of the 21st Century. They identified an important, institutionalized and wrong. They worked to expose and correct that wrong for 20 years. And, amazingly, they prevailed in a way that will change the precious metals markets, in particular, as well as commodity, stock, bond markets—and, perhaps even the financial structure of whole world. Major institutions will be bankrupted. Billionaires might be jailed. Some national and even global economies built on criminal activity may collapse.

All because two guys saw a wrong, set their heels, and fought against that wrong for 20 years.

What an inspiration they’ve provided. No, you don’t get to really play the hero if you fight for two hours, two days or two months. But, if you have the talent and determination to fight against wrong for 20 years—maybe more—you might not only win, but you might even make a mark on the world that might be revolutionary.

Our lives aren’t really hopeless until we surrender to the belief that they’re hopeless.

How good it is to see evidence of that lesson.

Each of us really can make a difference.

Nostradamus II?

I’m not offering any prophecy about gold prices. I’m not another Nostradamus, Cayce, or Jeremiah.

I could be wrong. The price of gold could still fall this year. In fact, as I write this article, gold is down almost $16 in the first hour of New York market trades. Who know? Maybe the crooks will push gold below $1,000 later this year.

All I’m offering in this article is an hypothesis based on a handful of facts subjected to what I regard as a mix of logic and intuition. I’m “connecting some dots” in a way that’s new–at least, to me.

Nevertheless, in broad strokes, I’m saying that the LBMA’s new code of ethics is evidence that price manipulation in precious metals markets is not only about to end, but may already be declining.

If I’m right, the next bull market in gold has already begun.

If I’m wrong, the next gold bull will begin later—whenever economic and/or political forces finally subject the officers and employees of the LBMA to a new, enforceable code of ethics and/or law.

In either case, the tide is clearly running in the free market’s favor. Whenever the bull market in gold begins, it’s coming. It’s got to come because the the current gold market has been a criminal enterprise that must ultimately fall under the weight of the free market. Sooner or later, the Shanghai Gold Exchange, Deutsche Bank convictions and the LBMA’s new code of ethics will cause market manipulation to end or at least significantly diminish. As market manipulation ends, the price of gold should rise steadily—and probably, for years.

For now, I assume that the new code of ethics will become increasingly effective over the balance of this year and market manipulation will be diminished. Based on that assumption, I’ll predict that the price of gold will rise by another 15% before the end of A.D. 2017. I’m looking for $1,450 gold before New Year’s Day. Maybe more.

We shall see.

Advertisements