It is quite clear that the market wants good reports from the earnings announcements that begin this week. We make that judgment based on Friday’s weak close, despite a solid week of some of best economic news of the year that culminated with the drop in unemployment to 7.8% from the expected 8.2%. That report followed a strong manufacturing ISM on Monday at 51.5 versus an expected 49.7, a solid Auto Sales report on Tuesday, an even better ADP Employment report of 162K versus an expected 133K on Wednesday, and a strong ISM services report of 55.1 versus an expected reading of 53.0, also on Wednesday.

It is quite clear that the market wants good reports from the earnings announcements that begin this week. We make that judgment based on Friday’s weak close, despite a solid week of some of best economic news of the year that culminated with the drop in unemployment to 7.8% from the expected 8.2%. That report followed a strong manufacturing ISM on Monday at 51.5 versus an expected 49.7, a solid Auto Sales report on Tuesday, an even better ADP Employment report of 162K versus an expected 133K on Wednesday, and a strong ISM services report of 55.1 versus an expected reading of 53.0, also on Wednesday.

Friday’s Factory Orders were better than expected but still negative, and the volatile Consumer Credit reported a whopping $18.1 billion versus an expected $5.0 billion. The S&P 500 gained more than 2% through the first four days of trading last week, but after opening up another 0.5% on Friday, it sold off the rest of the day to close down a tad. The Nasdaq was barely up for week but down Friday.

Today the S&P 500 fell about a half percent, the Nasdaq was a bit worse, and the Dow was off 0.2%. The market is waiting to see how earnings go this week while keeping an eye on Europe for finalization of the plan du jour.

Last week’s gain was predominately “flight-to-safety” again, led by Large-cap Value, up 1.76%, with Small-cap Growth coming in as the lowest style/cap, up 0.49%. Financials led the sectors with Consumer Non-Cyclicals and Healthcare close behind. Our SectorCast model last week correctly predicted the top four performing sectors, though the order was a bit scrambled. Technology, dragged down by continuing weakness from Apple (AAPL), did the worst, off 0.25% for the week.

Where we move from here depends heavily on how Q3 earnings unfold, and it will likely require at least two or three weeks to judge the overall progress. Also, the markets could be affected further depending on how Europe resolves or doesn’t resolve its issues, how Japan and China deal with their slowing growth, how the Middle East problems play out (a more rational Iran gives a bit of hope), and finally how our election progresses with regard to Congressional gridlock. The market hates all of this uncertainty.

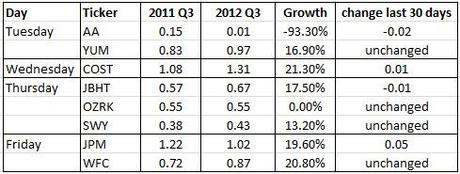

I thought it might help to give you a little scorecard of the earnings expectations from some of the most watched announcements this week. The list is predominately large-cap, with two mid-caps, and mostly consists of stocks in the Financial sector, reflecting our forward-looking SectorCast. We like Yum! Brands Inc. (YUM) because it is a consumer staple, and we like Costco Wholesale Corporation (COST), JPMorgan Chase & Co (JPM), and Wells Fargo & Company (WFC). Why? Because some analysts in each stock have revised their earnings estimates upward in the last seven days, on top of their already solid earnings growth projections.

Full disclosure: The author does not hold positions in any of the stocks mentioned in this article.