What's Next For Bitcoin and Ethereum

Today, we'll look at what's next for two of the leading cryptocurrency is in the market, Bitcoin and Ethereum. We will be considering what their next move should be like. A lot of speculations have been going around in the new year started with what we expect from Bitcoin this year and even Ethereum.

But it's difficult to tell who is doing their homework right and separate the wheat from the chaff. Guessing may seem like an approach that can be applied to crypto, but it may have serious consequences. You may consider that it's easy to guess since there can be two scenarios.

Either Bitcoin keeps going up or it comes down. However, what makes that a dangerous play is the volatility of Bitcoin and other cryptocurrencies. Generally, you can be sure it will be either of the two outcomes, but you can't tell by how much.

Just like we always warn, precautions are very necessary or else one can lose a lot of money. The cryptocurrency market has topped one trillion dollars for the first time in its twelve-year history, boosted by bitcoin hitting an all-time high.

A lot of people are now looking to invest in Bitcoin.

That reminds me of some news I saw recently a British man who accidentally threw a hard drive loaded with Bitcoin into the trash. Now he's offering the local authority where he lives more than 70 million dollars if they allow him to excavate a landfill site.

The drive he got rid of is set to hold a digital store of seventy-five hundred bitcoins between June and August in twenty thirteen. He had originally mined the virtual currency four years earlier when it was of little value.

But when the cryptocurrency shot up in value and he went in search of it, he discovered that he had mistakenly thrown the hard drive out with the trash. This is not the first time he begged his local authority to allow him to excavate the landfill. You know, it feels like to throw away hundreds of millions of dollars. Well, that's what he's facing right now.

The combined market capitalization of all cryptocurrencies now is greater than the combined value of payments giants.

MasterCard and Visa and Bitcoin has driven the market's revival of rising in price from below five thousand last March to above forty thousand dollars. There appears to be a broad consensus among many market analysts and cryptocurrency experts that Bitcoin's current price rally may be far from over.

It is the third great bull run in bitcoin's history, with previous market surges in 2013, and 2017 lasting between 18 and 36 months. The executive director of London based cryptocurrency exchange, CEO, Io, said he believes that Bitcoin is not giving it everything it's got quite yet.

He further explains that the coin's past behavior indicates that the cycle is still far from over and that he expects Bitcoin can hit fifty thousand dollars by the end of this quarter. If it does, it will also not be surprising for its price to continue going forward as the number is bound to attract more institutional and retail investors like both.

Previous price rallies were followed by painful corrections, which saw Bitcoin retreat to around 50 percent of its peak value. The cryptocurrency volatility was recently demonstrated by a flash crash that saw six thousand dollars wiped from its value in a matter of hours.

However, it quickly recovered. Some analysts believe more instability could follow in the short term as Bitcoin's price rises before a major market dip either later this year or in 2022. Simon Peters, a senior analyst of the online investment platform E Toro, so he believes we are going to continue seeing new all-time highs, but that he wouldn't completely rule out another price drop beforehand.

He said if we do see a dump of Bitcoin from larger investors, that we could see the price fall back to the 20,000 or 23,000 dollar range. Since launching in 2015, six years after bitcoin, Ethereum has seen remarkable growth due to its functionality, which extends beyond just being an alternative payment system like Bitcoin, Ethereum relies on the main underlying blockchain technology that means it's decentralized and does not rely on traditional financial institutions like banks to function. Ethereum is currently trading close to its all-time high, just like Bitcoin, but also unlike Bitcoin, which trades for like thirty thousand dollars.

Ethereum currently trades hands for just over a thousand dollars. Two hundred for crypto bulls that want to get in on the rally. This looks like an appealing opportunity, but as usual, you need to be careful.

Some experts actually do think a major gold coin season is on the way. Ethereum now is close to its all-time high of one thousand three hundred ninety-one dollars and seventy-four cents. However, because recently cryptocurrency is are still enjoying the bull run as a result of recent adoptions from big firms. Many experts are confident that a new high is just around the corner.

What does this mean?

Well, just as a rush of mainstream support drove Bitcoin higher, investor Place Markets analyst Tom Young recently highlighted the support behind Ethereum. Adoption is spreading on PayPal and other platforms, meaning Ethereum has a chance to catch up to its big Bitcoin brother.

Looking to the future, it seems safe to bet that this mainstream support will only continue to grow in terms of theory and price predictions.

Then consider this from Young. He said that the cryptocurrency valuation looks more of a popularity contest than a technical exercise, at least in the short term, and that Ethereum could easily double to twenty-five hundred dollars in 2021 if more users keep jumping on board.

Although Young also highlights the risks that Ethereum could hit five hundred dollars if the market goes south or a hack disrupts confidence, things seem bright. He advised that if you're confident in what is behind the crypto rally, Ethereum is worthy of consideration.

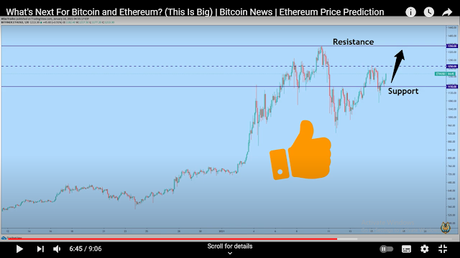

Let's take a look at the charts.

This chart shows Bitcoin on a pattern known as the ascending wedge pattern, also nicknamed megaphone. You can see the price touching both the top and base of the ascending wedge. The chart also shows the bitcoin is making big impulses that are followed by a corresponding correction. You can also see that the corrections are as big as the impulse.

So in the coming period, as we expect the price to go up massively, there is the likely consequence of massive drops as well. During the correction period, a lot of people will likely get scared and sell off their assets so as to avoid a long term downtrend. But with this analysis, the massive corrections don't mean Bitcoin will continue on a long-term bear. For all indications, Bitcoin is still on an upward trend.

In this chart, we can see a long term prediction of Bitcoin going as far as fifty-four thousand dollars currently, the price still dances around within the mid-thirty thousand regions. Notice how the candles make their way into the predicted channel in some instances.

This chart obviously points to an expectation of a long bullish run, which will see the price almost doubled its current value. This means that a new all-time high is predicted, which will prompt more investors to adopt Bitcoin. The kind of run predicted in this chart looks like one that can be influenced by big announcements in the coming weeks and months are obviously going to be full of events that may likely affect the price of Bitcoin.

This chart shows that Ethereum is set to break the next resistance at a thousand two hundred fifty dollars after this, the next target will probably be around one thousand three hundred fifty. You can see how the price has tested the two purple lines. The one above is the resistance line, as it is labeled, while the lower one is the support line.

Ethereum has tested the support line quite a number of times and even gone past it for a significant bear ride. However, it is back within the channel and looks like it's gunning for the resistance line, which it seems to have tested only once. This time around, it's expected that the price of Ethereum will go beyond the set resistance.

This last chart is a four hours chart predicting a theorem long term bull to above one thousand four hundred dollars. Notice those purple lines acting as support and resistance in this chart. It shows the possibility of Ethereum going for a little Bear run. But eventually, the trend is a bullish one with a chance of hitting another all time high.

The volatility of a theory is also visible in this chart as it shows the price testing, the resistance, and support lines a couple of times for slightly breaking out from this chart. There are some expectations that it will break out and continue on a bull run, which will take it to the possible all-time high.

An investment in both Bitcoin and Ethereum, hmm, looks like a great deal in the long run, there are predictions and analyses that demonstrate that they're both in for a bull in the long term. The predictions are expecting bigger new prices for both coins.

Some people are even saying that it will happen sooner rather than later. What is certain is that both coins are very volatile and care should be taken when investing in them. By now, you should have an idea of what the next big thing is.

With Bitcoin and Ethereum, both volatile coins seem to be on a long bullish trend, according to predictions. You should also do your own analysis before investing in volatile commodities like these.

photo credit : crypto lion & google Images