Ethereum is like the kid that you always knew was bright and they did some great things growing up and got into some trouble, and now they're off to the best school in the country, and you couldn't be prouder.

There's no denying, price action and Ethereum's performance during the EIP-1559 upgrade has been putting some pep in every Ethereum holder's step. And I've got the latest Ethereum updates for you today that might make you feel like signing my yearbook.

Everything is going well for Ethereum and its new atmosphere of recognition, upgrades, institutional money flow, and positive price action. Ah, those beautiful early fall days on campus are going well for Ethereum, and it's just made a call home to mom and dad. And we can't wait to hear what Ethereum has been up to. Let's get it! In this article, we look into what's new for ETH.

Miner fees

They were far from insignificant. In fact, they've been a major worry for traders and miners with the announcement of ETH 2.0 and leading up to the London hard fork. This concern was the source of the 51% attack threatened by Ethereum miners back in March. Remember that? The nerd attack never came. They didn't want to lose their profitability, and we understand that. No one does.

As it turns out, validator health reports by both Etherscan and CoinDesk are showing that due to the price breakout and the NFT frenzy happening on the Ethereum network as of late, miner revenue has managed to stay on par with what it was before despite the Ethereum burning that goes along with the EIP-1559 upgrade, which gives Ethereum some extra credit in the form of some deflationary action by burning the bulk of transaction fees and taking them out of circulation.

Over 30,000 ETH has been burned so far, amounting to a staggering $100 million-plus in Ethereum permanently taken out of circulation. You can see where Ethereum holders are happy and Ethereum miners are worried. Ethereum will now have its supply burned to become more valuable, while miners aren't getting paid the same number of ETH per validation. But it's a catch-22 because, without the upgrade, Ethereum may not have become more valuable and seeing this kind of price action. This trade-off has worked in the miners' favor in the end as miner revenue in US dollars has increased.

Transaction Increases

But the number of on-chain transactions has also increased because NFT transfers have increased 75% over the past week. And this means an increase in the number of transactions that miners are paid to validate.

One of the biggest NFT drops in the past weeks has been the pandemic punks. I can't actually say the real word that's the name of these because of Google policy. But they released the same day as the London hard fork and sold out within minutes.

Some users reported failed transactions because fees spiked from 100 gwei to 400 gwei in the first hour of the punks trading. And miners can still be rewarded an optional tip called a priority fee to speed up a transaction.

So far, a total of $22 million in priority fees has been paid by users to miners. This just shows how much demand there is for Ethereum and that it has a long way to go in its development.

Altair

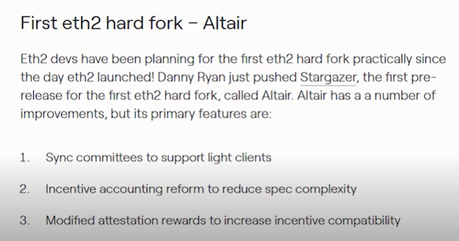

Altair, ETH 2.0's first hard fork, is on its way on the Prymont testnet on August 19. This hard fork is giving Eth2 staking capabilities a pop quiz about its staking. It wants to make staking easier but more fair.

Eth2 aims to be forgiving to honest-but-imperfectly- run validators such as at-home enthusiasts. There are mechanisms in Eth2 that are supposed to penalize validators that aren't run properly, but at the moment, its grading is just too harsh. Just like my sixth-grade Algebra teacher, Miss Brown. What a douche.

But these updates will also include a light client for using Eth2 on a small device like a cellphone. According to Etherscan, Eth2 staking deposits are ranking No. 1 with approximately 6,726,000, followed neck and neck by Wrapped Ether with 6,723,000.

The two are alternately taking their spot in the first place, and this points to two pieces of excellent news for ETH. First is that there is a lot of staked ETH which makes the price more robust and shows positive market sentiment for the future of Ethereum. The second is that decentralized exchanges that run on Ethereum are becoming more used than centralized because Wrapped Ether is mostly used on DeFi exchanges.

Bison Trails Program

We know that what's good for Ethereum or on DeFi is good for Ethereum, so this bit of information that popped up on my radar is something to watch. It's still the days of pioneering and discovering for many Ethereum developers, which is why the Eth2 team is giving early access to the Bison Trails program, a managed development system for institutions, VC firms, and other companies that want to start major development on Eth2.

This gives developers cutting-edge tools and visibility into Eth2 staking which gives Eth2 the network externalities it needs to stay ahead of Cardano.

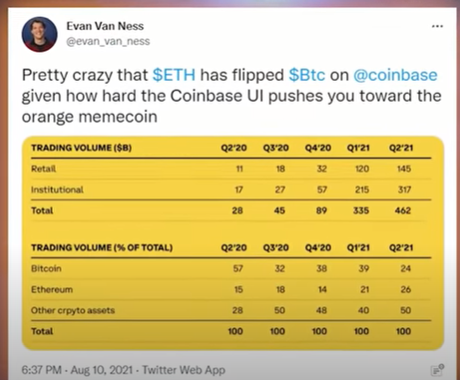

The Flippening & Fidelity

Ethereum trading volume on Coinbase has flipped Bitcoin's for the first time ever. Ethereum now accounts for more than 26% of all trading on Coinbase. But institutional clients want more Ethereum. We know that. And this has recently pushed Fidelity Investments to offer Ethereum to their clients.

By March 2022, Fidelity will allow Ethereum trading for its hedge fund, family office, and institutional clients with its digital arm, Fidelity Digital Assets. Big investment firms offering crypto is nothing new, and many major firms are filing for Bitcoin and Ethereum exchange-traded funds, or ETFs. Seeing Ethereum on the big money stage is always good news and something that ETH has called home to tell us about.

Fortune Magazine Holding

In other Ol-Fi-trying-to-keep-up-with-crypto news, Fortune Magazine has announced that it will be HODLing half of the 429 ETH it generated from the sale of its first NFT collection. The magazine sold 256 animated cover art pieces titled Crypto vs. Wall Street.

The collection sold out almost instantly. The estimated value in USD is about $1.4 million. Half will go to charity and the other half will give more credibility to the name "fortune" with the magazine HODLing the rest of the ETH for the long term, which is a good move because the Ethereum price seems to have found firm support for now at $3,000, hitting a double bottom around that point last Thursday before reaching $3300 on Saturday.

But all the Ethereum burning and updates have been a great price catalyst. And the timing couldn't be better with Bitcoin rallying above $47K. On Friday, Yahoo Finance released an article titled Ethereum Keeps Burning and Price Is Hot.

The article talks about institutional money coming into Ethereum as hedge funds and institutional investors are seeing Ethereum as a safe crypto bet with a lot of upsides. Mike McGlone, Bloomberg intelligence analyst, even touched on the flippening of Ethereum against Bitcoin for the top spot in crypto.

McClone said, "There appears little can stop the process of Ethereum flippening to take the top spot by market cap. Ethereum appears on an enduring path as the go-to platform for the crypto ecosystem and decentralization of finance akin to Amazon Inc. and e-commerce." And, yeah, we couldn't agree more. Like a proud father, it's good to hear from our favorite son, Ethereum, and hear all the cool stuff he's doing in college