I titled yesterday’s post "More Stimulus Please" and, as expected, we did indeed get another $670Bn (500Bn Euros) rumored around noon yesterday as the word is the EFSF is going to either double or eliminate it’s lending cap. This action was backed up by our own little Timmy Geithner, who backed the play, saying: "We’re encouraged by the progress [Europeans] are making, not just to put in place economic reforms across Europe to create the conditions for stronger growth in the future, but to try to build a stronger architecture for a fiscal union … and try to make sure there’s a sufficiently strong firewall in place to support those efforts."

It took 12 hours after the close but it seems to have finally occurred to market participants that the only reason we NEED a "sufficiently strong firewall" is BECAUSE EUROPE IS ON FIRE! Not only is the prospect of doubling down on the EFSF less than a month after it’s passed kind of worrying but the real concern in the markets this morning is that – another $670Bn is not enough!

Spain (GDP $1.5Tn) is a relatively mild $800Bn by comparison and only 55% in debt so if they lose their AA rating – on what basis do the big boys get to keep their AAAs?

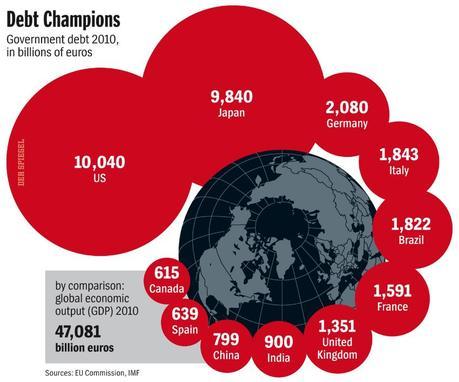

We were discussing the Global Debt situation in Member Chat this morning and Jthoma asked how long this can go on and I said you have to think of this a a Global game of musical chairs – only there are 7 Nations (the G7) dancing around just one, very rickety-looking chair. Since no one thinks they are likely to find a safe seat when the music stops – not even China – no one is going to stop the music and call an end to the came and they will all keep dancing and dancing until they collapse. THAT’s the Global Economy at the moment!