Let's not worry.

Let's not worry.

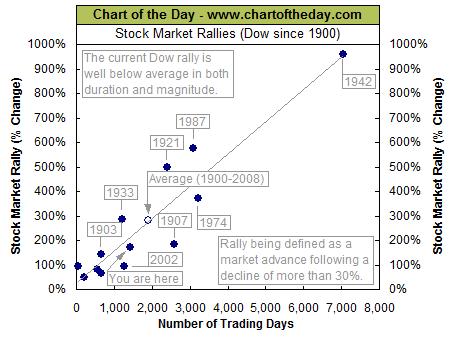

We're in the midst of a fantastic bull run so why ruin it with rational thinking? Barry Ritholtz used to be a rational guy but now he shills for Bloomberg (#8 on the Forbes 400 with $35Bn) and posts things like "Current Dow rally below average in both duration and magnitude" in order to encourage the beautiful sheeple to keep BUYBUYBUYing what his boss is SELLSELLSELLing.

I've warned before about how the smart money is leaving in droves while the dumb money piles in. Back on Sept 8th (S&P 2,010), for example, I wrote "Clear Proof of Massive Market Manipulation", saying:

It's pretty similar to what happened every day last week, with a high-volume (relatively) sell-off followed by a recovery on almost no volume into the close, giving us the impression that the markets are flat.

It is unbelievable, as in – something that should not be believed by intelligent people. When you see a magician on stage sawing a woman in half or levitating – you might be amazed at what a good trick it is but you don't start believing in magic, do you? What if that magician asks you to bet your retirement on the fact that he is really levitating people or that his assistant can medically be cut into pieces and reassembled?

You wouldn't risk your money on such obvious fakery, would you? You wouldn't give your hard-earned money to a person whose job it was to deceive you, would you? THEN WHY ARE YOU PUTTING YOUR MONEY INTO THIS FARCE OF A MARKET?

I know, I even crack myself up when I read this stuff in retrospect. Anyway, it wasn't so funny to people who didn't listen to me a month later, when the S&P was at 1,820, down a quick 10%

I know, I even crack myself up when I read this stuff in retrospect. Anyway, it wasn't so funny to people who didn't listen to me a month later, when the S&P was at 1,820, down a quick 10%

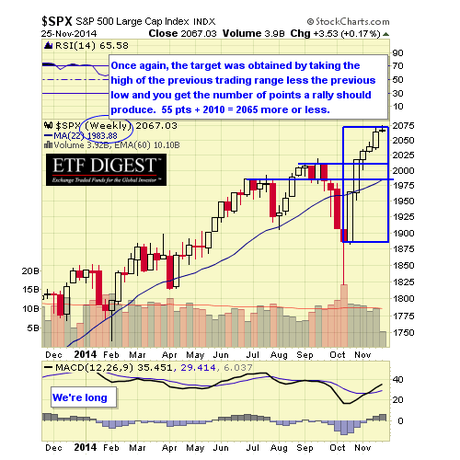

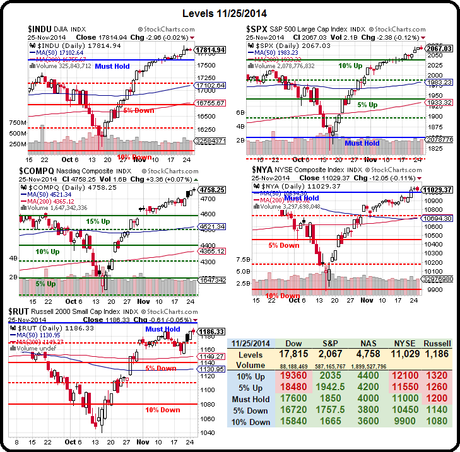

That was plenty of sell-off for us and we flipped more bullish at the bottom and caught a nice ride up (we're not perma-bears, just value investors) but now the ride has taken us up from 1,880 (non-spike low) back to 2,068, which just so happens to be EXACTLY a 10% move back up.

Fans of our 5% Rule™ know that a 10% move up is begging for a 2% (weak) correction back to 2,026 and even a 4% (strong) correction won't break the bullish trend at 1,985 but, at the moment, 2068 is just silly and overdone. That's not to say we can't get sillier and more overdone – but it does mean we're going to expect those corrections all the same.

As I mentioned yesterday, we're well-hedged enough in our Short-Term Portfolio that we don't really care if the market corrects. In fact, we'd actually prefer it so we could cash in some of our shorts and buy some more longs at better prices. See, we're not bearish at all – long-term, we're very bullish (and now I'll use Barry's chart to show how far we might go in a real rally) - we're simply realistic about how fast we think the economy is actually growing.

As I mentioned yesterday, we're well-hedged enough in our Short-Term Portfolio that we don't really care if the market corrects. In fact, we'd actually prefer it so we could cash in some of our shorts and buy some more longs at better prices. See, we're not bearish at all – long-term, we're very bullish (and now I'll use Barry's chart to show how far we might go in a real rally) - we're simply realistic about how fast we think the economy is actually growing.

Of course, charts like this are distorting because we're not bouncing back from a 30% correction, we're bouncing back from a 50% drop, from 14,000 to 7,000 back in 2008 but I'm sure this chart is counting the spike low of 6,469 in March of 2009 (2,096 days) – so we're up at 17,814 now and that's +11,345 or 175%. In reality, we're up 3,800 from the previous high, which is 27% in 7 years or just under 4% a year.

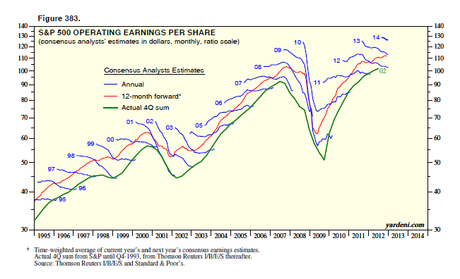

The value question we need to ask is "are companies earning 27% more than they were in 2007?" and the answer, sadly for most, is no. Some are, of course, higher and some are lower but, on the whole, as I pointed out on Monday, when we looked at the rapidly rising p/e ratios on the S&P, overall, they are not – especially outside the Financial sector, which is ground zero for QE stimulus. We were paying 27 times earnings for S&P stocks in 2007 (right before the collapse) and we're paying 27 times earnings now – do you see why I'm concerned?

The value question we need to ask is "are companies earning 27% more than they were in 2007?" and the answer, sadly for most, is no. Some are, of course, higher and some are lower but, on the whole, as I pointed out on Monday, when we looked at the rapidly rising p/e ratios on the S&P, overall, they are not – especially outside the Financial sector, which is ground zero for QE stimulus. We were paying 27 times earnings for S&P stocks in 2007 (right before the collapse) and we're paying 27 times earnings now – do you see why I'm concerned?

Mark Spitznagel, of Universa Investments is also very concerned, saying that the stimulus policies of the Federal Reserve and other central banks have the power to drive stocks higher. But they will ultimately be self-defeating:

“The Fed has created a trap in this yield-chasing environment, it allows you to be long, but it gets you in position to be short when it’s all over"

Mark is a fellow value investor and uses the LTP/STP strategy we teach our Members in his hedge fund, where bearish bets are be paired with broad holdings of stocks to produce consistent gains. “This is a way to be responsibly long, you’ve got to be buying when other people are selling it — and that’s very hard to do,” he said.

Mark is a fellow value investor and uses the LTP/STP strategy we teach our Members in his hedge fund, where bearish bets are be paired with broad holdings of stocks to produce consistent gains. “This is a way to be responsibly long, you’ve got to be buying when other people are selling it — and that’s very hard to do,” he said.

That's what our Members are looking for as well, we're not dreading a sell-off, we're anticipating it because we're READY for it and, if it never comes – we have plenty of longs to tide us over and plenty of cash to buy more with.

Meanwhile, we're Cashy and Cautious and RELAXED into the holidays. The NYSE and Russell still haven't confirmed a breakout as they are still below their year's highs, so it's not likely we'll be missing anything between now and Monday (Friday's a half-day for you hard-core traders) by sitting the markets out and enjoying our families.

And, of course, Friday is BLACK FRIDAY, so we'll get a great insight into Retail Sales as the data rolls in next week. Meanwhile, happy shopping!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!