I know that we have been trained to ignore supply and demand in commodities as well as to pretend that all prices are inelastic and that American consumers will buy anything at any price because they are generally mindless sheep that you can lead into anything with the right jingle but, if they are not willing to buy a $250,000 home with a 5% mortgage – what’s going to happen when that mortgage is 6%?

At 5%, a $250,000 mortgage has a monthly payment of $1,342.05. At 6% that payment jumps up to $1,498.88 – 10.5% higher! At 7% it’s $1,663.26, 24% higher – that’s the "cost" of housing as rates tick higher but, of course, that will force housing prices even lower to compensate and the Fed will tell us that inflation is low because home prices will be falling faster than food prices are rising – so we have that to look forward to…

I mentioned yesterday that China tightened their rates and home prices in Beijing fell 26.7% in the month of March. I waited all day to read more about it in the WSJ or Bloomberg or to see them discussing this on CNBC but no – it’s not the kind of news they want you to hear so – for your own good, it is not mentioned. I had to find this news in Business China but it’s also in the China Daily and the People Daily but where it isn’t is in any US newspaper I’ve looked at and neither is there mention of the problem caused by giant-sized, irradiated Asians poking buildings with sticks! (just kidding).

I mentioned yesterday that China tightened their rates and home prices in Beijing fell 26.7% in the month of March. I waited all day to read more about it in the WSJ or Bloomberg or to see them discussing this on CNBC but no – it’s not the kind of news they want you to hear so – for your own good, it is not mentioned. I had to find this news in Business China but it’s also in the China Daily and the People Daily but where it isn’t is in any US newspaper I’ve looked at and neither is there mention of the problem caused by giant-sized, irradiated Asians poking buildings with sticks! (just kidding).

We talk about Chinese censorship and control of information but what is this? If a Nigerian Rebel spits at a pipeline or if a Somali Pirate even glances in the direction of an oil tanker – it’s on the front page of the papers (sometimes before it even happens if they get their timing wrong) but when a 26.7% drop in housing prices in a single month in the World’s 16th largest city (population 12.7M) isn’t even mentioned in the MSM – you HAVE TO start wondering which government is really censoring your information. What else are we not being told?

Fitch Ratings downgraded their outlook on China’s long-term local-currency issuer default rating to negative from stable last night. We’ll see if this one gets any attention but at least I found it in MarketWatch. "The negative outlook reflects concern over the scale of sovereign contingent liabilities and risk to macro-financial stability arising from the very rapid pace of bank lending in recent years, especially against the backdrop of rising real estate valuations and inflation," said Andrew Colquhoun, head of Fitch’s Asia-Pacific Sovereigns group. "Fitch expects some sovereign support for the banking system will be required," he said.

Matt Tiabbi points out that we are not being told about the "other budget" – the ones the Republicans love, that is bigger than the budget they are fighting to contain and that’s the Federal Reserve’s $3.5Tn budget. As Tiabbi states:

Matt Tiabbi points out that we are not being told about the "other budget" – the ones the Republicans love, that is bigger than the budget they are fighting to contain and that’s the Federal Reserve’s $3.5Tn budget. As Tiabbi states:

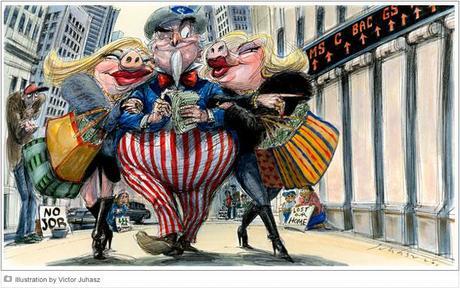

After the financial crash of 2008, it grew to monstrous dimensions, as the government attempted to unfreeze the credit markets by handing out trillions to banks and hedge funds. And thanks to a whole galaxy of obscure, acronym-laden bailout programs, it eventually rivaled the "official" budget in size — a huge roaring river of cash flowing out of the Federal Reserve to destinations neither chosen by the president nor reviewed by Congress, but instead handed out by fiat by unelected Fed officials using a seemingly nonsensical and apparently unknowable methodology.

Our friends at Goldman Sachs along received roughly $800Bn in loans from the Fed but what’s more interesting is $220M worth of loans made to Christy Mack (wife of MS Chairman, John Mack) and her partner, who were given low-interest loans by the Fed in a brand new enterprise they set up to take advantage of the FREE MONEY. As Tiabbi points out, the interest spread alone would guarantee them millions in profits in a program he calls "giving already stinking rich people gobs of money for no fucking reason at all." He goes into great detail so I won’t here but I will point out that THIS IS YOUR MONEY they are giving away – this is your debt burden that is being increased by the Fed’s actions – this is not a victimless crime – WE ARE THE VICTIMS!

IN PROGRESS