Accurate real-time data is essential to the proper functioning of the options market, but it would be tremendously challenging for individual associations to collect and process options market data. Exchanges involved in options trading produce huge amounts of data, far beyond of data than other asset classes generate. In other words: options data traffic produces at least 75% of all market data! This growth in data has caused a seemingly interminable increasing demand in hardware and software for vendors and customers as well. This all by increasing of the operating costs with just a little or even no benefit for the market participants. Hence, a solution has to be developed to address the issue. The solution which was developed has got the name Options Price Reporting Authority (OPRA).

What is the options price reporting authority (OPRA)?

An efficient market needs a consolidated options data. In the United States, a committee of representatives of securities exchanges provides these consolidated data, and the name of this committee, or organization is Options Price Reporting Authority (short: OPRA). What is the job of the Options Price Reporting Authority? Well, it collects data from the exchanges, consolidates it and then distributes to various consumers who need this data.

OPRA is a so-called national market system plan that acts as a securities information processor. A national market system plan, in turn, is a structured technique of disseminating financial asset transactions in real-time. In the United States, national market systems are governed by section 11A of the Securities Exchange Act of 1934.

OPRAs members, known as participants, are options exchanges from across the United States, including the American Stock Exchange (AMEX), the Chicago Board Options Exchange (CBOE), NYSE Arca, NASDAQ, and others. From these participants, OPRA collects quotes and other data and combines them into so-called OPRA feeds to produce a national best bid & offer (NBBO) quote. To be more exact: OPRA’s two primary data feeds include trades (last sale reports for completed transactions) and quotes (bids and offers for options).

Marginalia for the sake of completeness: the NBBO is a part of the national market system plan.

But besides the two primary data feeds, the OPRA feed also encompasses a huge amount of other data, besides the last sales reports and options quotes. These quotes are re-quoted when the underlying assets change. To handle the entire feed, recipient organizations are dealing with capacity of at least 40 Gbps and the computational infrastructure through the low latency network (NMS Net). It’s located in the Mahwah data center in New Jersey which was provided in 2020 by the company called “Options“.

The Options Price Reporting Authority has divided its services into two main areas. The first one is a basic service for all options. The only exception here are the foreign currency derivatives. The other part is the so-called “FCO service” for foreign currency options information.

As you can see, OPRA is doing an important job for the market participants. For without the consolidated data provided by OPRA, financial markets would be less developed which would lead to a higher cost of capital for buyers and sellers.

SIGN UP FOR UPDATES: SUBSCRIBE!

How do market participants get OPRA data?

Institutional market participants and other businesses have two ways to access options feeds from the Options Price Reporting Authority. They can get it from OPRA directly, or they can access the feed via a vendor.

Companies that choose the direct way must have the networking and compute resources to receive and analyze a lot of gigabits of data each second. But in this case, they are also responsible for filtering and processing the data in real-time.

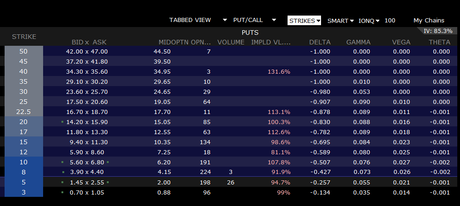

Therefore, some organizations may instead choose to access the options feeds via a third-party OPRA vendor. The vendor does the work of receiving the data, preparing it, and creating a new feed that contains the information options traders need in a more usable format. Also, OPRA vendors can add some value to the data feed with analytics that includes e.g. so-called greeks, bid/ask of the implied volatility, and so on. The advantage of using a service of a third-party vendor allows the market participants to access real-time options data without the infrastructure investment that would be needed in case of a direct way.

The result of such prepared date you can usually see in a form of a options chain:

Summary

- The Options Price Reporting Authority (OPRA) is collects and distributes price quotations for listed options in the United States

- OPRA is providing data feeds to financial companies, brokers, and traders of all kinds, showing the national best bid and offer for an option or option series.

- The Options Price Reporting Authority is divided into two main areas: a basic service for options and so-called “FCO” service for foreign currency options

- Options quotes are delivered as tables of data known as so-called options chains