Like the most concepts in trading, Max Pain is another “theory” or concept from the US related to trading with options. This theory is considered to be controversial and there is going a lot of discussion on about its usefulness and disutility. In this article I’ll explain you the idea behind this concept and I will also show you whether it’s worth for you to delve deeper into this topic or if it’s neglectable. So let’s start!

The Reasons Behind Max Pain

It’s said that a lot of market participants are buying options instead of selling them (which is actually the preferred method how to earn money with options). These option buyers are doing this for two purposes:

- To hedge their portfolios against undesirable events in the markets

- To make profits by buying options with a certain directional opinion in mind about the markets (or about single stocks)

And the max pain theory assumes that a lot of the institutional traders are selling options. This statement might cause the first controversial subject. Because some might say that this is not correct because the institutional market participants usually buy options. This might be true but maybe also wrong as the max pain theory is just a theory, and there doesn’t exist an evidence in practice.

One of the basic concepts behind max pain is to say that the institutional market participants, in this case brokers, don’t care about how the underlying (stock, commodity, ETF, etc.) is evolving. The reason for this is that the core business of the brokers is to get commissions you’re paying when you do some transactions.

But what if some institutional traders need to buy a lot of options (for whatever reason)? Well, as a broker is usually also a market maker, he has to sell the options if there are not enough options available in the market. That’s one of the commitments as a broker, which is to ensure that there is a minimum level of liquidity available. But when they commit, they want to benefit from the risk. That’s why they are interested to keep as much premium as possible.

The question is: where is it possible to generate the highest amount of premium for the broker? The answer is: The point of this event is where the most of the option buyers are losing money!

And that’s actually the basic idea of this whole max pain concept, to say that the point where the buyers lose the most money is the point where they have the most pain from the financial point of view. As you can see, the brokers (and for sure other bigger institutional market participants) who hold a lot of sold options, have an incentive to bring the price of a stock (or other underlying) to the max pain point by placing bigger order-chunks in the market to try to pin the price of the underlying as close as possible at the max pain point. Doing this, they also hedge their portfolio at the same time.

Calculating the max pain point

In the world of options, there exists an assumption that:

- 60% of all open option contracts will be closed by the traders themselves

- 30% will be expired worthless

- 10% will land in the money (ITM)

And on the expiration day, it’s all about those 10% of options are landing in the money.

Please Note: These figures could also be a point of discussion whether they are reliable or not. But for the sake of the max pain theory I’ll continue with these numbers as they are usually used in the world of trading.

It’s possible to calculate the max point which works as following (we will make a calculation example below, so you can better understand it, folks):

- Find all strikes of the option

- Find the open interest values on the put side for each of the strikes you have found

- Multiply the inner value (=strike price – closing price) of the each put with the each corresponding open interest. Then multiply the result by 100 as every option encompasses 100 shares. The result will be the so-called dollar value at each strike

- Do the same with the calls

- Add each call with each put to determine the common dollar value at each strike

- When you have done this, you will see that there would be a highest common dollar value at a certain strike. And this highest value will be the the max pain point

Calculation example with AAPL:

Please note: I’ve randomly chosen one strike because I just wanted to show you how the calculation is done.

1) Find all strikes of a stock. In our example I’ve taken them from the option chain in the Trader Work Station which is offered by Captrader. But actually, you can also google them easily. For example, you can also find them on yahoo.com

2) Find the open interest values for each put: you can see the open interest (OI) in the marked column

3) Determine the dollar value for each strike

To do this, identify first the inner value of each strike. You will get the inner value when you calculate the difference between the strike price of the each put and the closing price. Let’s calculate it with the strike of $172.5:

Now multiply the inner value of $0.43 by open interest which is 7.17K at the strike of 172.5. As a result, you will get the dollar value for one share at this strike:

Now multiply the dollar value for one share by 100. In our case it would be:

$3083.1 * 100 = $308.310

This was the dollar value for the strike $172.50 on the put side. Now you need to repeat the procedure for every strike on the put side. By the way, if you don’t want to know how the dollar value for 100 shares is, you can skip his step. In our example I used it just for the sake of completeness.

4) Do the same with the calls

I will omit the screenshots and just do the calculation because on the call side, it’s the same procedure like on the put side. The corresponding dollar value on the call side at the strike of $172.5 in our example is $299.280. Now repeat this for every strike on the call side.

5) Add each call with each put to determine the total dollar value at each strike:

In our example for the strike $172.5, the total dollar value is $607.590. Now you need to repeat this for every strike and at the end, you would get an overview with dollar values of the each strike. The max pain point would be at the point with the highest common value.

Now you know how to calculate the max pain point manually. By the way, at this point, the calculation itself seems to be controversial, too. At least some traders stating that the math is incorrect and they suggest another approach to find the max pain point.

But anyway, as you can see, the formula of max pain is really easy but there is another problem. For it’s really time-consuming if you would do this manually for every stock or other underlying, even by using some tools like Excel. But luckily, there are online max pain calculators available where you can calculate the max point automatically. You can use, for example, the max pain calculator provided by swaggystocks.com or maximum-pain.com.

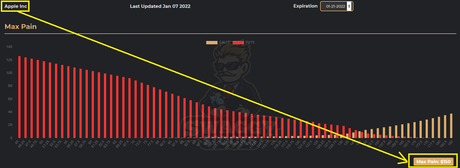

Using such a max pain calculator, you can determine the max pain point very quickly. For the option chain from our example the max pain point would be at the strike of $150:

Is The Concept Of Max Pain Really Useful?

So far about the theory. The final question is: how useful is max pain in the practice and for your trading?

The market makers have usually deep pockets, and they are able to move the prices briefly in a certain direction to indeed get to the point of max pain where they can earn the most money and the option buyers lose the most money. You can observe this very well in the indices (Dow Jones, S&P500, etc.) on the day when the options are expiring. Especially briefly before the actual expiration, sometimes you would see that the indices suddenly make a jump upwards or downwards, depending on where the market makers want to pin the price of the underlying.

Knowing this fact that the market makers can move the markets for a short period, you can look for these max pain points and position yourself around them (depending on whether you’re an option seller or option buyer). This is the advantage of the max pain concept, so the believers of this theory.

But from my point of experience I have to say that there is one big argument speaking against the advantage of max pain. And this argument is that when we determine the max pain point, we always see a snap-shot of the market! As soon as someone would open new positions or close existing positions, it could affect the max pain point. And this can happen not only daily but even hourly.

Therefore, at least from my point of view, if you want to use the max pain concept in your trading, you need to be a very active trader which is actually contradictory with options trading. For in options trading, you usually don’t open and close positions daily or even hourly. In options trading, you usually let your position evolve for days or even weeks before making the next step. There might be an exception in the options trading which is during the earnings season. But this is an exception and not the rule, and maybe this whole max pain concept is useful for institutional traders but for us, the private traders, it might be pretty challenging to follow the fast changes of the max pain point.

One field of activity where max pain might be useful, could be for the day traders because they have to sit in front of their computers all the time. But day trading is another story…

Before I end this article, please keep in mind: the information I provided you represents my own opinion and maybe you can indeed use the max pain theory in your options trading and have success with it. Therefore, take this information but also do your own experience and search for more information about the max pain theory. With all this in mind, happy trading, folks!