Although the IV Rank is a very useful tool to determine whether the implied volatility of a stock or commodity is high or low, it has a weak spot. This weak spot occurs for example always when the implied volatility spikes and generates outliers. This happens, for instance, during a crash. In this case you would get wrong conclusions considering only the IV Rank. The other weak spot of the IV Rank is that with this tool you can also get false conclusions although there are no outliers. One prominent example for this situation is the value of the VIX, the Implied Volatility Index. To make it better understandable, let’s first take a look at some examples. After this, I will continue with the answer for the question: “What is IV Percentile and how to use it?”.

The weak spots of the IV Rank

Example 1 – the VIX

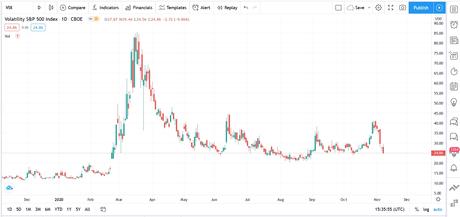

Take a look at the chart of the VIX below which has the value of around 25. In the chart you can also see that the VIX had a some high value in March 2020 which was during the corona crash. Now when you calculate the IV Rank, you will get a value of around 18 (the formula for the IV Rank you will find in my article about the IV Rank, folks).

An IV Rank of 18% is actually a very low value, and if you wanted to know if it’s worth to sell options on VIX, the answer would be clear: not it’s not! But in this case you will get a false conclusion using the IV Rank as a metric because the VIX’s value of around 25 is actually a high value.

Why? Well, it’s because the most time the VIX is located below the value of 20! I already explained this in my course about crashes and if you are familiar with the VIX, you already would know it. But knowing this, you would agree on that although the IV Rank of 18% is a really low value, it’s nevertheless worth it to sell options on the VIX.

And that’s where the IV Percentile comes into play to help you to generate better conclusions whether the implied volatility of a security (stock, commodity, etc.) is indeed low or whether the IV Rank provides false values.

Now let’s check the second example, folks. After this, I’ll explain to you the IV Percentile and show you how to use this metric.

Example 2: a random stock

In the example above we checked an index. In the second example, let’s check a stock and let’s take the Apple stock because Apple is a stock everyone is knowing. This time, I took the chart from the Trader Work Station (available at Interactive Brokers or Captrader). The TWS is already showing us the IV Rank of Apple which is 19%.

And again, an IV Rank of 19% is signalizing that it’s not worth to sell options on Apple at this moment. Therefore, it would be great to know if an IV Rank of 19% is indeed a low value or if it’s just a diluted one. And again, you can answer this question by taking a look at the IV Percentile which I’ll explain you in the next section.

What is IV Percentile

The IV Percentile closes the weak spot of the IV Rank and helps to determine whether the implied volatility of a security is really high or low. And to do this, the IV Percentile answers the following question: “How was the volatility of a stock or commodity in the past the most time?”

As a result, you will get a percentage value telling you how often the volatility was below the current volatility. And actually, that’s the whole secret behind the IV Percentile.With this metric, we compare the current volatility with every single day in the past of a certain period which is usually 252 days (1 trading year).

Let’s check the formula for this metric before I will explain you how to use the IV Percentile.

IV Percentile = Number of days under current implied volatility/number of trading days

And at this point you might already realize that to calculate the IV Percentile manually is pretty complex and that’s why it makes sense to use a software. More about the software you will find at the end of this article.

But for this moment, let’s continue with the next section and answer the question “How to use the Implied Volatility Percentile?”

How to use the Implied Volatility Percentile?

Let’s check the screenshot with the IV Rank you have seen at the beginning of this article. But this time, I added an extra column with the IV Percentile:

Now we have the IV Rank with a value of 19% and the IV Percentile with 35%. So what does the value of 35% telling us? As you learned in the section above, the IV Percentile is answering the question: “How was the volatility in the past the most time?”.

With a value of 35%, we can answer this question like following: In 35% of all cases (which was during the last 252 days) the volatility was lower than of the current volatility. Reversely it means, that in 65% of all cases the volatility was higher than the current volatility.

And with this information it’s clear, that the IV Rank of 19% is indeed a low value, and for this moment it’s not worth to sell options on Apple.

I hope, with this example it got clear for you how to use the IV Percentile.

Difference between IV Rank and IV Percentile

Now let’s check the difference between the IV Rank and the IV Percentile because these both metrics seem to be very similar. And yes, they are indeed similar but with one significant difference.

The IV Rank is just looking for the Implied Volatility highest and lowest value during a certain period, and compares it with the current implied volatility.

The IV Percentile is not doing this. It considers not only the highest and the lowest value but every single day of a certain period of time. As a result, you will get a much smoother value by using the IV Percentile. And that’s why a lot of traders are using it as a complement for the IV Rank.

When to sell options by regarding the IV Percentile?

The higher the IV Percentile the better it would be for option sellers. And in combination with the IV Rank, you will get a useful metric to determine whether it’s worth to sell options or not.

But whatever you are going to do, my advice to you is not to jump from one metric to the other. Instead, I recommend you to be consistent. If you would like to use the IV Rank but dismiss the IV Percentile, great! But as long as you do it consistently. If you would jump from one to the other metric, it would cause rather a confusion than the use of these two metrics.

Where to check the IV Percentile and is there a free IV Percentile scanner available?

At this moment, there is no free IV Percentile screener available. At least, I couldn’t find a free one on the internet. In case you find a free one, please leave a comment in the comment section.

Where to see the IV rank

In all other cases, when you don’t need an IV Percentile scanner, you should see the IV Percentile in the trading software of your broker. At least, these brokers are offering the IV Rank in their trading platforms:

Interactive Brokers (also Captrader)

Interactive Brokers with its Introducing Broker Captrader offers the IV Rank in its trading software Trader Work Station (TWS). The only prerequisite for this is that you turn the software from the classic layout into the mosaic layout. Then you can start to add the IV Percentile and also the IV Rank column.

Tastyworks

A great platform I know that they offer the IV Percentile. Another feature you will get when you open a trading account at tastyworks is a kind of an IV Rank scanner which looks like a grid page:

But also without this grid page you will find the IV Percentile for every stock you will find in tastyworks. And not only this, the IV Percentile in tastyworks is shown you not just for the last 52 weeks but also for different periods of time like 30 days or 60 days. At least it was available in their former software called dough.

I also don’t have a tastyworks account. But I liked this grid page on dough.com a lot, and I can really recommend you to open a tastyworks account in case you are looking for a trading platform.

Okay folks, that’s it about the sources. There are for sure other trading platforms offering the IV Percentile but with these three ones, you should have a good starting point.

Advertisement

Would you like to know how to profit from crashes in the stock markets? Then check this preview and enroll this course on Udemy.

Disclaimer:

The information I am giving you in this article is for educational purposes only and should not be treated as investment advice. The information presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in trading activities related to the information in this article should do their own research and seek advice from a licensed financial adviser.