The term for LEAP options (also called LEAPS) is Long-Term Equity Anticipation Securities. A boring term, I know. But it’s simple and not complicated at all: LEAPS are just normal options (securities) with a very long expiration time. Whereupon “very long” means an expiration time longer than one year. But anything else is practically the same. In this article, we will take a closer look on the whole topic about this type of options and check how to make money in stocks (or even futures) by trading LEAPS.

What LEAP options are good for?

As you have seen it in the introduction, we already answered the question “What are LEAP options”. LEAPS are normal options but with just an expiration time of at least one year. The next question is now what LEAP options are good for and is there a LEAP options strategy you can make money with?

In general, under certain circumstances, LEAP options are good for option buyers and option sellers as well, depending on the situation. Therefore, let’s check it separately and let’s start with the option buyers.

Save money by buying LEAP options

Usually, LEAP option buyers purchase LEAPS instead of a stock to save a lot of money. Let’s do a simple calculation to make it clear.

Let’s say, you found a stock from which you anticipate it would increase very soon, and you would like to buy 100 stocks worth $138 each. Buying this stock, you would spend $13.800.

$13.800 can be a lot of money, especially for smaller accounts. So let’s check, how much you would spend buying a long term option.

First, we need to choose a strike. But what is a correct strike for a LEAP option? The answer is simple: there is no correct strike as such! It all depends on you and your own research, your own assumption.

But for our example, let’s say, we choose a strike at the money. You don’t know the term “at the money”? In this case, I can recommend you to enroll some trading options courses* or just check some free videos on YouTube.

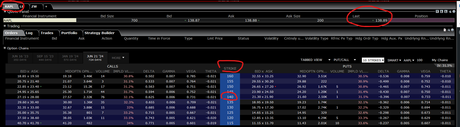

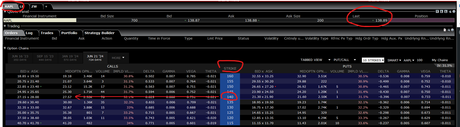

In our example I’ve chosen the Apple stock (because everyone knows this one). Because the price for an Apple stock in our example is around $138, the next closest price level within an options chain would be a strike of $140 (at the money):

Now let’s choose an expiration date. Here it’s also up to you what to choose. But just for an orientation, as I explained it before in my article about buying options, you can use the following rule of thumb: double the amount of time of your expectation. As LEAP options have by definition a time period of at least one year, you can chose an expiration time of at least two years if you want to follow that rule.

In our example, I’ve chosen such an expiration date which is not exactly 2 years, but with one year and 11 months, we are acting very close along the rule of thumb.

Now, when you check the screenshot, you will see, that the price for a call option with an expiration date of 21st of June 2024 cost around $27.57 (mid price).

In total, you would spend $2.757 instead of $13.800.

With that, you would save around 80% by comparison of purchasing the stock directly. As you can see, it’s a very simple but useful leap options strategy – to save money by buying the stock indirectly.

When LEAP options are useful for option buyers?

- For option buyers, LEAP options can be useful at the end of a bear market. At the end of the bear market, the most stocks are declined to a level where you are spoilt for choice. But not always you could have the right account size to buy all the stocks you would like. And here’s where LEAP options come into play. As we have seen, you can save a lot of money when you buy long term options as opposed to a purchase of the stock itself.

- Of course, you can apply LEAP options also in a bull market because for the same reasons as at the end of a bear market. In a bull market, you might miss the lowest point of a bear market, but this would be no problem. For also in an ongoing bull market you would have a plenty of choices to make money in stocks by buying LEAP options.

- When the implied volatility is low. That’s actually the most important rule. At least that’s what my experience taught me. You would strongly increase your chances to make money in stocks by buying LEAP options when the implied volatility is as low as possible. Otherwise, even if the stock on which you bought a long term option would increase, you wouldn’t make decent profits or any profits at all if your option was too expensive. When you’re able to determine a low implied volatility, e.g. by using the IV Rank, maybe combined with the IV Percentile, you could make money on stocks with options like a pro if you take this business seriously.

- No matter whether it would be the end of a bear market or a bull market, you need to do your homework to find a decent entry point. Therefore, buying LEAP options to make money in stocks is suitable especially for good chart analysts and fundamental analysts. Besides the implied volatility, it’s another piece of puzzle you need to solve if you want to increase your profits by making money on stocks. People who are good at chart analysis and fundamental analysis have an advantage as opposed to traders who are just guessing where and when to open a position.

How much can you earn by buying LEAP options?

In theory, by buying options, regardless whether normal options or LEAPS, your profits can be unlimited.

But that’s just the theory. In practice, it just depends on how good the price of a stock (or a futures contract) would evolve and how good you did your homework I described above.

Besides that, you need to keep in mind that your break even would be at the point where you would be even with your original spending. In our example, we would spend $2757 buying a LEAP option. So you need the stock to move upwards at least this amount of money. Only then you would be even and after that, you would start earning money.

When should you NOT buy LEAP options?

- In general, in the middle of a bear market. When a bear market is ongoing, it could be pretty unprofitable if you buy LEAP options. The reason for this is that nobody knows when an ongoing bear market would end, and the price of the security could fall such deep that it wouldn’t have enough time to evolve at least back to the point where the option was bought. Therefore, it’s always advisable to make sure that the bear market is over before buying long term options.

- When the implied volatility is high. As I mentioned it above, you should buy a long term option when the implied volatility is low. Therefore, try to avoid to buy a long term option when the implied volatility is high unless you have a dead certain information that your stock or other security will skyrocket. But that’s easier said that done.

SIGN UP FOR UPDATES: SUBSCRIBE!

When LEAP options are useful for option sellers?

Now let’s check another leap options strategy how to make money in stocks buy selling long term options.

- At the end of a bear market when implied volatility is high. It’s actually always the case in the stock market: when the prices decline, the implied volatility increases. When you see that the bear market ends, you can start to select between stocks or ETFs with the highest implied volatility to get the highest possible premium.

- After a crash by exploiting the Vega. Vega is one of the so-called “Greeks” in the world of options, and it measures the amount of increase or decrease in the premium of an option based on a 1% change in implied volatility.

If you have never heard about the “Greeks”, you can check them easily online or by enrolling some trading options courses*, for it would go far beyond the scope in this article to explain them in detail.

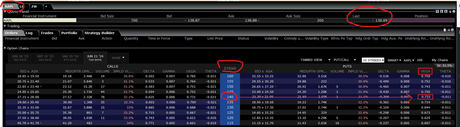

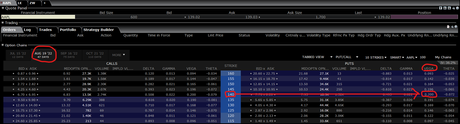

But what’s so special about the Vega? For this, let’s check the Vega with the help of the following screenshot. It’s an options chain of the Apple stock we have seen above. And as you can see, the Vega for the LEAP option at the strike of $140 is 0.733:

But when we take a look at an option with an expiration time of just 47 days, what do we see? Correct, a much lower Vega of 0.200 at the strike of $140:

And here’s the deal: when a crash happens, the implied volatility would increase remarkably. And because the implied volatility affects the Vega which would also remarkably increase, the price of a LEAP option would also increase more than under normal circumstances. Therefore, when you sell a long term option just before the crash ends, you would get much higher premium than usual. But that’s not the end: after a crash, the implied volatility decreases usually pretty fast and with that also the Vega with the effect that also the price of a LEAP options would decrease pretty fast as well! If you were looking for information on how to make money on stocks fast, this would be indeed such a possibility. Too bad that we don’t have a crash every day, right? By the way, if you’re would like to know how to determine whether a crash in the markets is over or not, check my online course about those signals*.

- Making money with LEAP options in a bull market? Well, in a bull market, selling a long term option is suitable to a limited extent. The reason for this is that in a bull market, the implied volatility is usually low, and you wouldn’t get as much premium if you would wait for periods with a higher implied volatility.

How much can you earn by selling LEAPS?

By selling options instead of buying them, your profit is always limited to the maximum premium you would get. But that’s actually no problem as you have seen that there are situations where buying options can make more sense than selling them, and vice versa. Therefore, you just need to get into it, gather experience and find your way how to make money in stocks by using options.

When should you NOT sell LEAPS?

- When you’re not sure whether the bear market has come to its end. To avoid unnecessary losses or some sleepless nights because of entering the markets prematurely, get sure that the markets will rise again soon before you open a position.

- When the implied volatility is low. When you sell LEAP options at times of a low implied volatility, you would give away the premium you would otherwise earn at times of high implied volatility. And of course, it could also have an impact on your risk profile and you could risk a margin call in case you exploited you account ad nauseam.

- During a normal trading period. During such periods, not only the implied volatility is low, but you’re also risking to have open positions before the next crash. This could again end in a margin call.

Summary

- To earn money with LEAP options, you need to choose whether to buy them or to sell them. Both possibilities require to consider different situations and have their own advantages but also disadvantages

- Selling LEAP options is one of the rare possibilities how to make money on stocks fast (But not get rich over night!)

- Buying LEAP options is suitable for saving money and to open more positions

- By buying LEAPS, your theoretical profit is unlimited, and your risk is limited because you can only use what you have spent

- By selling LEAPS, your profit is always limited to the amount of your premium. The loss, on the other hand, can ruin your account because it’s much higher. I can’t say it’s always unlimited because it would be only in the case when you naked calls as LEAPS. Instead, you should always sell LEAP puts. In this case, you loss cannot be unlimited because a stock can only decline to a worth of $0. But such movements can very well ruin your trading account

- There is no right or the best leap options strategy but it all depends on you preferences and your experience

- If you want to learn how to make money by trading options seriously, start with some trading options courses* to get into it.

Disclaimer: This information is neither an investment advice nor an investment strategy or investment recommendation. The information I am giving you in this article is for informative purposes only. The information presented would not be suitable for investors who are not familiar with securities. Any readers interested in trading or investment activities related to the information in this article should do their own research and seek advice from a licensed financial adviser. The securities are products that are not simple and can be difficult to understand. This information contains information that relates to the past. Past performance is not a reliable indicator of future results.