German Finance Minister, Schaeuble arrives at the Athens airport.

An immigration officer asks him: "Nationality?" Schaeuble says: "German." The immigration officer asks: "Occupation?" To which Schaeuble responds: "Nein, I am here for a few days only."

"Gallows humor" is popular during depressions. No one is looking for a belly laugh – just a little smirk to brighten up the never-ending string of despair people usually have to deal with. Films were a popular means of escape in the 1930s and we were very into IMAX when they were below $12.50 during the crash as we expected a similar move up in movies audiences as we moved through this century's Great Recession.

However, it only cost a dime to go to the movies in 1930 and, to put it in perspective, the price of gas was .20 at the time. Now it costs $15 to see an IMAX film and gas is $4 a gallon this weekend and we're beginning to see a bit of blow-back from consumers – who simply can't afford to spend $30 for two tickets when they just spent $60 to fill up the car.

However, it only cost a dime to go to the movies in 1930 and, to put it in perspective, the price of gas was .20 at the time. Now it costs $15 to see an IMAX film and gas is $4 a gallon this weekend and we're beginning to see a bit of blow-back from consumers – who simply can't afford to spend $30 for two tickets when they just spent $60 to fill up the car.

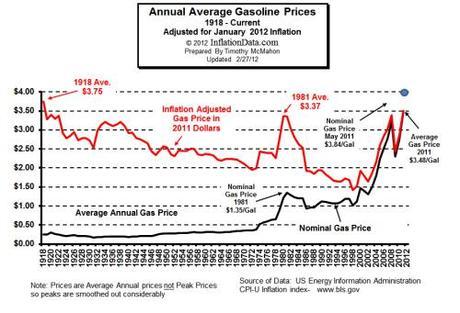

Gasoline was also persistently high in the 30s (relative to inflation) but came down from a relative $3 per gallon in 1940 to $2 a gallon in the 70s as the US entered an age of prosperity and we built this nation around the idea of having an inexpensive and readily-available fuel source.

After the initial price shock of the 70s, which pushed us into another recession, things were improving all the way through about 2002, when gasoline prices soared to inflation-adjusted records. While the supply is still plentiful, the prices are no longer affordable and 86M barrels of oil a day at 42 gallons a barrel x 365 days a year at $3.50 per gallon comes out to $4.6Tn a year. Of course, not all oil converts to gasoline but you get the idea. Also, our friends in Europe are reading this and saying "$3.50 a gallon – in your dreams!" as they pay roughly $9 at the pumps.

Add in the effect the high price of oil has on food and other downstream products that rely on oil and you are looking at oil alone diverting 5% of our global GDP – in EXCESS of the realistic $70 per barrel price – away from more productive uses than buying a commodity that literally goes up in smoke as soon as we use it (see "Goldman's Global Oil Scam Passes the 50 Madoff Mark" for more details).

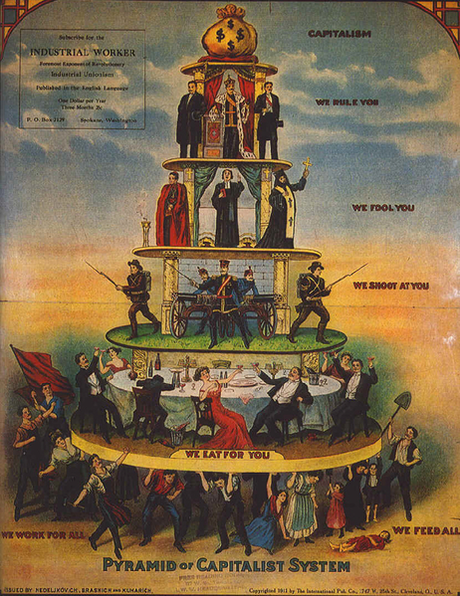

This is why Capitalism is the enemy of mankind. Since rising oil prices had and have very little relationship to the cost of extraction – it is fantastically profitable for the oil companies when we have these little price spikes.

This is why Capitalism is the enemy of mankind. Since rising oil prices had and have very little relationship to the cost of extraction – it is fantastically profitable for the oil companies when we have these little price spikes.

It is also fantastically profitable for the speculators, who insert themselves between the commodity producers (who take the actual risks) and the consumers (who create the actual demand) and the goal of the speculator is, of course, to pay the producers of the commodities as little as possible while charging the consumers as much as possible.

I have warned people for years that these same speculators are now, even as I warn you, circling their wagons and looking to insert themselves between you and your water as well. One day they will go after the air that you breathe but water is already on the table and will one day be as manipulated as gasoline if we don't stop them now.

I have warned people for years that these same speculators are now, even as I warn you, circling their wagons and looking to insert themselves between you and your water as well. One day they will go after the air that you breathe but water is already on the table and will one day be as manipulated as gasoline if we don't stop them now.

This isn't an article about that but I do think it's important to keep you alert for the signs to come as we move into the final phases of corporations controlling everything you need to live. As I was saying, Capitalism is the enemy of mankind because, as we saw in the early 2000s, when oil companies and commodity producers make a lot of money – then the "hot money" flows into them. In real Capitalism, that's a good thing as more people drill wells and plant corn, etc. and, ultimately, drive prices back down to a level that meets the demand curve properly.

Unfortunately, we don't even have true Capitalism, we have a perversion of it that has spawned a Corporate Kleptocracy where companies are rewarded for monopolizing resources and delivering the lowest quality product for the highest possible price across the board. This is not a long-term benefit to anyone except for those few who end up making all the money. In fact, if you are in the top 10%, it's likely you often choose quality over price and for very good reason – but more and more that choice is denied to the masses and the lifestyle of Americans since the early 70s is very easily summarized as getting less for more – year after year.

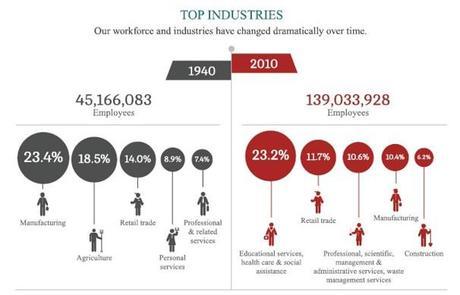

Corporations are rewarded for shipping our jobs overseas and, as the consumers get poorer and poorer, they are willing to sacrifice things like being able to try on clothes at an actual store or having knowledgeable salespeople answer their questions before they purchase durable goods and the lack of knowledgeable salespeople and closing of actual retail stores (that employed actual people) encourages more and more people to shop on-line, giving Corporations more and more profits and encouraging them to cut more staff and more stores – perpetuating the cycle.

As I said, this is how Capitalism becomes the enemy of mankind: We reward Amazon, who employ 56,200 people, with a price-earnings ratio of 141 while Best Buy, who employs 180,000 people garners a p/e of 6.

As I said, this is how Capitalism becomes the enemy of mankind: We reward Amazon, who employ 56,200 people, with a price-earnings ratio of 141 while Best Buy, who employs 180,000 people garners a p/e of 6.

What kind of business do we encourage entrepreneurs to build and invest in? Efficiency is a noble goal and works wonders when you have an ever-expanding market but what happens when you saturate the planet with efficiently-produced goods and services?

Eventually, perhaps 700M people plus machines will be able to produce and distribute everything that 7Bn people on this planet require. What then? 6.3Bn people won't be just unemployed, they will be unnecessary – except for as consumers. But there's obviously no point in paying them not to work but if it's not profitable to employ them and we're not going to support them but we need them to buy our stuff – what then? If we kill them they can't consume – this is a conundrum that we're already facing, somewhere between the 1/3 of the population that "needs" to work today and the 1/10th that will need to work in the future – we'd BETTER figure this out!

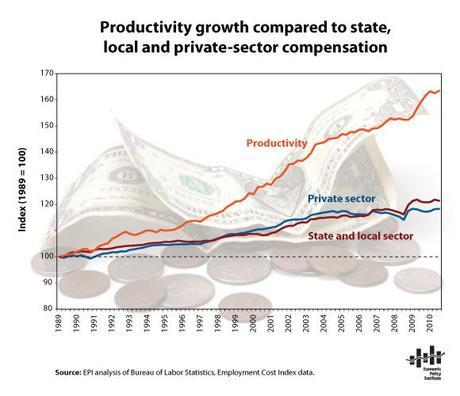

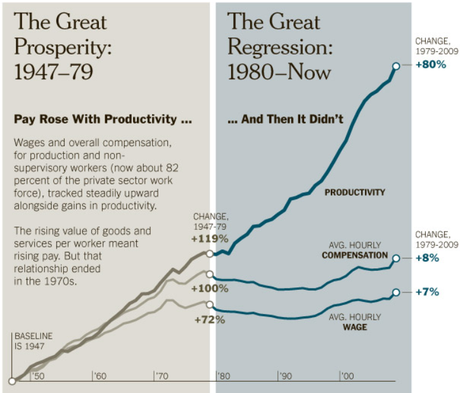

As you can see from the above chart, we certainly don't share the benefits of increased productivity with our workers, do we?

As you can see from the above chart, we certainly don't share the benefits of increased productivity with our workers, do we?

Out of an 80% increase in Productivity since 1980, less than 7% of those gains showed up as wages – not even enough to keep up with inflation. This is what Capitalism REWARDS, this is what Capitalism steers us to – and it's still not enough – it will never be enough as the hot money chases the companies that make the most by doing the least – day after day, year after year – shaping our economy, our social structure and our Government the way a river shapes a canyon.

Creating an underclass – even a slave class – is the natural end-game of Capitalism – a Corporate Kleptocracy simply seeks to hurry things along to their inevitable conclusion while making sure the players who are currently on top remain on top. In other words, they won the first round – and now they want to change the rules to make sure there are no surprises for the rest of the game.

Marx argued that, due to economic inequality, the purchase of labor cannot occur under "free" conditions. Since capitalists control the means of production (e.g., factories, businesses, machinery) and workers control only their labor, the worker is naturally coerced into allowing their labor to be exploited. Labor historian Immanuel Wallerstein has argued that unfree labor – by slaves, indentured servants, prisoners, and other coerced persons – is compatible with capitalist relationships.

While in major capitalist economies the minimum wage is legislatively imposed by the state, there is no maximum wage limit, which is supposedly determined by the forces of the free market. They further argue that the minimum wage measure does not serve to set a lower limit in a worker's earnings; it actually functions as an upper limit on the earnings of a person that just enters the workforce. The existence of minimum wage, coupled with the absence of maximum, permits rapid wealth accumulation and leads to a phenomenon termed "plutonomy" by Citigroup. In effect, wages are kept low for almost all of the population while the remaining minute percentage is allowed to meet overwhelming profits.