Volker Kauder, the head of Germany's leading Parliamentary group thinks so, saying: "I hope that the ECB acknowledges its limits and quickly rakes in the money later." Mr. Kauder's warning follows similar comments made by Ms. Merkel at the most recent summit of European leaders on March 2. Responding to warnings by Brazil about a "tsunami of cheap money" flooding global markets, Merkel said during a news conference that she was certain that the ECB had now ended its program of issuing cheap 3-year loans to banks. Merkel also reassured critics that the ECB would not repeat such measures again.

The ECB's balance sheet is now nearly 1/3 of the Euro-Zone economy, 50% worse than the Fed's 19% stake in the US and even the Bank of England has "only" pumped their balance sheet to 21% of the UK GDP. On Friday, through some interesting number juggling, Germany's Federal Statistics Office announced that the country's deficit plunged in 2011 and, at 1 percent, is now well within EU limits. They are now ratcheting up the pressure for other nations to follow suit. As pointed out by Mish:

Spanish prime minister Mariano Rajoy has already announced his own budget target of 5.8% of GDP in 2012, ignoring the EMU mandate of 4.4% on the way to an alleged 3% in 2013. Rest assured 4.4% will not be met, nor will 5.8%. Last year's deficit was 8.5% and with Spain heading into a monster recession, 7.0% might be a more reasonable expectation for 2012.

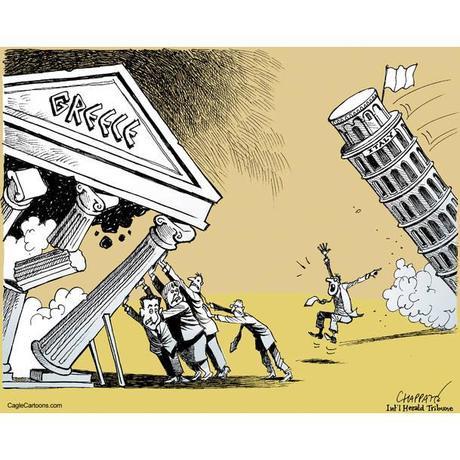

This may all be just internal noise to placate the hawks in Germany or it may be stage one of panic over the 2.5% plunge in the Euro last week – despite Greece being "fixed" again. The bottom line is, without similar balance sheet inflation from the BOE and the Fed next week, the Euro still has a long way to fall and we know how a bouncing Dollar plays havoc with the markets.

This may all be just internal noise to placate the hawks in Germany or it may be stage one of panic over the 2.5% plunge in the Euro last week – despite Greece being "fixed" again. The bottom line is, without similar balance sheet inflation from the BOE and the Fed next week, the Euro still has a long way to fall and we know how a bouncing Dollar plays havoc with the markets.

Portugal is already showing a 2.8% CONTRACTION in GDP for the final 3 months of 2011, 1.3% worse than Q3 and no one thinks it's getting better in Q1. Their statistics agency said domestic demand and investment fell sharply, while growth in exports slowed. Portugal's largest export partner is Spain, who are just beginning…