This is concerning.

This is concerning.

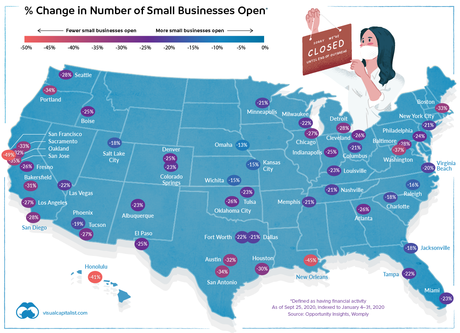

In this excellent but disturbing graphic by Visual Capitalist, major cities are averaging 30% drops in small business activity with San Francisco HALF closed and New Oreleans not far behind. When you break it down to liesure and hospitality businesses, it's a devastating 65% and 72% in those cities and even Washington, DC has 55% of their L&H sector closed among 37% of all small businesses still shut down.

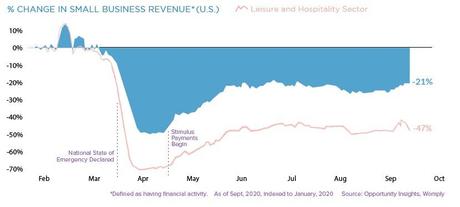

Yet out Congresspeople can't see the need for more stimulus? Do we need any better reason to throw the bums out? And it's not like we're having some fantastic recovery. Overall Small Business Activity in the US is down 21% – no better than it was in June and that's AFTER the first $4Tn in stimulus has been spent.

There's been some spillover from Main Street to Wall Street as Bank of America's (BAC) profits are down 16% in today's report and Wells Fargo's (WFC) are down 56% but Goldman Sachs' profits almost doubled expectation at $9.68 per $215 share in a single quarter – very impressive. We don't have much banking in the LTP and GS is a good one (well, evil, but good earnings) so let's add them with the following trade:

- Sell 5 GS 2023 $165 puts for $20 ($10,000)

- Buy 10 GS 2023 $170 calls for $60 ($60,000)

- Sell 10 GS 2023 $210 calls for $40 ($40,000)

That's net $10,000 on the $40,000 spread that's 100% in the money to start and all GS has to do is not be lower than it is today in 2.25 years and we make $30,000 (300%) – aren't options fun? Our worst-case scenario is owning 500 shares at net $185, 15% lower than the current price and the ordinary margin requirement is just $5,718 – so it's a very margin-efficient way to make $30,000 too!

JPMorgan Chase and Citigroup posted better-than-expected results Tuesday, while also warning that the economy isn’t out of the woods yet and there may be significant defaults on loans by customers in the future. While the Big Banks may be able to profit off the misery of others, the regional banks will be hit…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!