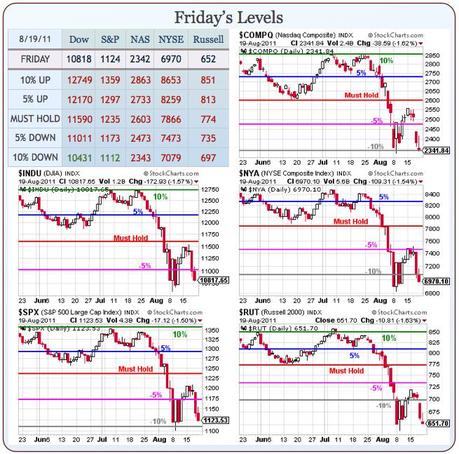

Here we go again. We made it through our "Testy Tuesday" and, as you can see from our Big Chart, we hit our goals with 4 of our 5 indexes coming right up to their resistance lines – not bad for support lines we first drew in April of 2009!

As I often say: I am neither Bullish nor Bearish – just Rangeish. Rangeish has been the winning play for us for quite a while. I was on TV August 2nd, where I laid out our plan for the month (20% drop) and we were VERY HAPPY to do our bottom fishing at those -10% lines for the last few weeks and now we are back in a zone of relative uncertainty where we must hold our Must Hold lines.

On Friday, the 19th, we were confident enough in our bottom call (I led the post off with: "We are now officially getting silly" as the futures tanked that morning) that we shorted EWG puts in the morning post and shorted the VIX at $42.50 with a VXX spread that’s already up 1,433% but well on track to double that.

Also in that morning post (and this is just the free stuff!) I put up a bullish trade idea on XOM at $70 that is obviously doing very well (XOM $74 yesterday) as well as calling for longs on the Futures at Russell (/TF) at 650, Nasdaq (/NQ) at 2,050 and Oil (/CL) at $80. If you didn’t play those bullish, don’t look now because you might cry…

We are able to do that when we take advantage of the very high VIX (which we expected to go down) as well as taking specific advantage of HPQ coming off disappointing earnings but it’s not the charts — it can NEVER be the charts that tell you to buy a stock that is plummeting – it’s FUNDAMENTALS!

We also picked up TIE that afternoon and an aggressive upside play on the Russell with a TNA (at $36 that day) Sept $35/39 bull call spread at $2, paying for it with the sale of the Sept $26 puts at $1.60 for net .40 on the $4 spread. TNA is now $49.25 (up 36%) and the spread is $3.60 and the short puts are .15 for net $3.45, which is up 762% – also in two weeks.

That’s a great example of how you can use options to pick up tremendous leverage on index movements although 36% in the index itself is not too shabby…

As you can see from the Big Chart of August 19th (above) – there was nothing in the TA telling us to go bullish that day. Indeed we finished at the day’s lows and we were, in fact, expecting to possibly re-test the lows but our FUNDAMENTAL analysis of the data, the newsflow, earnings reports, etc. made us comfortable getting a little bullish that day. This is the pay-off from maintaining a "Cashy and Cautious" stance for most of the month – we were ready, willing AND able to act when the opportunity presented itself.

I say this now because we’re back in the middle of our range and we NEED to realize that our certainty level can not be the same as it was when we were at the bottom of our range. Calling movements at the bottom or tops of ranges is much easier than calling the middle and we need to go back to being cautious (cautiously bullish at the moment because of QE3) as we move through this critical zone. Fundamentals only take you so far – I can tell you that the Dow SHOULD be at 11,590 (our Must Hold level) and if you say – "is 10,500 too low", I can easily say yes and if you say "is 13,000 too high", I can easily say yes but is 11,300 or 11,700 too high or too low? No, that’s silly, it’s close enough and, as I said yesterday – in absence of news or data to the contrary, we can expect a gravitational drift back towards those must hold lines which are, more or less, the "right" price for our indexes at the moment.

Even mighty Canada’s GDP is DECLINING – down 0.1% last Q on falling oil prices. China is keeping Australia afloat for now but a combination of rising input costs and rising wages has sent the Shanghai Composite down 8.6% this year, adding to last year’s 14% drop and, as I mentioned the other day, the PBOC is currently DRAINING liquidity to the tune of 10% of the GDP ($600Bn) to try to reign in food inflation that is causing riots all over the Nation.

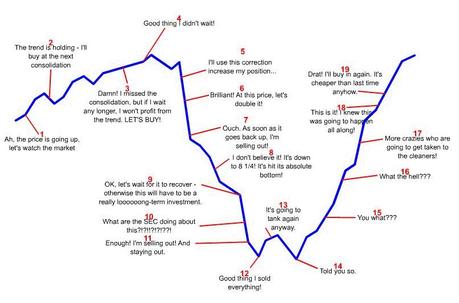

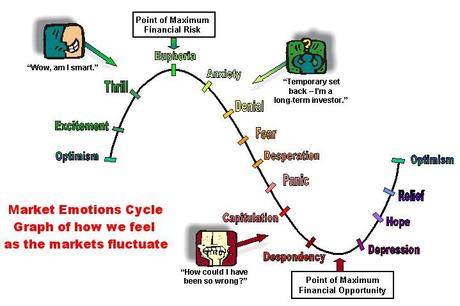

ALWAYS be aware of who your counterparties are when you are trading. Since the "Arab Spring" revolutions began, we’ve had Billions of dollars pouring into gold markets as nervous despots and their toadies looked for places to park their cash and in Asia it’s the metal of choice for inflation fighers, despite the fact that gold has, historically, been a poor overall hedge against inflation.

I have a simple system for knowing which way to go on gold. Are more commercials on TV asking you to sell them gold or trying to sell you gold? If most of the commercials on CNBC are people who are spending money to tell you what a great investment gold is and that you should be buying it from them – THAT is probably a good time to sell gold. When people are spending their money on TV telling you to melt down all your jewelry and send it to them for cash – THAT is when it is time to buy. This morning, I’ve seen 10 commercials looking to sell me gold and no buyers….

Fundamentally, we could go either way at this point so let’s watch those technicals and, of course – let’s be careful out there!