We hit our $98.50 goal line on oil and that's up $6,500 per contact from $105 at the beginning of the month, where we went heavily short. When oil was at $102.50, on Feb 21st, I said to our Members:

Oil – You can play it either way off the lines. The reason I play short is because, over the long-term (3 months), I don't see oil sustaining $100 so, if oil goes to $105 on a violent pop, and I'm down $2,500 per contract, I don't mind doubling down to raise my net to $103.75 and, if it goes up to $106.25, I don't mind doubling down again to average a very big position at $105 average and sitting on it for as long as it takes to get real. If I were betting oil up and it dropped $2.50, however, I'd feel like a complete moron and I'd have no desire to DD and then I'd be hopelessly out of position and miserable and if it dropped another $2.50, I'd only feel stupider. That's why I prefer to play the side I have conviction on but, believe me, in the course of my own 10,000 hours – I learned that the hard way!

Realistically, if you think direction doesn't matter – you probably shouldn't be playing with Futures – other than very quick nickel and dime trading off support and resistance lines – which is how most people do play them (the beautiful sheeple). Thank goodness for them, they provide the "liquidity" that goes into our pockets!

Oil peaked out on March 3rd at $105.22 over the Ukraine issue. That's still not resolved but, as we expected in the morning post, it still wasn't enough to sustain $105 on oil. In fact, our first trade of the morning in Member Chat was the USO April $38 puts at $1.25 and, already, they closed yesterday at $2.40 – up 92%, but they should look better this morning and we'll take that 100% gain and run when it comes so quickly.

In the main post that day, I also suggested the TZA April $14/17 bull call spread at $1.05, offset with the sale of the $14 puts at .50 for net .55 on the $3 spread. After a rough start, that spread closed at .66 yesterday, up 20% so far and excellent protection with a 445% upside potential should the Russell continue to fall. The Russell is only back to where it was that day (1,183). Because we are BEING THE HOUSE – and not the gambler, we make money on our hedges, even in a flat market.

In the main post that day, I also suggested the TZA April $14/17 bull call spread at $1.05, offset with the sale of the $14 puts at .50 for net .55 on the $3 spread. After a rough start, that spread closed at .66 yesterday, up 20% so far and excellent protection with a 445% upside potential should the Russell continue to fall. The Russell is only back to where it was that day (1,183). Because we are BEING THE HOUSE – and not the gambler, we make money on our hedges, even in a flat market.

That day (March 3rd) we also called the bottom on Natural Gas (/NG) Futures at $4.50 and the gyrations between $4.50 and $4.70 (our shorting line) have been good for $2,000 per contract, over and over and over again this month. As I said yesterday (and all month), there's no harm in going to CASH!!! - we can find plenty of good things to play WITHOUT having to sit on all that market risk when direction is uncertain.

One thing that was certain this morning was the collapse of the Nikkei in Japan. That index was down 2.5% for day, finishing at 14,700 on /NKD, which is a nice $3,500 per contract gain from our shorting line at 15,400 from just 5 days ago (Friday, 9:06 am). That was another silly spike up that we had the conviction to short into. We're actually looking for 14,500 or maybe even 14,000 on a proper breakdown so the 14,700 line can now be used as a new entry – with tight stops above.

One thing that was certain this morning was the collapse of the Nikkei in Japan. That index was down 2.5% for day, finishing at 14,700 on /NKD, which is a nice $3,500 per contract gain from our shorting line at 15,400 from just 5 days ago (Friday, 9:06 am). That was another silly spike up that we had the conviction to short into. We're actually looking for 14,500 or maybe even 14,000 on a proper breakdown so the 14,700 line can now be used as a new entry – with tight stops above.

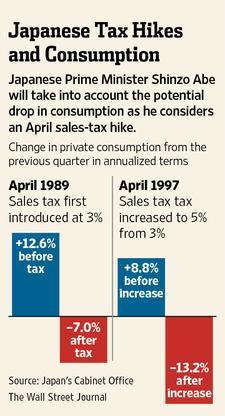

Japan was an easy call because we can READ and we've known about the April sales tax increase that will slow down the economy since last Fall. Since we KNOW what's going to happen, it's hard to fool us when the Nikkei is spiked higher based on rumors of more easing, etc. Another factor hitting the Nikkei is the Yen once again rising as China and other Asian currencies begin to look scarier than the Yen, and a rising Yen is awful for Japan's export-driven economy.

Japan was an easy call because we can READ and we've known about the April sales tax increase that will slow down the economy since last Fall. Since we KNOW what's going to happen, it's hard to fool us when the Nikkei is spiked higher based on rumors of more easing, etc. Another factor hitting the Nikkei is the Yen once again rising as China and other Asian currencies begin to look scarier than the Yen, and a rising Yen is awful for Japan's export-driven economy.

This is the kind of boring, fundamental stuff we talk about every day in our Member Chat Room (and you can join us here) where we think it's more important to understand WHY you are trading than just making trades. This is something I discussed in yesterday's Live Trading Webcast (we do them every Tuesday at 1pm). It's a very simple philosophy and you've certainly heard it before:

Give a man a fish and you feed him for a day; teach a man to fish and you feed him for a lifetime.

Since it's a good time to be in cash – perhaps we can reflect on that concept and take the time to watch "The Man Who Planted Trees" once again – as we prepare to hopefully have a chance to do a little more bottom-fishing (assuming we finally get a proper correction) and take the time to correctly position our portfolios for consistent future returns.