The Fed is not going to raise 0.75%.

The Fed is not going to raise 0.75%.

That would be 100% of where we are now – I don't see it happening and, just two weeks ago, they were uniformly saying 0.5% so why blow their credibility just to push 0.25% based on last week's inflation data that they clearly knew was coming? That is our premise going into this afternoon's rate announcement and we've taken (as noted in yesterday's Short-Term Portfolio Review) a more bullish stance at what we HOPE is the bottom – for now.

We feel that this week was a "forced" bottom with Banksters like Goldman Sachs (GS) and their attack monkeys like Jim Cramer doing whatever it takes to scare retail investors out of their positions so their "Private" (ie. very rich) clients can scoop up blue chips for 50 cents on the Dollar. At PSW, our hedges prevent us from having to panic in these situations and, just like the wealthiest people on Earth, we are able to add to our positions when the market is on sale. THAT is how you build real long-term wealth.

Unfortunately, it is human nature to abandon positions when they are down. It's not just about having the WILL to stick with what you have but also the MEANS and that, unfortunately, takes planning. Planning and patience are the hardest things we teach our Members at PhilStockWorld but they are also the most rewarding. It's a lesson from the Bible but also a lesson I reiterated way back in November, when I said to our Members in "Which Way Wednesday – Toppy or Just Getting Started?":

If you are in a market that is experiencing unsustainable gains then, at some point – IT WILL CORRECT. A correction is NOT a pullback – a correction is a move towards a CORRECT level that IS sustainable. Historically, that has been 8% annual growth.

From 2000 until 2010 the Nasdaq was below the 2,500 line and it hit 5,000 (again) in 2015 but, if we use 2010 as a base and give 5,000 points 8% growth for 12 years – we get to 13,058 – THAT is trend growth for the Nasdaq and we're 25% over that. Perhaps give us 10% for inflation and the rest is stimulus but none of that is deserved or sustainable though inflation can keep the party going for quite a while as stock prices do tend to keep up with inflation.

In any event, at 40x earnings, we are certainly coming near to the end of the run so I do urge caution. We bumped up our hedges in yesterday's Short-Term Portfolio Review and we are being extremely selective with our long positions while remaining at least 2/3 in CASH!!! – just in case the bottom does fall out faster than we think.

Notice the Nasdaq bounced right off the 13,058 line in March that was predicted by our 5% Rule™ in November. The 5% Rule™ is so good at predicting TA moves because it's not TA at all – it's just math! We simply use the TA to illustrate it since it turns out that math is too hard a concept for most Americans to grasp but pretty pictures with colors and lines – THAT is what gets "investors" excited these days!

Notice the Nasdaq bounced right off the 13,058 line in March that was predicted by our 5% Rule™ in November. The 5% Rule™ is so good at predicting TA moves because it's not TA at all – it's just math! We simply use the TA to illustrate it since it turns out that math is too hard a concept for most Americans to grasp but pretty pictures with colors and lines – THAT is what gets "investors" excited these days!

Notice the 5% Rule™ also predicted the top of the range at 15,000 and now we're down to the Strong Bounce line at 12,000 that was also predicted 6 months ago. This is now our CORRECT trading zone – don't expect us to bounce back from here – this is where the market belongs.

As I noted in Monday's PSW Report, we expect 11,000 (weak bounce) on the Nasdaq to be bouncy as the 200-week moving average is rising to that spot and the MACD line indicates some fairly oversold conditions and the Fed is NOT going to double rates this afternoon so all the idiots who thought they will are going to have to start buying in a panic and we'll see how well this run goes. If we count our current fall from 15,000 to 12,000 and consider the additional fall to 11,500 to be a manipulated overshoot courtesy of our "trusted" financial media and the criminal empire who sponsors them – then the bounce lines should be 12,600 (weak) and 13,200 (strong) and I doubt we get higher than that without new stimulus.

As I noted in Monday's PSW Report, we expect 11,000 (weak bounce) on the Nasdaq to be bouncy as the 200-week moving average is rising to that spot and the MACD line indicates some fairly oversold conditions and the Fed is NOT going to double rates this afternoon so all the idiots who thought they will are going to have to start buying in a panic and we'll see how well this run goes. If we count our current fall from 15,000 to 12,000 and consider the additional fall to 11,500 to be a manipulated overshoot courtesy of our "trusted" financial media and the criminal empire who sponsors them – then the bounce lines should be 12,600 (weak) and 13,200 (strong) and I doubt we get higher than that without new stimulus.

After this, our primary mover will be Earnings, which begin again in 30 days, with BLK, CAG, DAL, JPM, MS and PGR all reporting on the 14th, followed by a slew of Banksters the next day. As I have noted this week, the strong Dollar (caused by Fed tightening) is hurting relative earnings for the S&P 500, who take in 60% of their revenues overseas in what are now weaker currencies.

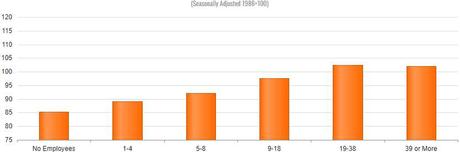

On the other hand, small cap stocks, like the Russell 2000 has, tend to do better when the Dollar is strong and Small Business Optimism, which came out yesterday, is down to 93.1 for May but that's essentially flat to April and NOT as bad as it was in early 2020, when things first shut down. Yet, there are PLENTY of stocks we can buy at the prices they were at in April of 2020, so we have been doing some shopping as things are not actually THAT bad.

On the other hand, small cap stocks, like the Russell 2000 has, tend to do better when the Dollar is strong and Small Business Optimism, which came out yesterday, is down to 93.1 for May but that's essentially flat to April and NOT as bad as it was in early 2020, when things first shut down. Yet, there are PLENTY of stocks we can buy at the prices they were at in April of 2020, so we have been doing some shopping as things are not actually THAT bad.

Keep in mind we HAD stimulus and now we don't so a lot of the readings that look bad this year are not fair comparisons. It's like saying that, when you were in the hospital, was 100 but now it's 85. Is 85 bad? No, it's pretty normal but, in the hospital, they had you hooked up to a tube that gave you oxygen. So your reading out of the hospital is down 15% BUT THERE'S NOTHING WRONG WITH YOU! The economy is like that – you can't just compare numbers to numbers – you have to think of the circumstances under which each reading occurred or you will never understand the bigger picture.

That goes for reports too because, if we look deeper into the Business Confidence Index, we see that it's the very small companies (under 19 employees) that are dragging us down while the bigger small caps are actually kind of confident, at about 102. We don't buy stock in the micros – we buy them in the 39 or more employee range, don't we?

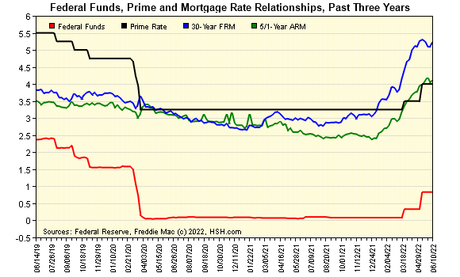

Sadly, as evidenced over and over again this decade, FACTS don't stop people from panicking so, while this data is useful, we are still mindful of the headline BS that the beautiful sheeple are swallowing from the MSM. You can see here the top of the WSJ's main web page this morning but there's also an article on Home Equity and it notes that the current level of Home Equity is $27.8Tn, that is up from $5Tn at the peak of the last housing cycle in 2006.

Sadly, as evidenced over and over again this decade, FACTS don't stop people from panicking so, while this data is useful, we are still mindful of the headline BS that the beautiful sheeple are swallowing from the MSM. You can see here the top of the WSJ's main web page this morning but there's also an article on Home Equity and it notes that the current level of Home Equity is $27.8Tn, that is up from $5Tn at the peak of the last housing cycle in 2006.

I had to look this stuff up to make the connections (it's called "research") but the relevant connection is that we have 5.5x more equity now than we did in 2006 and in 2005 there were $370Bn worth of "Cash Out Refis" (where homeowners took money to spend out of their homes) and that peaked at $351Bn the next year and $252Bn in 2007 and $126Bn in 2008.

That "Refi Boom" was blamed for the crash as consumers were able to live beyond their means for a few years yet, last year, with 5.5x more available credit, consumers only tapped $275Bn in home equity. Consumers don't need more stimulus, they can give it to themselves in amounts that can meaningfully affect the GDP – but it would be nice if we stopped DEPRESSING them with this non-stop doom and gloom fest from the MSM, right? Otherwise, all that untapped potential will remain untapped.

What the Banksters absolutely do NOT want is all those homeowners trading in their home equity for stocks while they are 50% off. $27Tn is enough to buy a good chunk of the market and GS isn't done buying for their private clients yet – so they continue to have their media buddies scare the retail investors out of stocks which keeps the homeowners out of stocks while they load up – THEN they will tell you it's time to BUYBUYBUY.

Yes, it's all a gigantic SCAM but we don't care if it's a scam – as long as we understand how the scam works and are able to play along. As Cramer says, "the great thing about the market is it has nothing to do with the actual stocks." Value investors understand this and we take advantage when Retail Traders panic out of positions – that's what we're doing this week in our Member Portfolio Reviews.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!