If what goes up, must come down – oil has a LONG way to fall:

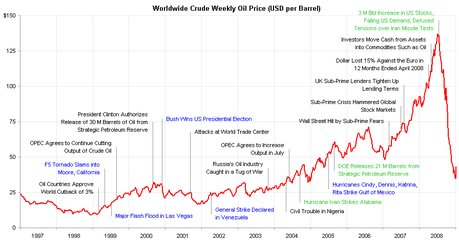

As you can see, during the glorious Clinton era, oil prices generally stayed down in the $20s despite OPEC cutbacks (because Clinton counteracted them by releasing oil from the SPR), hurricanes, tornadoes, wars in the Middle East (we used to win them, you know), etc. Then, a real disaster struck and oil man GWB was elected to office.

As you can see, during the glorious Clinton era, oil prices generally stayed down in the $20s despite OPEC cutbacks (because Clinton counteracted them by releasing oil from the SPR), hurricanes, tornadoes, wars in the Middle East (we used to win them, you know), etc. Then, a real disaster struck and oil man GWB was elected to office.

Bush and his Enron buddies destablized the commodities markets (under looser regulations) and Bush started wars in Iraq and Afghanistan to catch Osama Bin Laden, who was in Pakistan and, while he had the US military destroying Iraq's 3Mbd production and burning up another 1 Million barrels of oil a day looking for Osama in all the wrong places, he was also BUYING an average of 500,000 barrels a day to stick in the ground – doubling the size and filling to the brim our strategic petroleum reserve.

That led to a "reserve oil gap" and, of course, other countries began building and filling their own SPRs as well so more oil was bought by more countries, only to be shoved into the ground and never used. This created a very false sense of demand for oil and, when the price of oil rose to the point where consumers could no longer afford to drive – President Bush gave every family $3,000 to spend on oil – and they did – and oil hit $140 a barrel. "Cha-ching" indeed!

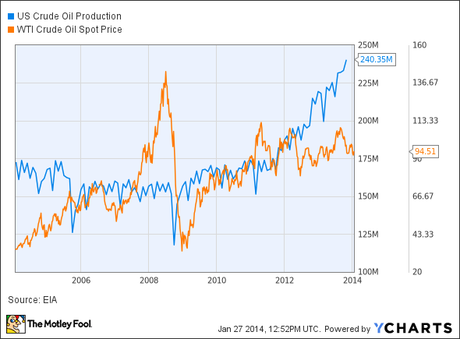

But then the $3,000 was gone and so was the ridiculous spike in oil and it fell and fell and fell and fell and fell – all the way down to $35 before stabilizing for a few months around $40 and then heading back to $80 as the market doubled and then, since 2010, US production has jumped 50% and generally kept oil under $100, despite MASSIVE manipulation by the Banksters (see "Goldman's Global Oil Scam Passes the 50 Madoff Mark").

But then the $3,000 was gone and so was the ridiculous spike in oil and it fell and fell and fell and fell and fell – all the way down to $35 before stabilizing for a few months around $40 and then heading back to $80 as the market doubled and then, since 2010, US production has jumped 50% and generally kept oil under $100, despite MASSIVE manipulation by the Banksters (see "Goldman's Global Oil Scam Passes the 50 Madoff Mark").

Now it is falling again and, like 2008, people love to call the bottom every $5 on the way down. All the same reasons are being used but, in commodities, a glut is a glut and you can't always count on the cost of production to set a floor on the price of a commodity until the surplus is worked off – we're still a long way from that on oil because the demand that the current production is geared-up to serve simply isn't there anymore.

We called a bottom on the Oil Futures (/CL) this morning in our Live Member Chat Room (as well as /TF at 1,150) but we're only playing for the bounce to $81 (weak) or $82 (strong). Already this morning we're at $81.31 so $81 is now our stop line and the Egg McMuffins are paid for! I gave my outlook for oil in yesterday's Live Trading Webinar and I'm sure there will be a replay available, so I won't bore you with those details here.

We called a bottom on the Oil Futures (/CL) this morning in our Live Member Chat Room (as well as /TF at 1,150) but we're only playing for the bounce to $81 (weak) or $82 (strong). Already this morning we're at $81.31 so $81 is now our stop line and the Egg McMuffins are paid for! I gave my outlook for oil in yesterday's Live Trading Webinar and I'm sure there will be a replay available, so I won't bore you with those details here.

We did pick up 25 USO Jan $32/34 bull call spreads for net $0.94 ($2,350) in the Short-Term Portfolio since we needed some long plays (we're up 80% for the year and too short now) and the net on the spread is now 0.73 (-22%) but the Jan $32 calls are still $1.50 and now we can roll those out to the April $30 calls at $2.94 for net $1.44 ($3,600) and, if oil fails to hold $80, we will sell the April $30s to some other sucker for $2.50(ish) and use that $2.50 to roll down to the 2016 $27 or $28 calls (now $5) and that would be our bet that oil is higher than $75 by Jan 2016.

That's what we call a "trading plan" and it's good to have a road map so you are prepared for any market situation. Also in the STP, since we needed longs to protect our short gains, we have 30 TNA Oct $58/60.50 bull call spreads that we bought for net 0.85 and now they are $1.12 (up 24%) and we'll take advantage of the morning dip to roll the Oct $58s ($2.05) to the Nov $56/63 bull call spread at $3 for +0.95 ($2,850), which will put us in the $7 spread ($21,000) for net $1.80 ($5,400), giving us $15,600 (288%) of upside protection should the Russell bounce back just a bit.

That's what we call a "trading plan" and it's good to have a road map so you are prepared for any market situation. Also in the STP, since we needed longs to protect our short gains, we have 30 TNA Oct $58/60.50 bull call spreads that we bought for net 0.85 and now they are $1.12 (up 24%) and we'll take advantage of the morning dip to roll the Oct $58s ($2.05) to the Nov $56/63 bull call spread at $3 for +0.95 ($2,850), which will put us in the $7 spread ($21,000) for net $1.80 ($5,400), giving us $15,600 (288%) of upside protection should the Russell bounce back just a bit.

We're very well-covered to the downside and this is where we expect a bounce so the above plays are all about locking in our massive gains we made by shorting ahead of this correction. In Monday's morning post, for example, we discussed the DXD Nov $26/29 bull call spread at net 0.62, using $5,000 to hedge against a loss this week. Yesterday, that hedge closed at 0.88, up $2,100 (42%) in two days – THAT's HOW YOU HEDGE!

Whether you are too bullish or too bearish or your portfolio is "just right" and you are looking for new trade ideas – today is a good day to join us in Member Chat as we will be going over our Buy List and rebalancing our portfolios for the month ahead.

Tags: DIA, DXD, Hedging, IWM, Market manipulation, Oil, oil futures, Russell Futures, TNA, USO

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!