Not much going on in May.

Not much going on in May.

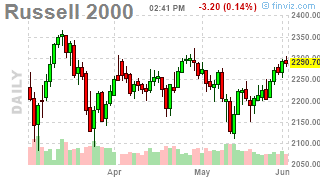

We started the month at 4,200 on the S&P 500 (see "Testy Tuesday – S&P 4,200 (again)" for the technical perspective) and this morning we're at 4,196 and the Dow is 1% higher and the Nasdaq is 2.5% lower and the Russell is 4% lower as earnings have, overall, been good but not great and, as I mentioned last week, economic surprises have been mostly to the downside recently. None of this matters at the moment because no one is trading this week with daily volume on the SPY barely 50M, roughly half the normal level (and most of that is automatic pension trading).

There's not a whole lot to do in a week like this and people are simply not into working as it's the first 3-day weekend in more than a year when we can kind of, sort of go out as if everything is normal. Normal enough, in fact, that Fast and Furious #9 made $162M last weekend in foreign markets (it doesn't open here until late June) so that's going to be a blockbuster – the first one in a very long time. IMAX was one of our pandemic picks and we got out when they spiked over $20 in March simply because we had already made 90% of our intended profits and there was still a risk of another virus wave but 40% of the US is now vaccinated and $135M of F9s money was made in China, which is IMAX's #1 foreign market, so I'd say this company is back on track going forward.

At $21.61, IMAX has a $1.28Bn market cap and, pre-pandemic, they were making $50M but they lost $144M last year and this year is likely to be a small loss as well but by 2022, they should be showing the growth that comes from new theater installations that were made duringt he shut-down and, of course, movie releases will be back on track as well. We don't expect a huge move up but we expect steady, long-term growth, which makes it a good candidate for our Butterfly Portfolio as follows:

- Sell 10 IMAX 2023 $20 puts for $4 ($4,000)

- Buy 20 IMAX 2023 $20 calls for $5.75 ($11,500)

- Sell

…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!