$4,000 per contract (you're welcome)!

$4,000 per contract (you're welcome)!

That's the profit from yesterday's Russell (/RTY) Futures shorts at 2,180 as we're now falling back all the way to 2,100 and we'll stop out 1/2 here to lock in $4,000 per contract and put a stop on the other 2 at $3,500 per contract (2,110) so our worst case is an average exit of $3,750 but we can make another $2,000 per original (4) contract if we have another 80-point drop from here.

We don't try to make a massive killing on the Futures, they are just bonus protection until our hedges begin to kick in and they allow us to make quick profits when the market has a little dip. In yesterday morning's PSW Report (just $3/day to make sure you don't miss it!), we also played the Dow Futures (/YM) short at 31,000 and we're below 30,500 now (1/2 stop, rest at 3,600) for another $2,500 per contract win and the Nasdaq paid $20 per point from 13,500 (a GREAT shorting line) to 13,350 ($3,000 per contract) and we set the stop there at 13,375 on the other half and the S&P (/ES) Futures paid $50 per contract from 3,850 to 3,800 ($2,500/contract) and you KNOW 3,800 is going to be bouncy so we stop out there completely and simply re-play it if it fails but why play out the bounce?

You HAVE to have hedges in such a clearly broken market. We went over our main hedges in our Short-Term Portfolio Review two weeks ago and discussed it in that day's Live Trading Webinar, so I'm not going to get into it here but we had a good $293,000 worth of protection, not including A LOT of additional profit if TSLA and CMG ever come down to Earth.

Thank goodness we didn't bet against GameStop (GME), which left the Earth last week and is now passing Jupiter, not at $147, which was yesterday's close but at $225 now – and that's AFTER pulling back from $350 in yesterday's INSANE after-hours run-up that bought the market cap of GME to over $22 BILLION.

Thank goodness we didn't bet against GameStop (GME), which left the Earth last week and is now passing Jupiter, not at $147, which was yesterday's close but at $225 now – and that's AFTER pulling back from $350 in yesterday's INSANE after-hours run-up that bought the market cap of GME to over $22 BILLION.

That's for a Retailer who makes $400M in a good year and 2019 was not a good year, with a $794M loss and 2020 wasn't much better, with a $464M loss but I guess you'd say things are turning around so why not pay them 55 times best-case earnings?

That's the insanity of the market we're in at the moment, where reality and valuations are not on speaking terms. We've solved the problem by simply not participating in the madness. Sure, we're still picking up the occasional bargains like IBM and INTC – we love our blue chips when they go on sale – but mostly we're sidelined, watching the madness bubble on.

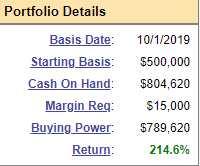

That doesn't stop us from making money. Our fairly conservative (for this market) Long-Term Portfolio is now up 214.6%, at $1,573,213, which is up $57,013 from our review 2 weeks ago (Members Only) and $28,500/week is a reasonable salary to pay ourselves while we wait for more stocks to go on sale – don't you think?

That doesn't stop us from making money. Our fairly conservative (for this market) Long-Term Portfolio is now up 214.6%, at $1,573,213, which is up $57,013 from our review 2 weeks ago (Members Only) and $28,500/week is a reasonable salary to pay ourselves while we wait for more stocks to go on sale – don't you think?

It's especially nice when you consider our starting basis was just $500,000 just over a year ago and we've safely stashed $800,000 in CASH!!!, where we're waiting for more stocks to go on sale (they always do – even in a bubble) and notice we have a very low margin requirement as well – we're not taking any chances in this ridiculous market with our main portfolio!

So PLEASE, trade very carefully as we're clearly in a broken market – GME is evidence of that just as Yahoo was in 1999 – sure it's amazing to see those gains but you also KNOW it doesn't make sense and if that doesn't make sense – then you can lose money on all sorts of things in all sorts of ways that make no sense to you as well.

I'm not a pessimist – anyone who knows me knows that – I'm a REALIST and this is a REALLY dangerous time to be playing the market. Don't trade with money you can't afford to lose and make sure you are well-hedged. We know this party is going to end – we just don't know when.

Join us this afternoon (1pm, EST) for our Live Trading Webinar – things are starting to get exciting!

Also there's a Fed Decision at 2pm and Powell at 2:30 – what a day!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!