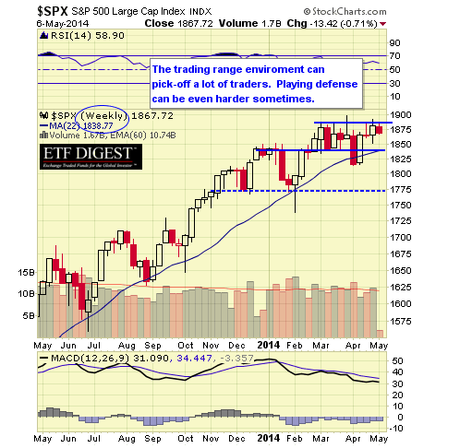

All of last week, I kept saying the market was only hitting highs because it was being manipulated that way and, by Friday we'd had enough and took our ill-gotten gains off the table once again. This week, it's obvious we're in trouble – but it's a lot harder to sell your stocks when they're already in trouble, isn't it?

It's a very hard discipline to take winners off the table but you should scale out of posiitons on the way up the same way you should scale into them on the way down (and the Strategy Section at Philstockworld has a great article about scaling – also lots of additional commentary in chat below the article).

There's nothing wrong with being in cash. Yesterday, from 1pm until 2:30, we had on of our Live Futures Trading Workshops (replay available here) and our 4 trades made $360 by the close (4pm) for a very nice $100+ per hour salary for just trading a few contracts. Our trade idea from yesterday's morning post (which you can get delivered to you pre-market, every day by SUBSCRIBING HERE) was to short the Nikkei (/NKD) at 14,350 and this morning we hit 14,050 – good for a $1,500 PER CONTRACT profit!

That's one of the things you can do with cash. We also have fun making earnings plays, like the FSLR trade we added to our Short-Term Portfolio yesterday. That trade idea was:

That's one of the things you can do with cash. We also have fun making earnings plays, like the FSLR trade we added to our Short-Term Portfolio yesterday. That trade idea was:

I think it's worth a try at selling 5 July $75 calls for $3 ($1,500) and buying, to cover, 4 Jan $77.50/85 bull call spreads at $2 ($800) for a net credit of $700 – let's do a set of those in the STP.

If FSLR is under $75 (it's about $69 after earnings), we pocket $700 PLUS whatever value remains on the January bull call spread (probably about half). That's against zero cash outlay ($700 credit, in fact) and possibly we'll just take quick money off the table and reload for our next earnings trade.

This morning, ahead of Yellen's 10am speech, we flipped bullish on the Russell Futures (/TF) at 1,105 in our early morning Member Chat and we've already tested 1,110, which is $500 up from that line (though we were more like 1,106 by the time we caught it for +$400 in an hour). We're done with the long ahead of the Productivity Report at 8:30 – which we expect to be disappointing. Also this morning, I reiterated our short entry on oil at $100.20 and we already got a dip back to $100, but our goal is $98.50 after inventories (10:30) though now we'd stop out again over $100.20 and wait for a better entry – so stay tuned!

We've been watching Brent Crude contracts drifting lower and USO (based on WTIC, which is what the /CL Futures reflect) usually tracks it very closely and now Brent is at $107.25, back where it was in early April, when WTIC was under $99. That is pegging our BS meter to 8.5, especially since the Ukraine crisis SHOULD be supportive of Brent – and it isn't. That's a huge red flag for oil bulls (the kind they run into and get skewered).

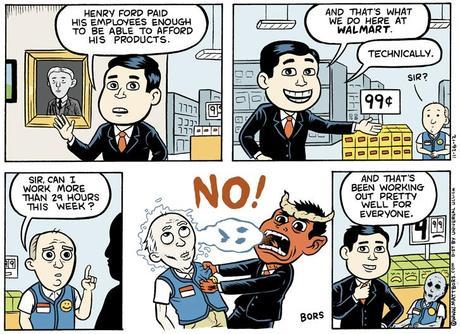

Speaking of getting skewered: Here's the Productivity report and is SUCKS – down 1.7% for Q1 and, even worse for our Corporate Masters – Unit Labor Costs are up a whopping 4.2%. In other words labor costs are rising and they can't whip the wage slaves any harder than they already are.

Speaking of getting skewered: Here's the Productivity report and is SUCKS – down 1.7% for Q1 and, even worse for our Corporate Masters – Unit Labor Costs are up a whopping 4.2%. In other words labor costs are rising and they can't whip the wage slaves any harder than they already are.

There are no cheaper places left to outsource, even CHINA!!! has been dealing with growing labor unrest as it becomes more and more clear that the Communist Party, which was founded to benefit the country's workers and peasants – has become a Billionaire's club for oligarchs – almost as bad as the US (but not quite).

“In China, there is a common saying,” says Lin Dong, of the Labor Dispute Center. “The government doesn’t help the people fix their problems. They fix the people who point out the problems, instead.” Workers who were valued principally as inexpensive production cogs during China’s initial economic flowering are now expected to star as consumers. Consumption accounts for only 35 percent of the Chinese economy, well below the 50 percent-plus characteristic of East Asian countries such as South Korea, which modernized earlier.

“In China, there is a common saying,” says Lin Dong, of the Labor Dispute Center. “The government doesn’t help the people fix their problems. They fix the people who point out the problems, instead.” Workers who were valued principally as inexpensive production cogs during China’s initial economic flowering are now expected to star as consumers. Consumption accounts for only 35 percent of the Chinese economy, well below the 50 percent-plus characteristic of East Asian countries such as South Korea, which modernized earlier.

“It’s like that old Henry Ford story: I’ve got to pay my workers enough so they can buy my product,” said David Dollar, a former U.S. Treasury Department official in Beijing. “China’s reaching that Henry Ford moment.”

Unfortunately, the US is far from that "Henry Ford Moment," as you can see from the chart above. Let's face it, we're a nation of timid sheep who have just sat back and taken it while our wages have flatlined for 25 years while UK workers (the above example) were given 30% increases. At least the Chinese are smart enough to march – what the hell is wrong with US?

Maybe the rising Unit Labor Costs are finally a sign that US workers are not going to take it anymore. If so, that will be a long-term benefit for the economy but, in the short run, companies that are addicted to low wages like WMT, NKE, MCD, etc. are in for a bit of pain.

Email This Post

Email This Post

Twitter

Twitter

LinkedIn

LinkedIn

del.icio.us

Google+

del.icio.us

Google+