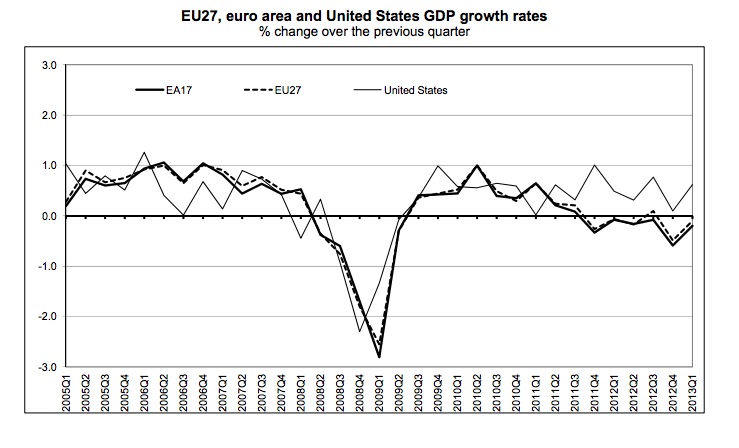

So, the statistics for GDP in the EU and Euro area were released not long ago. The EU is down by 0.1% from last year, and the Euro area down by 0.2%. This seems to go against efforts made by many EU governments to shore up their economies, something that contrasts with signs of growth in America. However, the EU does still remain the world’s largest economy, and there is no reason to think that this part of a downward trajectory and not merely a blip.

Euro & US GDP growth rate

The London stock exchange went up by 2.6% this morning, and posted a 5% rise in income for the year. However, French stocks, for example were lower, following bad news in the first quarter. European shares were up by 0.04 percent, for the FTSEurofirst 300. The eurozone is still in a good position, as ”Inflows remain strong, with so much liquidity from the central banks. Investors are buying every dip” (David Thebault from Global Equities).

The GDP for the EU & euro area last year was €12.89 trillion (US$16.56 trillion). Germany led the way with over 20% of the EU’s GDP, and is sure to resume a leadership this year, even with the new results.

GDP provides an easy comparison for economic activity, as the measurement has largely been standardised, and its adoption is across the board. It’s important to think about how much meaning these results really have though, as Frank Shostak, writing for the Ludwig von Mises Institute, claimed that GDP was far too ‘abstract’ with no link to reality:

The GDP framework cannot tell us whether final goods and services that were produced during a particular period of time are a reflection of real wealth expansion, or a reflection of capital consumption.

For instance, if a government embarks on the building of a pyramid, which adds absolutely nothing to the well-being of individuals, the GDP framework will regard this as economic growth. In reality, however, the building of the pyramid will divert real funding from wealth-generating activities, thereby stifling the production of wealth.Because the GDP framework completely disregards the intermediate stages of production, it can be of little help in the assessment of boom-bust cycles. It is little wonder then that mainstream economists are forced to conclude that recessions are a response to a sudden fall in consumer spending. Consequently, it is quite logical within the GDP framework to advocate loose monetary policies to revive the “economy.”