Welcome back Covid!

Welcome back Covid!

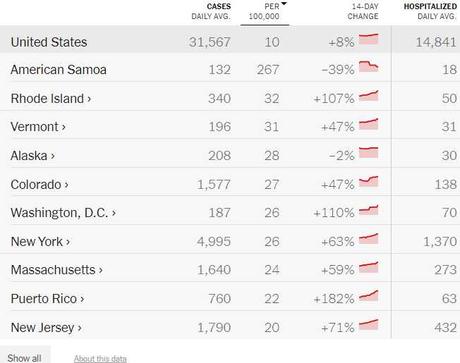

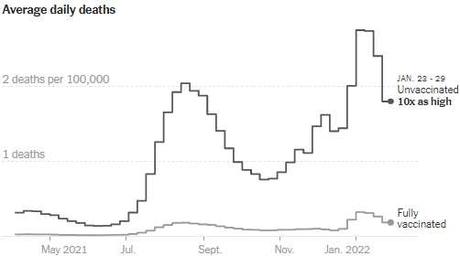

As you can see, we are having some big infection rates on the rise again and the rate of hospitalization is very high because MOST cases of Covid are now unreported UNLESS they are serious. Test kits are no longer free and most vaccinated people get mild cases and simply get over it like the flu and never report being sick so the majority of cases that do get reported are severe and since the severe cases tend to be among the unvaccinated – they tend to get Covid bad enough that they end up in a hospital.

Unfortunately, Covid has great timing and always seems to swing up around our holiday weekends (after is obvious but before is just mean) and when 2 people per 1,000 have a severely infectious disease and you get a lot of people together in airports and churches and at family gatherings – well, statistics tends to take care of the rest.

Not only that but severe Covid has some very nasty long-term effects that you are also much more likely to avoid if vaccinated but one of those effects is a decrease in cognitive funcions – which then leads people to make poor decisions regaring getting vaccinated. That's a very clever virus – making the victims too dumb to defend themselves!

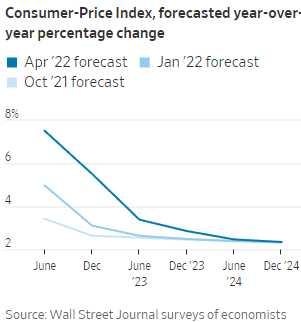

Also too dumb to defend themselves are our Leading Economorons, who still only react to things AFTER they've seen the news. Currently, our Nation's diminishing Brain Trust is forecasting a 28% chance of a Recession in the next 12 months and 33% was as high as we've ever gotten without actually having a recession and that was 2011, when we were still recovering from the 2008/9 Recession and the Fed was lowering rates – not raising them.

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!