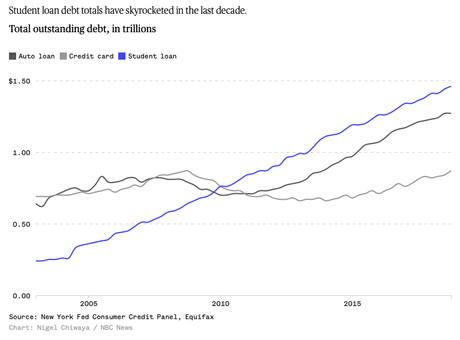

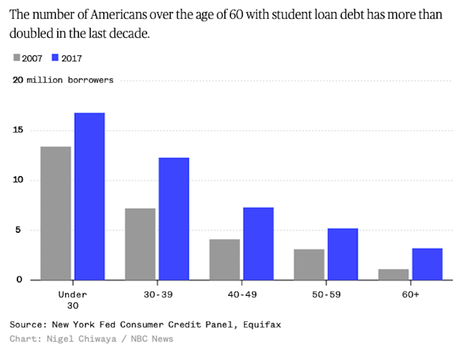

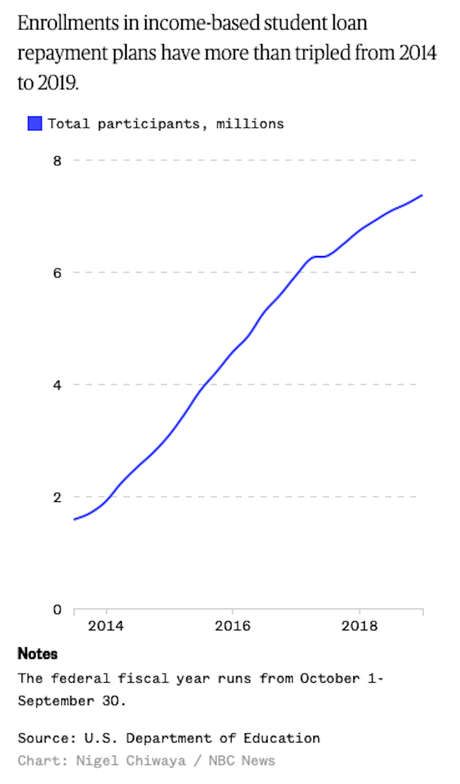

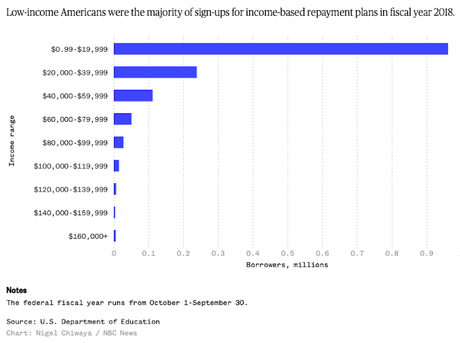

The charts above, from NBC News, illustrate a significant and growing problem in the United States. Colleges and universities are being priced out of reach for working and middle class students. To attend a college, students are forced to borrow large sums of money -- meaning they start their working lives with a large amount of debt.

The Republicans don't care. As long as the rich are doing well, they are happy. Their solution to the growing student debt in the last Congress was to raise the interest rate on those student loans. Trump offers nothing better. He wants to limit the amount of money a student can borrow -- which would affect the students who need help the most.

There is someone who has a plan to address the student loan debt crisis -- Senator Elizabeth Warren (D- Massachusetts). She is running for the Democratic Party's presidential nomination in 2020, and one of her campaign planks is a plan to address this. Here, in her own words, is what she proposes:

It’s time for bold action to actually fix the debt crisis. Here’s what my new plan would do:

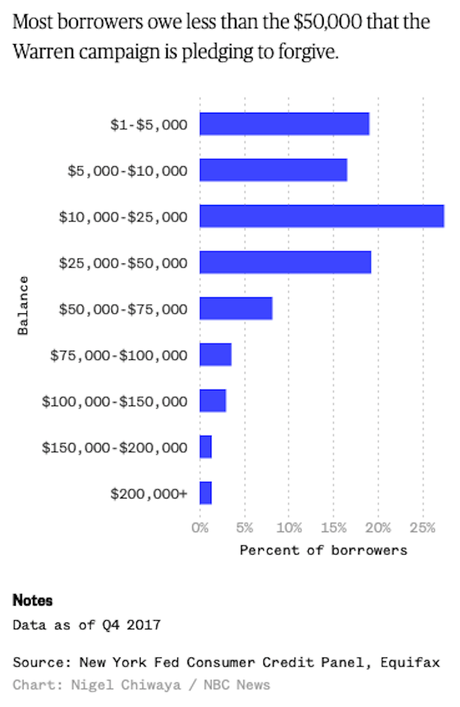

- It cancels $50,000 in student loan debt for every person with household income under $100,000.

- It provides substantial debt cancellation for every person with household income between $100,000 and $250,000. The $50,000 cancellation amount phases out by $1 for every $3 in income above $100,000, so, for example, a person with household income of $130,000 gets $40,000 in cancellation, while a person with household income of $160,000 gets $30,000 in cancellation.

- It offers no debt cancellation to people with household income above $250,000 (the top 5%).

- For most Americans, cancellation will take place automatically using data already available to the federal government about income and outstanding student loan debt.

- Private student loan debt is also eligible for cancellation, and the federal government will work with borrowers and the holders of this debt to provide relief.

- Canceled debt will not be taxed as income.

But we need to go beyond just covering the cost of tuition and fees. Non-tuition costs of college like room and board and books have been going way up too. Between 1975 and 2015, cost-of-living expenses grew by nearly "); text-decoration: none;" target="_blank" href="https://tcf.org/content/report/the-real-price-of-college/?agreed=1" rel="nofollow noopener" class="markup--anchor markup--blockquote-anchor" data-href="https://tcf.org/content/report/the-real-price-of-college/?agreed=1">80% at public colleges even after accounting for inflation. Non-tuition costs now account for "); text-decoration: none;" target="_blank" href="https://www.demos.org/research/blueprint-college-without-debt-policy-and-messaging-guide-states-make-higher-education#How-to-Build-an-Equitable,-Bold,-and-Simple-Guarantee-of-College-without-Debt" rel="nofollow noopener" class="markup--anchor markup--blockquote-anchor" data-href="https://www.demos.org/research/blueprint-college-without-debt-policy-and-messaging-guide-states-make-higher-education#How-to-Build-an-Equitable,-Bold,-and-Simple-Guarantee-of-College-without-Debt">80"); text-decoration: none;" target="_blank" href="https://trends.collegeboard.org/college-pricing/figures-tables/average-estimated-undergraduate-budgets-2018-19" rel="nofollow noopener" class="markup--anchor markup--blockquote-anchor" data-href="https://trends.collegeboard.org/college-pricing/figures-tables/average-estimated-undergraduate-budgets-2018-19">% of the cost of attendance at community colleges and "); text-decoration: none;" target="_blank" href="https://tcf.org/content/report/the-real-price-of-college/?agreed=1" rel="nofollow noopener" class="markup--anchor markup--blockquote-anchor" data-href="https://tcf.org/content/report/the-real-price-of-college/?agreed=1">61% of the cost of attendance at public four-year colleges.To allow students to graduate debt-free — especially students from lower-income families — we must expand the funding available to cover non-tuition expenses. In addition to the existing federal higher education funding that can be redirected to cover non-tuition expenses, we should invest an additional $100 billion over the next ten years in Pell Grants — and expand who is eligible for a Grant — to make sure lower-income and middle-class students have a better chance of graduating without debt. Research shows that more funding for non-tuition costs helps "); text-decoration: none;" target="_blank" href="https://hope4college.com/wp-content/uploads/2018/09/Goldrick-Rab-etal-Reducing-Income-Inequality-in-Educational-Attainment.pdf" rel="nofollow noopener" class="markup--anchor markup--p-anchor" data-href="https://hope4college.com/wp-content/uploads/2018/09/Goldrick-Rab-etal-Reducing-Income-Inequality-in-Educational-Attainment.pdf">improve graduation rates, which must be our goal. . . . Experts estimate my debt cancellation plan creates a one-time cost to the government of $640 billion. The Universal Free College program brings the total cost of the program to roughly $1.25 trillion over ten years. The actual costs of these new ideas are likely to be even less than that. Experts find that my debt cancellation plan will create an economic stimulus, and "); text-decoration: none;" target="_blank" href="https://www.demos.org/research/blueprint-college-without-debt-policy-and-messaging-guide-states-make-higher-education#footnote12_hehzjsw" rel="nofollow noopener" class="markup--anchor markup--p-anchor" data-href="https://www.demos.org/research/blueprint-college-without-debt-policy-and-messaging-guide-states-make-higher-education#footnote12_hehzjsw">study after "); text-decoration: none;" target="_blank" href="http://www.oecd.org/edu/education-at-a-glance-19991487.htm" rel="nofollow noopener" class="markup--anchor markup--p-anchor" data-href="http://www.oecd.org/edu/education-at-a-glance-19991487.htm">study shows that investments in higher education provide huge returns for every dollar. But even setting aside the eventual returns to these investments, we can fully cover the cost of these ideas with revenue from my "); text-decoration: none;" target="_blank" href="https://elizabethwarren.com/ultra-millionaire-tax/" rel="nofollow noopener" class="markup--anchor markup--p-anchor" data-href="https://elizabethwarren.com/ultra-millionaire-tax/">Ultra-Millionaire Tax on the wealthiest 75,000 families in the country — those with fortunes of $50 million or more.

We can address the student loan crisis and cancel debt for families that are struggling. We can provide truly universal free college. We can fix some of the structural problems that are preventing our higher education system from fairly serving lower-income students and students of color. We can make big structural change and create new opportunities for all Americans.