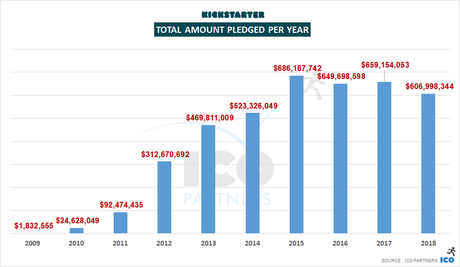

The crowdfunding industry is growing by leaps and bounds. It is projected to grow to over $300 billion by 2025. Crowdfunding is a great business and Kickstarter is the ultimate standard of crowdfunding. It is a multi-sided business model, which has project creators and backers. It helps startups, ventures, and projects gather funds by soliciting small donations from a lot of people or “crowd” termed as backers. This platform has helped many musicians, artists, designers, etc. to raise funds.

In order to start a business similar to Kickstarter, you need to understand how crowdfunding platforms make money. This post throws light on the business models of these platforms to help you in your endeavors.

- Commission:

Kickstarter makes money from the project creators for the funds raised. If the project listed is able to raise 100% of the funds, the platform charges a 5% fee. The platform also charges an additional payment processing fees up to 5%. The fee is not taken until 100% of the funds aren’t raised. This model is attractive for fundraisers who have to pay fees only if the money is raised successfully. - Membership fees:

For project creators to register on your crowdfunding platform, you can charge a certain amount of membership fees. This can be kept nominal to attract more number of people to register on your platform and create projects for funding. - Donation:

A donation-based revenue model can be adopted by non-profit crowdfunding platforms similar to Kickstarter. When the backers checkout, they can be given an option to donate to the platform. This revenue model is suitable for other types of crowdfunding platforms as well. - Promoted listings:

You can keep an option of promoted listings, which project creators can opt for to create better awareness. A certain amount of money for listing a particular project as recommended projects can be taken from project creators. You get to earn, and project creators get exposure to more number of backers. - Advertisements:

Advertisements are one of the best sources of earning revenues for crowdfunding platforms. You can allow third-party websites to advertise on your platform to improve their reach. - Listing Fees:

Listing fees work best in case of equity crowdfunding platforms if you wish to choose that. These platforms charge listing fees instead of commission, which can be monthly or a one-time fee. You can earn this fees irrespective of whether the funding is raised or not. - Keep-it-All (KIA) or All-or-Nothing (AON):

Keep-it-all model involves setting a funding goal and keeping the fund raised even when the fundraising goal hasn’t been met. Whereas the All-or-Nothing model, which Kickstarter follows, means accepting funds only when the funding goal has been achieved within the designated timeline. KIA model is more favorable for small-sized projects and AON for large ones, based on which you can choose the right model for you.

Winding it up

By combining various business models, you can create your own fundraising platform and function with great efficiency. If you want to jump-start your crowdfunding business, choosing a clone script can be beneficial.

MintTM’s robust fundraising scripts have been built by incorporating cutting-edge technologies, allowing you to build a custom crowdfunding website with much ease. Our Kickstart clone will fulfill your requirements of setting up a feature-rich fundraising portal similar to Kickstarter to accommodate the needs of both project creators and backers.

To get support from us for building your own crowdfunding platform, feel free to reach out to us through [email protected]. We’ll be glad to provide you with further details and help you create the next Kickstarter!