![USDX Deflation [courtesy Google Images]](https://m5.paperblog.com/i/116/1167526/usdx-deflation-L-4g1HAW.jpeg)

[courtesy Google Images]

I finished the following article last Saturday (March 14th). It was published in the “American Survival” newsletter on Monday (March 16th). And here I am publishing on my blog in Wednesday (March 18th)–the same day that the USDX dropped by almost two points in one day.For most of my lifetime, the US government and Federal Reserve have caused a moderate but persistent rate of annual inflation—about 1.5% to 2%. Inflation has sometimes run considerably higher, but seldom lower.

During a period of inflation, the value (purchasing power) of the dollar falls. During inflation, a dollar saved will purchase less at some time in the future than the same dollar spent today.

Inflation offers two apparent “advantages”:

1) Inflation reduces debts.

Because the value (purchasing power) of an inflating currency is constantly falling, inflation favors debtors and disfavors creditors.

For example, during a period of 2% annual inflation, if you borrowed $100,000 today and repaid it ten years later, you’d repay the nominal sum of “$100,000,” but that sum would only have a purchasing power of $80,000 as compared to the purchasing power of the $100,000 when the loan was initiated. Creditors are impoverished by inflation because they’d be repaid in “cheaper dollars”. Debtors are enriched by being able repay loans with “cheaper dollars”.

Consumers with good credit ratings can be enriched by inflation. They could borrow $100,000, repay the equivalent of $80,000 and essentially “pocket” the remaining $20,000. They could borrow $250,000, repay the equivalent of $200,000, and “pocket” the remaining $50,000. They could borrow $100 million, repay the equivalent of $80 million, and “pocket” the remaining $20 million for themselves.

Those who had good credit ratings and borrowed aggressively to make solid investments could grow fabulously wealthy. Those who had poor credit ratings or who insisted on saving rather than borrowing and spending, would tend to become impoverished during periods of inflation.

It’s arguable that the current income inequality between the top 1% of Americans and the remaining 99%, has been caused by the top 1% understanding inflation, having good credit ratings, borrowing aggressively, and repaying only part of the original purchasing power of their borrowed currency.

Evidence of persistent and intentional inflation can be seen in the purchasing power of a modern US dollar which is about a nickel as compared to that of a dollar in A.D. 1970.

Inflation favors debtors by enabling them to repay their debts with “cheaper dollars”. The US government is the world’s biggest debtor. It’s natural that the US government would favor inflation so as to repay its enormous debts with cheaper dollars. As a result, we’ve had institutionalized inflation for most of your and my lifetimes.

2) Inflation “stimulates” the economy.

Because an inflating currency will purchase less in the future than it will currently, people are disinclined to save and more inclined to spend during periods of inflation. In fact, because inflation causes the currency to lose value, people are more inclined to borrow and spend—and go into debt—because they can repay their debts with “cheaper dollars” at some time in the future.

The ability to repay debts with “cheaper dollars” in the future has been a fundamental motivation for many people to build or buy new homes now. As more people buy new homes, the sale of concrete, lumber, roofing materials, home hardware, electrical lines and plumbing supplies increases, more people have jobs, and the economy is “stimulated”.

If the economy slows, Dr. Feelgood (Chairman of the Federal Reserve) will try to “stimulate” the economy with the “quick-pick-me-up” called inflation. Most recently, Dr. Feelgood has tried to stimulate the economy out of the Great Recession “Quantitative Easing” (QE) One, Two and Three.

These attempts to inflate the fiat dollar and thereby stimulate the US economy have been only moderately successful. QE has caused enough inflation and economic stimulus to avert or postpon an overt Depression, but has failed to cause enough stimulus to push us out of the lingering recession.

Something Strange

Given that government needs inflation to: 1) devalue the fiat dollar and allow the gov-co to repay the National Debt with “cheaper dollars”; and 2) stimulate the economy—the past 7 or 8 months (since July of A.D. 2014), something really strange has been happening. As measured on the US Dollar Index (USDX), the purchasing power of the fiat dollar (as compared to half a dozen other fiat currencies) has jumped by 25%.

That’s evidence of deflation.

Deflation is the opposite of inflation.

Under deflation, the fiat dollar becomes more valuable. As the dollar’s value (purchasing power) rises, people realize that their fiat dollars will purchase more in the future than they purchase now. People therefore tend to save their currency rather than spend it. As savings rise, less goods and services are sold, employment wanes, and the economy tends to slow.

As the deflating dollar becomes more valuable, those who’ve had excellent credit ratings and gone deeply into debt during the previous period of inflation, find themselves faced with the unanticipated problem of having to repay their debts with “more expensive” (rather than “cheaper”) dollars.

The man with the good credit rating who borrowed $100,000 and, thanks to inflation, expected to repay his debt with the equivalent of $80,000 (and essentially “pocket” the remaining $20,000) can find himself obligated to repay the equivalent of $125,000 (purchasing power) as compared to his original $100,000 loan and be forced to suffer a $25,000 loss. In theory, that’s what’s happened over the past 8 months as the value of the US fiat dollar on the USDX jumped 25%. 25% deflation could cause an additional cost of $25,000 on a $100,000 loan. That additional cost might be enough to cause the borrower to lose his home to foreclosure or even push him into bankruptcy.

If the economic climate changes from inflation to deflation, the man who’d borrowed $100 million during inflation, expected repay the equivalent of $80 million, and “pocket” the remaining $20 million—may find himself obligated to repay his $100 million loan with “more expensive dollars” whose purchasing power is equivalent of $125 million in purchasing power and thereby suffer a $25 million loss. Again, if deflation causes such losses, it can drive the borrower into bankruptcy.

During periods of deflation, the super-rich (super-debtors) tend to jump out of skyscraper windows.

Deflation favors creditors and can ruin debtors.

Who’s the biggest debtor in the world? The US government.

During the past 8 months, the US national debt has remained nominally, about the same $18 trillion as was more or less true last July. But, thanks to the 25% deflationary jump in the value (purchasing power) of the fiat dollar, the national debt’s purchasing power has grown from $18 trillion to nearly $23 trillion.

What th’ Heck is Going On?

I’m confused and bewildered. Given that government has proved its love of inflation throughout my lifetime, I can’t understand why our government has allowed the last 8 months of deflation on the USDX.

Deflation is at least a hallmark, and probably a cause, for economic depressions. Deflation increases the burden of debt since you must repay your debts with more expensive dollars. Deflation increases the value of the national debt—which could be fatal to US government finances.

Deflation is contrary to the public interest since it can cause an economic depression. Deflation is contrary to the government’s interest since it can cause gov-co to default on its debts.

So, why has the US government allowed the past 8 months of deflation on the USDX?

I can see only two generic answers:

1) Government is intentionally allowing and even causing deflation; and,

2) Government is too weak to resist the forces of deflation.

If the first answer is valid, government has the power to control the economy but, for reasons I can’t yet fathom, is intentionally pushing America towards an economic depression.

If the second answer if valid, the forces favoring deflation are too strong for government to resist. Government is no longer in control of the economy and, barring some miracle, we are heading into an economic depression.

Either way, if the deflation seen on the USDX persists, the economy is headed towards an overt depression.

Going Vertical?

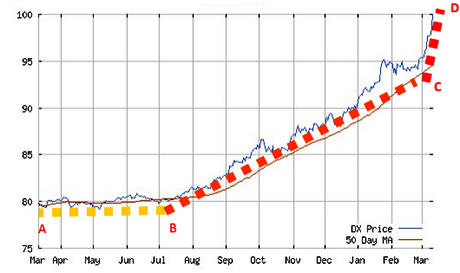

The following chart of the USDX for the past 12 months suggests that in just the last few weeks, the forces of deflation have gone “vertical”.

AS you can see, the thin, jagged blue line represents the fiat dollar’s value on USDX over the past year.

The thin, smooth, solid brown line represents the 50 day moving average for the dollar during the year.

The three, dotted lines represent a simplified view of USDX trends over the past 12 month.

The first trend line is the yellow, dotted line segment between points “A” and “B”. This trend line shows that the dollar’s value was a steady “80” on the USDX from March to July of A.D. 2014.

The second trend line is the orange, dotted line segment between points “B” and “C”. This trend line indicates that the dollar’s value rose steadily from July of last year to late February of this year at an angle roughly 30⁰ above the horizontal. During this period of USDX deflation, the price of crude oil (as denominated in fiat dollars) fell by over 50% and the price of gold (as denominated in fiat dollars) dropped by about 9%.

In theory, the 30⁰ “BC” trend line is unusually steep, but might’ve continued for some months or even quarters into the future.

But, now consider the third, red, dotted line segment between points “C” and “D” at the top right of the graph. That line is almost 80⁰ above the horizontal, almost vertical and almost inexplicable. It can’t be sustained beyond the short term.

It’s possible that the third trend line “CD” can be sustained for another month or two, but it seems certain that this “vertical” trend line can’t be sustained for long without collapsing the economy.

More, while the dollar’s value is currently skyrocketing, when that trajectory burns out, the dollar will stop rising on the USDX. When that happens, the dollar may hold its value (120?) and may simply move horizontally on the graph over time.

Or it might slowly decline at, say, a -30⁰ angle in relation to the graph’s horizontal.

Or it might drop like a stone at a -80⁰ angle in relation to the graph horizon.

I’m betting that what goes up like a rocket will fall like a stone. I’m betting that after the current “vertical” trend upward in the USDX expires, it will soon be followed by a downward trend is also nearly vertical.

Cry Me a River

Today, people in the oil industry are bawling over the dramatic fall in the price of crude oil. That fall has been at least partially caused by USDX deflation.

Today, people holding gold and silver are weeping over the fall in precious metal prices over the past 7 or 8 months. That fall has also been at least partially cause by USDX deflation.

But if folks in the oil patch and the gold mines are depressed by deflation, what do you think that people who are deep in debt think? I’ll bet they’re crying themselves to sleep every night and praying to God to protect their over-leveraged wealth from the forces of deflation.

And government? If USDX deflation has already increased the real value (purchasing power) of the US National Debt by 25% in the past 8 months, then—unless gov-co really wants an overt depression and economic collapse—gov-co officers and officials must be alternately wracked by bouts of terror and tears by persistent evidence of deflation.

No one is well-served by deflation except those who are not indebted and/or have a reliable, steady source of income. Such people may not only survive but prosper if deflation continues and the Greater Depression arrives—especially if their savings are stored in the media of precious metals.

On the other hand, government could soon come to its senses and fight valiantly against the USDX deflation. If government can restore enough inflation to destroy the forces of deflation, the prices of crude oil and precious metals should also rise dramatically.

Don’t forget—as seen on the graph—the value of the fiat dollar has been rising vertically for the past three weeks. That rise can’t be sustained for long without destroying debtors, precipitating bankruptcies, forcing government to default on its debts, and possibly precipitating a “Greater Depression”.

If that upward spike in the USDX trend line stops (as it must) and turns into a downward plunge (as it may), the prices of commodities around the world should jump.

Implication: The fiat dollar is likely to lose value in the near future. If so, now (when the fiat dollar has a relatively high degree of value/purchasing power) is a great time to stock up on food and precious metals.

Figures Lie and Liars Figure—But Not Always

It may seem improbable, confusing and even disingenuous to say so, but it’s still true that the price of gold is rising dramatically in terms of all major currencies—except the dollar.

The price of gold is rising around the globe—except in the US.

How can that be? It’s happening because the US dollar is the only major currency that’s in a period of deflation; most other major currencies are in or trying to enter another era of significant inflation.

In any case, consider this:

Last July, the USDX was 80 and the price of gold was about $1,310.

Today, the USDX is almost 100 (up 25% in 8 months) and the price of gold is $1,155 (down 12% in terms of fiat dollars).

So, is gold up or down?

Well, in terms of nominal price in fiat dollars, gold is down 12% in 8 months.

But in terms of purchasing power, gold is up.

How can that be?

Well, given that the fiat dollar is up 25% on the USDX since last July, the dollars we use to calculate today’s price of gold are worth 25% more (at least on the USDX) than they were last July. That implies that while the nominal price of gold is down 12% (at least terms of dollars), the value (purchasing power) of gold is worth 1.25 times the current dollar price = $1,443.75.

The “1.25” multiplier reflects the fact that, according to the USDX, today’s fiat dollars are worth about 25% more in terms of purchasing power (as compared to six other fiat currencies) than they were last July.

Thus, I won’t say it’s absolutely true, but it’s arguable that even though the nominal price of gold (in dollars) has fallen 12% in the past 8 month, because the purchasing power of fiat dollars has increased by 25% in the same period, the purchasing power of gold measured in fiat dollars has increased by 13% (25% up for purchasing power of dollars minus 12% down for nominal price of gold).

Confused?

Me, too.

It seems possible that even though the price of gold is down 12%, the actual value/purchasing-power of gold is up 13%.

Seems crazy doesn’t it?

Again, how can this be?

It can be because fiat dollars are inherently irrational. They are measuring devices that have no fixed value. They are the “rubber rulers” for economic measurements.

Note that I’m not claiming that the value of gold is up 13% even though the price of gold is down 12%. I’m simply saying that such lunacy is possible because fiat currencies are crazy.

In fact, so long as we rely on fiat currency, no one really knows the value of gold, crude oil, or pop rivets just now. Oh, we know the prices. But who knows the value?

That ignorance is cause for frustration, but also cause for hope. Maybe gold’s purchasing power is up 13% in the past 8 months. Or maybe it’s up 5% or even 1%—but isn’t that better than being nominally down 12%?

The world is teetering on the edge of economic madness.

Q: What’s the antidote for such madness?

A: An economic ruler that everyone agreed was fixed, stable, reliable, valuable. Something like physical gold.

P.S. When I wrote the previous article last Saturday, I predicted that the “vertical” rise in the dollar’s value could not last long and, when it turned, it would most likely go almost straight down.

Today, Wednesday, the fiat dollar fell almost two points on the USDX.

It’s too early to say that that astonishing reversal marks an end to the deflationary spike in the USDX–but it might. Tomorrow, the dollar might again spike upward. But there’s at least a chance that today’s 2-point fall on the USDX might be evidence that much of what I’ve written above is roughly correct.

We shall see.

About these ads