If you are looking for a comprehensive overview of Yalber Review, you are in the right place. Here are pros and cons and alternatives to help you decide if Yalber is right for you.

Even if we hate the old adage, "Money is needed to make money," there is a certain truth.

If you've ever seen programs like " Shark Tank," you'll find that many entrepreneurs share their business ideas in the hope that an investor will give them money. You need money for inventory, payroll, manufacturing, to cover orders, or for other commercial expenses, and that's perfectly normal! Every company needs an infusion at one time or another: perhaps a job, a sale, or an external source.

The difficulties in financing transactions like sharks are ...

You receive the money for a percentage of your business property.

Giving up property may not be so bad for some people because they think mentoring is worth it, but equity arrangements do not work for everyone. Some of the most common reasons why equity arrangements do not work are:

Yalber Review 2019: Is Yalber Good Fit For You? Get up to $500,000 within 48 hours

Detailed About Yalber Review

Yalber is a fast and easy financing option for companies looking for working capital. No personal guarantee or guarantee is required to receive contributions up to a maximum of $ 500,000.

Since 2007, Yalber has invested more than $ 280 million in more than 12,000 companies.

Yalber, known in the financial world as a royalty-based investment, deducts a percentage of your company's future claims against the initial funding. However, unlike other royalty investments, Yalber does not receive royalties during the lifetime of its business.

Instead, payment will be discontinued once the full refund amount has been returned. The agreed percentage will also be fixed until the agreement is finalized.

How does Yalber work? (Read Full Yalber Review Here)

Yalber offers royalty-based investments. The company makes money by collecting a percentage of the future income of its business. In return, you will receive start-up financing. Unlike other companies, Yalber does not charge royalties beyond a certain point. In other words, they do not report their revenue throughout the life of their business.

Payments will be stopped as soon as the money you have borrowed is fully repaid. Yalber offers percentages of fixed and agreed rates that do not fluctuate. This means that you no longer have to pay when your business profits increase. However, if your business has difficulties, you can not renegotiate your payments.

With Yalber, you can earn working capital to increase the royalties on your income. Working Capital is a term that describes the efficiency with which your business earns money. It also reflects the short-term financial situation of your company.

In other words, working capital is the amount that is available to manage the day-to-day operations of your business. You can calculate your working capital by deducting the assets of your company from the liabilities. Working capital is important as it reflects your success as a business owner and operator.

Yalber offers your company working capital by investing in your product or service. They offer you a first loan or investment in exchange for a percentage of your company's future income. Once the loan is fully paid, the license fee will be returned to your company and you will no longer have to pay. This is a unique feature because you have to pay for most royalty investments in the business.

This is one of the many benefits of working with Yalber compared to other financial companies.

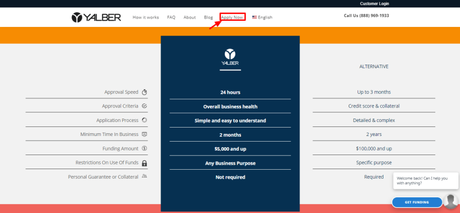

Funding through Yalber is quick and easy. You can earn up to $ 500,000 in credit within 24 hours if you qualify. According to the website, most borrowers receive their money within 72 hours. This is ideal for business owners who need fast money and can not wait. The average waiting time is seven to ten working days.

Yalber loans are difficult to qualify. You have to meet strict expectations and be in business for two months. If you have bad or no credit, it can be difficult to get an investment in royalty from Yalbar. However, nothing on the website indicates that your balance is being reviewed. There is little information available about the company's services online.

Therefore, it is difficult to compare Yalber in terms of royalties with other investment companies.

These are some highlights of Yalber Services.

Fast financing

Most business owners will transfer the money to their account within 24 hours. The average waiting time is 72 hours. This is much faster than the response time for most loans, which lasts on average up to a week or more.

Fast approval time

The company needs 24 hours to approve or reject your request. In this way, you can quickly search for other financing options if you do not qualify for a Royalty investment loan with Yalber.

Limited documents are needed

To apply, you only need documents about your company's financial situation in the last three months. Most companies require a credit rating of up to one year or more to apply. This is ideal for business owners who have not been in business for a long time or who do not have a good financial position.

The funding ranges from $ 5,000 to $ 500,000 and can be used for commercial purposes. The amount you qualify for depends on your financial situation. Some companies require you to invest more money to achieve a specific goal. But Yalber gives you financial freedom in the way you spend your money, as long as it's related to the business. Do not spend more money than you need to keep your investment rates within budget.

Your business needs to earn an average of $ 7,000 per month to qualify as royalty investment. It is higher than other loans. Yalber, however, does not require a personal guarantee from you. In this way, you confirm that you are making enough money to make payments on your investment.

Amount of funds

This means that you do not have to provide a guarantee or sign a personal guarantee to qualify for investment. Most lending companies require at least one of the two reserve persons if you can not afford your payments. It is not clear if Yalber informs the three main credit bureaus. However, it is a good idea to assume that they are doing this to make their payments on time and to maintain a good reputation as a credit institution.

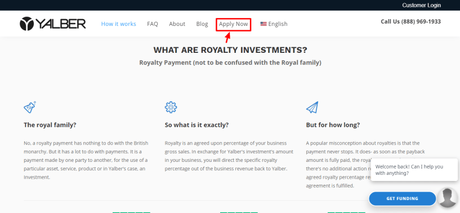

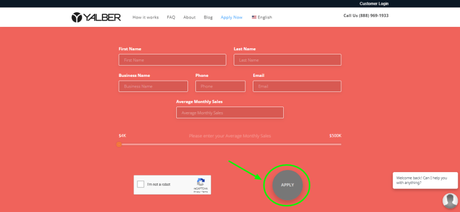

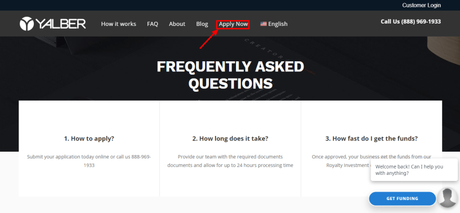

How do I apply Yalber?

The application process seems easy. It is a good idea to collect the required documents before starting an application. This can be your personal information as well as information about the financial situation of your company in the last three months. That way you can get your money as fast as possible.

There is no guarantee or personal guarantee required

Upon receiving your request, the company will contact you to discuss your custom options. The company undertakes to respond within 24 hours of receiving your request. After approval, choose from a list of custom options that reflect your creditworthiness and investment opportunities. Once you have chosen your payment option, the money will be transferred to your account the next working day.

Visit the Yalber website to submit a request in the queueOnce you have registered with Yalber, the company strives to provide excellent customer service. They have a dedicated customer portal and a personal agent assigned to their account.

This means that every time you contact the company, you talk about your account with someone who understands your needs, not a random team member. You can contact your representative 24 hours a day, 7 days a week, including holidays. You can also visit the company's website and chat live with a team member at any time of the day.

Yalber will contact you to analyze your custom options.What Is Revenue-based Yalber Financing?

Unlike a traditional loan, income-based financing allows you to use a percentage of your company's monthly income as payment. There are no fixed or monthly fixed prices. When you make an income-based investment, you know the percentage of your payment from the beginning.

Log in to YalberThis interest rate will not change for the duration of your loan, which will be completed once the money you have borrowed has been fully returned. Funds are available within 24 hours of approval.

Income financing differs from other loans because it uses your company's income as a means of payment. On the other hand, traditional loans require that you make a fixed monthly payment with interest that may or may not increase over time.

For Yalber investment loans, you only have to pay the agreed percentage of your monthly income. Your creditworthiness is less likely to affect the amount you borrowed. Instead, Yalber focuses on the amount your company pays monthly. Yalber uses this information to create an individual packaging plan for your rental options.

An investment in royalty allows you to save money on interest and other standard costs of the traditional lung. However, it is more difficult to qualify for a royalty investment than for other loans. Yalber does not seem to consider his credit rating. Instead, you must have a gross income of at least $ 7,000 per month. You must have been in the business for at least two months to qualify for a loan. This helps to ensure that your business earns enough money to make timely payments.

One of the key benefits of using royalty is that it encourages you to run a business successfully. Your monthly payments are based on your monthly income. This means that the more successful your business is, the more money you earn after your monthly payment.

On the other hand, companies that are not doing well will see a decline in their income because of the money they owe for their investments. By investing in royalties, business owners are encouraged to make their monthly payments while retaining the desired benefits.

Once you've paid your entire investment, your responsibility at Yalber is complete. You do not have to pay for her anymore. This is another way to motivate you to invest in Yalber royalty to become a successful company. The earlier your loan is paid, the sooner your commitment to Yalber will be fulfilled and you will be able to keep all of your monthly income.

Yalber Royalty Investment Review

Investments in Yalber do not seem to be as changeable as traditional loans. This includes sign-up fees, late fees, high-interest rates, etc. However, you should discuss these fees with a customer representative before you receive a loan.

You also want to verify that your payment activity is reported to the top three credit bureaus. In this case, this is an excellent way to determine your creditworthiness. Keep in mind that late or missed payments can negatively affect your score when your activity is reported. For this reason, it is important to make one-off payments each month until your loan is fully paid out.

Yalber Terms & Fees

Pros and Cons | Yalber Review

Who can benefit from an investment loan with Yalber royalties?

A Yalber Royalty investment loan is ideal for an established business owner. You do not need good credit to qualify, but you need to earn at least $ 7,000 a month. You must have been in business for at least two months.

Entrepreneurs who do not meet these criteria may find it difficult to qualify. An investment loan does not seem to indicate its activity to the three credit bureaus. If you want to get a loan to build up your balance, you may need to look elsewhere. Remember that every time you borrow money, your business can be monitored.

YALBER PROS

- Easy application process: you will know within 24 hours if it has been approved

- It can be approved for a loan ranging from $ 500,000 to $ 5,000 as needed.

- The amount will be transferred to your bank account on the business day following approval.

- When applying for a loan, it is acceptable to have little or no credit. Yalber does not consider your credit rating. Instead, your application will be approved

- based on your company's monthly revenue. They also do not seem to demand high-interest rates.

- Unlike a traditional loan, a royalty investment can help you run a successful business. Many entrepreneurs believe that a royalty investment encourages them to bring more money home to compensate for the percentage they have to repay.

- Your commitment with your loan and with Yalber will be fulfilled once you have repaid all your money. For other investment companies in the form of royalties,

- you have to make monthly payments in business. This means that you can keep your monthly income after the full payment of your loan.

- Your own Account Manager will be assigned based on your industry and region. You also have 24×7 access to customer service and a customer portal when you need it.

- Yalber is also open on public holidays, so you can contact the company at any time.

- You can contact Yalber by phone, email or live chat on their website.

- You can use your money as you like, as long as it's related to the business. Some lending companies have strict requirements regarding the way you spend your money. Yalber offers you financial freedom.

This can affect your balance. An investment loan in the form of Yalber royalties can vary between $ 5,000 and $ 500,000. The funds are distributed quickly. This makes Yalber an ideal option if you need money in a day or two. You can also go with Yalber if you do not have the funds to repay a traditional loan. In fact, an investment loan in the form of royalties takes a percentage of your monthly income.

YALBER CONSYou do not need to use other sources of revenue for your monthly payments. In addition, you do not have to give a guarantee or personal agreement to receive a loan. If you need the money and do not own a property, a royalty investment loan may be right for you.

- There is little information about Yalber and its investment in royalty online. This makes it difficult to make an informed decision about the company and its services.

- Yalber requires that you have a successful business before you apply for a loan. You need to earn $ 7,000 a month to qualify for an investment loan. In this way, the company works with bad credit to make sure that it pays on time. Yalber knows you do not have enough money to make your payments if your business is unsuccessful. You must have been in the business for at least two months before you can apply for a loan. This means that if you have a newly formed business, you may have trouble finding the funds you need before you become a more established business.

- It is not clear if Yalber informs the three credit bureaus. It's good or bad, depending on your payment history. If you make payments on time, Yalber will report your activity to increase your credit rating. However, if you consistently make late payments, you do not want this activity reported. If your goal is to get credit while borrowing, you can call another company or look for other ways to build your credit.

Conclusion: Is It Worth Or Not? | Yalber Review 2019

A Yalber Royalty investment loan is a good idea for entrepreneurs who are already well established and can afford to make payments based on their monthly income. Loans for the investment of royalties differ from other loans according to their repayment terms. You will not be charged high interest or other fees. However, you are asked to repay your loan based on a percentage of your monthly benefit.

Yalber offers loans between $ 500,000 and $ 5,000, depending on your entitlement. Your loan obligations are met once you have paid everything you owe. Other investment companies in the form of licensing fees require you to pay each month while you are in business. There does not seem to be any extra charge for you. Before you enroll in Yalber, however, you should inform yourself about the details of your loan.

If you want to build your credit during lending, you may consider other options. Yalber does not appear to report to the three major credit bureaus. This means that your payment history does not affect your creditworthiness. However, it is advisable to ask your account manager for this information before signing.

Unlike other investment companies, Yalber does not require a personal guarantee or guarantee. They also do not control how he uses his money. You are free to spend your credit money on all business matters, provided you make monthly payments. Once your money is paid in full, your responsibility at Yalber has expired and you can keep your monthly income.

Visit the website today and talk to a customer service representative to see if a loan investment loan is right for you.