Contrary to a blast from a popular financial outlet that the 20Y auction should "go well", the just concluded sale of $15BN in 20Y paper did not go well. In fact, it went very badly.

Despite the Treasury's attempt to normalize the treasury yield curve "kink" where the 20Y sticks out like a sore thumb...

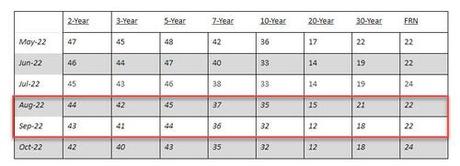

... by rapidly shrinking the size of upcoming 20Y auction (and thus force demand)...

... the outcome at least in today's auction was just the opposite.

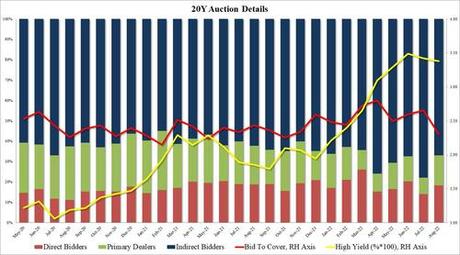

Stopping at a high yield of 3.380%, this was a tail of 2.5bps to the When Issued 3.355%, the biggest tail since the launch of 20Y paper in May 2020, even though the yield dropped for the second month in a row, sliding from 3.42% in July and a record high (for now) 3.488% in June.

The Bid to Cover also was ugly, sliding from 2.65 to 2.30, the lowest since October 2021 (and clearly well below the recent six-auction average).

Lastly, internals were also ugly, with Indirects awarded just 67.0%, the lowest since March, and with Directs taking down 18.3%, or roughly in line with the recent average of 18.8%, Dealers were left holding 14.7% the most since December 2021.