Last week, Freddie Mac reported record lows on rates, with the 30-year notes at 3.91%. This has not, of course, encouraged many people to go out and buy homes but it has DISCOURAGED people from putting their money into bonds and ENCOURAGED them to put their money into stocks. There is, however, a problem with this. When people put money into Treasuries, it is "locked up" for a period of time but stocks are more liquid so, as soon as rates begin going up (and they will when the panic in Europe subsides despite the Fed’s efforts), then money can come out of stocks as quickly as it went in and move into 5% paper.

See, I said 5% paper and you were thinking "Yeah, I’d like some of that." So are Trillions of Dollars worth of other investors and that means, I am sorry to tell you, that this little Federally-funded rally is full of holes you can drive a truck through.

The program’s final debt purchase of the year was Thursday, when the Fed bought $4.6 billion in long-dated securities. The final sale Wednesday targets $8 billion to $8.75 billion worth of notes due in 2014. It will be a holiday-shortened week: The bond market was shut Monday and will close early, at 2 p.m., on Friday.

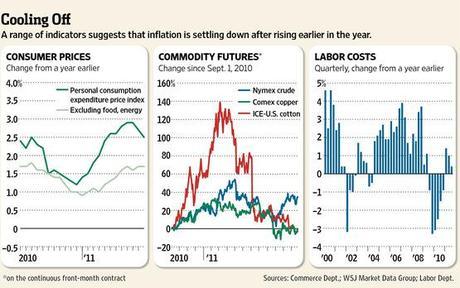

The problem is some corners of the market think the Fed’s tools are losing their punch. The financial system is already flush with money from the bank’s previous easing programs, and analysts argue that the Fed’s extra money is increasingly less useful. Borrowing costs, for instance, are at all-time lows and yet many investors aren’t taking advantage. If Operation Twist isn’t enough to get us through 2012 – what’s going to be left in the Fed’s tool belt once the Global panic into Dollars begins to subside?

You can see, on the above chart, where the Fed announced Operation Twist in September as…