This is getting very ugly.

This is getting very ugly.

This picture was from Moscow on Friday, with the sign offering 54 Rubles for $1 and offering to sell Dollars for 59 Rubles (nasty spread). Today, just 4 days later, you need 80 Rubles to buy a Dollar with that currency dropping 45% (so far) in less than a week. This is happening DESPITE the Russian Central Bank raising it's overnight rates to 17% from 10.5% – up 62% overnight – AND IT DIDN'T HELP.

This is bad, folks. Russia isn't Greece, Russia is a $2Tn economy with 143M people and very close ties to satellite nations that surround them so the contagion is likely to be fast and direct and can very easily spread quickly to Eastern Europe, which hasn't been strong in the first place. In our Live Member Chat Room this morning, we discussed the impact of the Russian Rate increase:

Raising the rates makes (in theory) your notes more attractive so people use their relatively stable foreign currencies to buy your Ruble notes so they can benefit from the high interest rates. The problem for Russia is that their currency is down 50% this year and 10% this week so it's not that attractive to exchange $10,000 for 650,000 Rubles (at 65 to the Dollar) at 17% and get back 760,000 Rubles next year only to find out it's now 100 Rubles to the Dollar and now you only have $7,600. This is the kind of spiral that leads to hyperinflation.

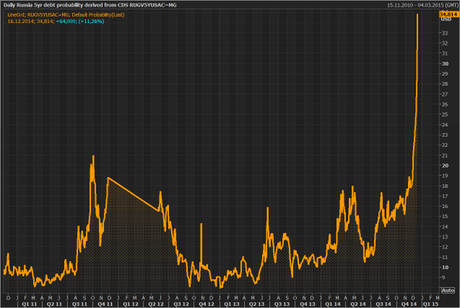

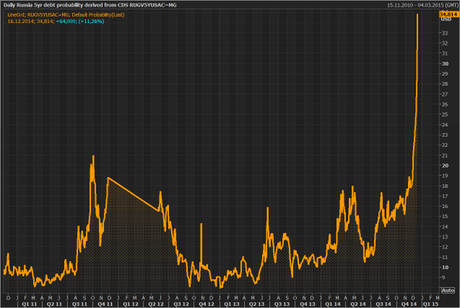

Don't forget, you also have to believe that the country you are lending money to won't default. Russia did default in 1998, which was only 16 years ago and now oil is simply crushing their economy so why on Earth would you give them $10,000 to hold for 2-5 years – even with 17% interest. The Credit Default Swap (insurance against bond default) on Russia is now 5% (per year) and rising fast, so your net "safe" return on investment is just 12% and, even then, you still get back Rubles and you still have the risk of the devaluing currency.

That's another Catch-22 in the currency game. By raising the rate of interest they promise to pay, they make a default much more likely, so expect CDS rates to climb very quickly (was up 15% yesterday alone) and eat up a lot of that 12% spread.

I wrote those comments at 6:26 and now it's 7:34 and the situation in Russia is deteriorating quickly. The only reason our markets aren't collapsing with it is because we have a Fed meeting tomorrow and the situation is dire enough that the doves are once again circling and expecting MORE FREE MONEY from our Fed, who PROBABLY don't want to risk 6 weeks until the Jan 28th meeting before doing something to stabilize things.

Of course, the fact that the Fed may WANT to do something doesn't mean they can – or should. This situation will give the doves (and Yellen is one) plenty of ammunition to do something crazy tomorrow (2pm) but Europe is already done for the year and the BOJ has nothing planned so we'd be acting alone and, should our Central Banksters' actions prove as futile as their Russian counterparts did today – then we face a total crisis of confidence during Christmas week – that's the risk the Fed runs if they do try to do something.

Of course, the fact that the Fed may WANT to do something doesn't mean they can – or should. This situation will give the doves (and Yellen is one) plenty of ammunition to do something crazy tomorrow (2pm) but Europe is already done for the year and the BOJ has nothing planned so we'd be acting alone and, should our Central Banksters' actions prove as futile as their Russian counterparts did today – then we face a total crisis of confidence during Christmas week – that's the risk the Fed runs if they do try to do something.

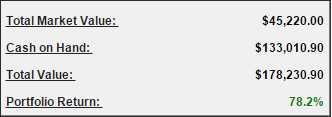

Fortunately, we saw this coming a mile away and we've been playing the market short (as I've been telling you all month) and our Short-Term Portfolio has rocketed up to +78.2% for the year. As you can see from the summary, we're mainly in cash – something you may have heard me recommend once or twice as we moved on into Holiday Season.

Fortunately, we saw this coming a mile away and we've been playing the market short (as I've been telling you all month) and our Short-Term Portfolio has rocketed up to +78.2% for the year. As you can see from the summary, we're mainly in cash – something you may have heard me recommend once or twice as we moved on into Holiday Season.

I went over all of our virtual portfolio positions in this morning's Member Chat, so I'll just summarize by saying we are thrilled with this little sell-off but we do hope it doesn't turn catastrophic. Not because we won't make a fortune from it (we would), but because that would just suck for the US and Global economy – and no one wants that.

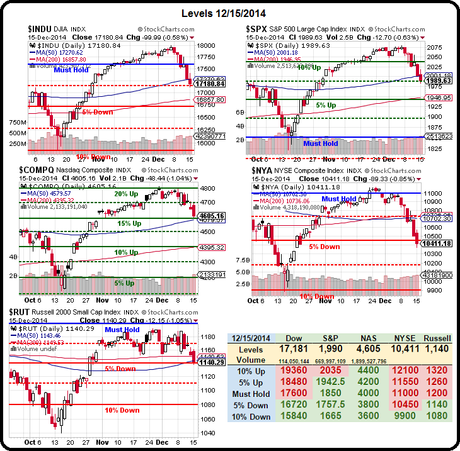

We are now (in pre-market) below our 5% drop lines that we predicicted last week. They were Dow 17,200, S&P 1,980, Nasdaq 4,560, NYSE 10,450 and Russell 1,130. We're certainly not going to be impressed by any move that doesn't take all 5 of those levels back and, unfortunately, now that we've made our 5% drops, it takes a 1% move just to make a weak bounce (still bearish), with strong bounce another 1% above that.

We are now (in pre-market) below our 5% drop lines that we predicicted last week. They were Dow 17,200, S&P 1,980, Nasdaq 4,560, NYSE 10,450 and Russell 1,130. We're certainly not going to be impressed by any move that doesn't take all 5 of those levels back and, unfortunately, now that we've made our 5% drops, it takes a 1% move just to make a weak bounce (still bearish), with strong bounce another 1% above that.

It's a little tricky as we're down about half a point in the Futures (8 am) so what we need is essentially a +0.5% move to stabilize for the day (and it has to hold). By tomorrow's Fed, we'll need to capture the full 2% move and we're not going to be impressed by anything less. Since a bounce is very likely here, we have to consider taking some of our bearish bets off the table – but we'll have to call an audible today during our Live Trading Webinar (1pm).

That would include the TZA hedge we were using last week to profit from this downturn. At the time (Wednesday morning) we called for the Jan $12/14 bull call spread at 0.70, selling the Jan $12 puts for 0.45 for net 0.25 on the spread. At yesterday's close, the spread was net 0.86, up 244% in less than a week – not bad for a hedge!

That would include the TZA hedge we were using last week to profit from this downturn. At the time (Wednesday morning) we called for the Jan $12/14 bull call spread at 0.70, selling the Jan $12 puts for 0.45 for net 0.25 on the spread. At yesterday's close, the spread was net 0.86, up 244% in less than a week – not bad for a hedge!

As a bet, it should certainly come off the table and, as a hedge, I'd just keep a stop around net 0.75 to lock in a 200% gain. Another trade idea we mentioned in that same post was our EWJ Dec $12 puts at 0.25 and those finished at 0.94 yesterday (up 276%) but we've moved on to the Jan $12 puts already at 0.55 (now 0.96) to take advantage of a possible major collapse in the Nikkei. And you don't even want to know what the profits were on the Futures shorts we mentioned last Wednesday – S&P (/ES) 2,050, Nikkei (/NKD) 17,600 and Russell (/TF) 1,185 are now up $4,000, $5,000 and $5,000 per contract respectively.

This is why I said "DO NOT SUBSCRIBE" last Wednesday – you certainly don't want to make that kind of money in a down market, do you? Certainly on the Futures, if you are still in them – I would take that money and RUN! this morning. I'll be very surprised if we don't get our 1% bounce and that means we can go long at 17,000 on /YM, 1,965 on /ES, 4,120 on /NQ and 1,130 on /TF – very tight stops and out if any of them break down but, even as we speak, I can see Russia trying to force the Ruble back down from 80.

This is why I said "DO NOT SUBSCRIBE" last Wednesday – you certainly don't want to make that kind of money in a down market, do you? Certainly on the Futures, if you are still in them – I would take that money and RUN! this morning. I'll be very surprised if we don't get our 1% bounce and that means we can go long at 17,000 on /YM, 1,965 on /ES, 4,120 on /NQ and 1,130 on /TF – very tight stops and out if any of them break down but, even as we speak, I can see Russia trying to force the Ruble back down from 80.

Remember – I can only tell you what is going to happen and how to make money trading it – the rest is up to you!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!