European markets are down 1.25%, primarily on concerns of inflation data - which actually doesn't seem so bad, so far. EU stocks are hitting 2-week lows, down about 4% and on the way to testing -5% and THAT has finally gotten our indexes to reconsider their all-time highs, perhaps? Also, the EU is taking action against the tech giants that US traders are completely ignoring - as if what the EU does doesn't matter - this is a serious blindness US traders tend to have regarding events that occur past our own shorelines.

European markets are down 1.25%, primarily on concerns of inflation data - which actually doesn't seem so bad, so far. EU stocks are hitting 2-week lows, down about 4% and on the way to testing -5% and THAT has finally gotten our indexes to reconsider their all-time highs, perhaps? Also, the EU is taking action against the tech giants that US traders are completely ignoring - as if what the EU does doesn't matter - this is a serious blindness US traders tend to have regarding events that occur past our own shorelines. The EU also has very strict rules about disclosures which, amazingly, require CEOs and CFOs to tell investors the truth in their investment calls. What they have been hearing recently has led to growing concerns about European Business Health and the health of the Consumers who, like the US Consumers, have been pulling back on spending recently.

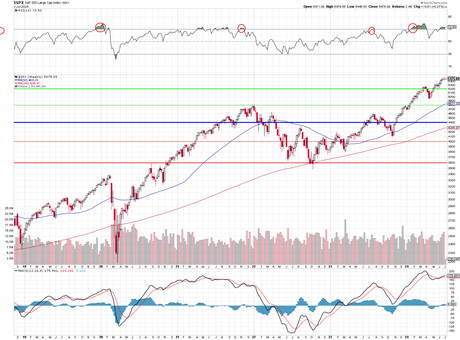

In the US, the Nasdaq is up 18% for the first half and the S&P is up 14.5% so let's say 5,520 is +15% from 4,800 in January for the S&P 500 so 720-points up means 144-point retracements back to 5,376 (weak) and 5,232 (strong) are what we'll be watching on that index. A nice trading shortcut is whether or not the NYSE is above or below 18,000 - that will tell you which way the market is heading...

We've been discussing the lack (or complete absence of) Market Breadth during the rally and, finally, other analysts are starting to notice and it's ringing alarm bells. Never be surprised by how long it takes traders to grasp the obvious - just go with the flow! Another of my pet peeves that's starting to gain traction is these 30x+ valuations in the tech space - it's simply not sustainable as it indicates a 3.3% return on your stock investment vs 5% in the bank.

Of course, money in the bank may soon suffer a major shift in value as global currency dynamics undergo significant changes. One of the most consequential shifts on the horizon is the potential end of the PetroDollar era, a development that could reshape the landscape for US investors and the global economy at large.

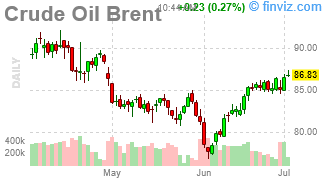

For decades, the PetroDollar System has been a cornerstone of US economic dominance, ensuring that oil - the world's most traded commodity - was priced and traded in US Dollars. However, recent moves by OPEC nations, particularly Saudi Arabia, suggest this long-standing arrangement may be evolving. In a critical move on June 9, Saudi Arabia has decided to terminate its long-standing PetroDollar agreement with the United States.

The PetroDollar system generates surplus U.S. dollar reserves for oil-producing countries, which need to be " recycled." These surplus dollars are spent on domestic consumption, lent abroad to developing nations, or invested in U.S. dollar-denominated assets. This recycling benefits the U.S. dollar as PetroDollars flow back into the U.S., purchasing securities like Treasury bills, creating financial market liquidity, keeping interest rates low, and promoting non-inflationary growth. OPEC states avoid currency conversion risks and invest in secure U.S. assets.

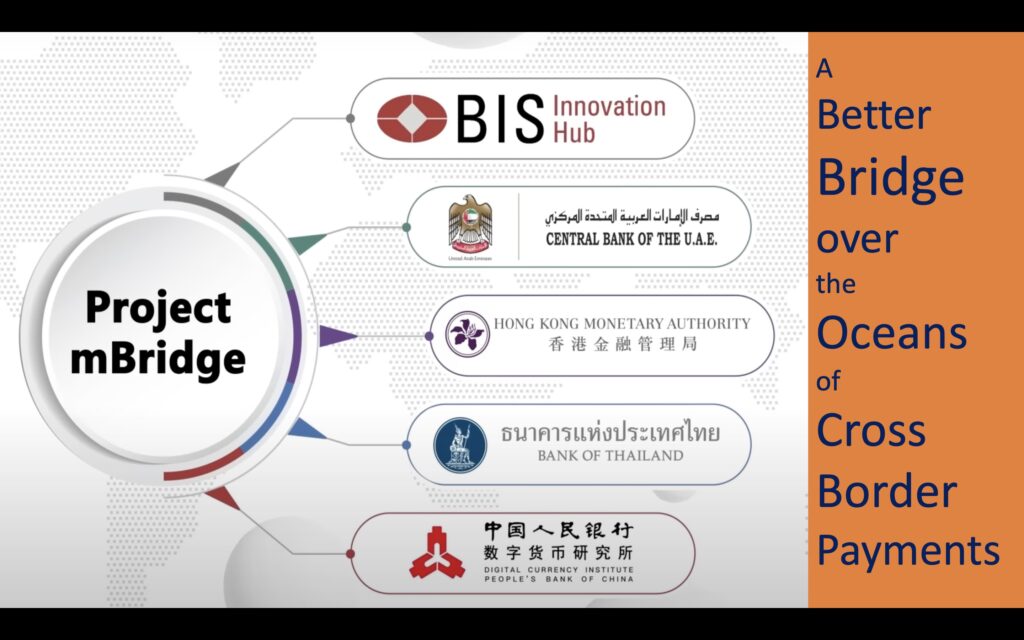

This project aims to enable instant cross-border payments and foreign-exchange transactions using distributed ledger technology. Launched in 2021, Project mBridge involves several major Central Banks and institutions worldwide and has recently reached the Minimum Viable Product (MVP) stage, inviting private-sector firms to propose innovations and use cases for further development of the platform.

👺 The Potential End of the Petrodollar Era: Implications for US Investors

The petrodollar system, established in the 1970s, has been a cornerstone of US economic dominance for decades. It ensured that oil, the world's most traded commodity, was priced and traded in US dollars, creating a consistent global demand for the currency. However, recent developments suggest this system may be undergoing a transformation:

Implications for US Investors:

However, it's crucial to note that any transition away from the petrodollar system is likely to be gradual rather than abrupt:

Strategies for US Investors:

In conclusion, while the transition away from petrodollars is a significant development, it's likely to be a gradual process rather than an overnight change. US investors should remain vigilant and adaptable, balancing the risks of this transition with the potential opportunities it may create in the global marketplace. As always, diversification and staying informed will be key to navigating these evolving economic dynamics.

Be careful out there!