Not much going on. Huge holiday in the US so most Wall Street traders aren't back from the Hamptons yet so this ends up being one of the slowest trading weeks of the year. Neel Kashkari started the week off with a bang, however, saying that the Federal Reserve should wait for "significant progress on inflation before cutting interest rates."

Not much going on. Huge holiday in the US so most Wall Street traders aren't back from the Hamptons yet so this ends up being one of the slowest trading weeks of the year. Neel Kashkari started the week off with a bang, however, saying that the Federal Reserve should wait for "significant progress on inflation before cutting interest rates." Asked what conditions were needed for the Fed to cut rates once or twice this year, Kashkari said: "Many more months of positive inflation data, I think, to give me confidence that it's appropriate to dial back ." He said the central bank could potentially even hike rates if inflation fails to come down further. " I don't think we should rule anything out at this point," Kashkari added that he was confident the Fed would ultimately reach its 2% inflation target, but added: " I'm not seeing the need to hurry and do rate cuts, I think we should take our time and get it right."

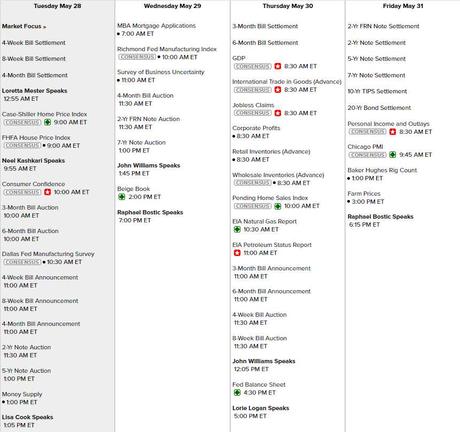

Kashkari is even speaking again at 9:55, ahead of the 5 auctions this morning as one of 7 Fed speeches scheduled this week we have the Fed's Beige Book tomorrow in a heavy 4 days of data including Case-Shiller, Home Prices, the Dallas Fed and Consumer Confidence this morning followed by the Richmond Fed and Business Uncertainty tomorrow. Thursday is GDP and SOMEONE is going to be surprised as leading Economorons say 2.1 while the Atlanta Fed is at 3.4% - rumble indeed...

Dell is a peripheral player in the AI space and it has been on a tear since September and, since then, they have gained $100 (166%) and are not trading at 36 times last year's earnings but only 18 times projected earnings so we'll see if they live up to the hype in Thursday's earnings report. COST is a puzzler to me as they are trading around 50x earnings and COST really makes their money from Memberships though possibly the fact that they buy in bulk means they sell at higher prices and slightly improved margins.

Let's have a fun week!