Thank you Fed may we have another?

Thank you Fed may we have another?

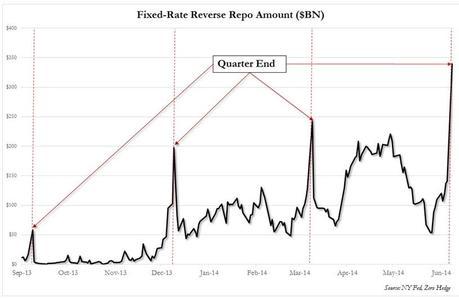

And, by another, I mean another $340Bn that the Fed paid out to their Bankster buddies in "Reverse Repo" purchases at the end of the month. That's right, the Fed essentially bought THE ENTIRE STOCK MARKET (in terms of transaction value) from the banks over the last few days of June and THAT injection of cash is how they kept the rally going into the end of the quarter.

As you can see from the NY Fed's own chart (via Dave Fry and Zero Hedge), this kind of charity buying isn't unusual for the Fed – more like Standard Operating Procedure to inflate equity prices into the end of each quarter. Does it work? Sure, look at the results:

What's very interesting is that our stimulus theory is still holding up. We developed this back in 2012, through observation of the effect of Central Banksters market meddling on Global Equities and it turns out that $10Bn per quarter buys 1 S&P point. Look how perfectly that aligns on the chart!

Bill Dudley, New York Fed president, warned last month that if use of the repo facility were to grow too quickly it might “result in a large amount of disintermediation out of banks through money market funds and other financial intermediaries into the facility. This could encourage further enlargement of the shadow banking system.”

Hey, a little enlargement of the Shadow Banking system never hurt anyone, did it China? China, in fact, also pitched in with more stimulus of their own by changing the…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Tags: CHINA, Fed, Reserve Ratios, Reverse Repo, SPX

This entry was posted on Tuesday, July 1st, 2014 at 7:50 am and is filed under Uncategorized. You can leave a response, or trackback from your own site.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!