Gotta get used to waiting

You know how the ice is

It's thin where you're skating

(This is no social crisis)

Just another tricky day for you, fellah – The Who

I'm ready to give up.

I WANT to give up, actually. I want to bash my brains in with a BRIC and just mindlessly BUYBUYBUY so that, when I wake up to yet another Central Bank staving off yet another near-collapse by dumping money on the problem, I can go "Yay, they fixed it" instead of "OMG, we almost collapsed again!"

It's so much more fun being an optimist. An optimist can whistle right up to the edge of the cliff and whistle all the way down, right up until the inevitably SPLAT. Of course the bad news in that case is very short-lived while we otherwise enjoy the entire ride – just like a sperm whale that spontaneously appears in the upper atmostphere (and yes, there's a relevant link for that!).

The crisis du jour was China's overnight repo rate jumping 20%, from 5% to 6%, which prompted the PBOC to jam their finger into the dike in the form of $12.4Bn in reverse 7-day repurchase agreements AND $30Bn of 21-day revers repos overnight.

The crisis du jour was China's overnight repo rate jumping 20%, from 5% to 6%, which prompted the PBOC to jam their finger into the dike in the form of $12.4Bn in reverse 7-day repurchase agreements AND $30Bn of 21-day revers repos overnight.

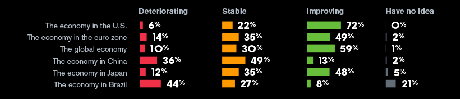

Keep in mind that $42.4Bn is 0.5% of China's ENTIRE GDP – that would be like the Fed tossing $89Bn EXTRA QE on the fire in one day (a month's worth). Would that make you more or less comfortable about the stability of our economy? Ha ha – it's a trick question – everything should make you MORE comfortable about out economy. In fact, investors have never been more comfortable than they are at the moment with 94% seeing the US Economy as Improving or Stable in 2014 and 89% just as happy with the Global Economy:

Brazil beats out China as a major concern, even though Brazil's GDP is only 1/4th of China's (but still bigger than India). In our news tweet today (Follow us on Twitter for early morning news reports and trade ideas) we noted Brazil Stocks falling 1% on the weak economic data from China but they too are improving now that already rich people have been given more money – that fixes everyting, doesn't it?

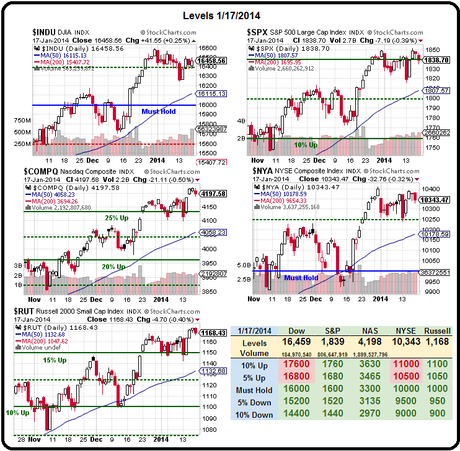

Our morning Tweet had a trade idea to short oil at $95 but we're now shorting the /CLH4 (March) contract, as the February contract closes today. We were also trying to short the Russell at 1,170 but it hasn't crossed that line yet but 1,172 looks like a good short (with tight stops) as the Dolla is testing 81.50 and, if it breaks over, both will likely fall hard and fast. We'll look at those Futures trades live at 1pm in today's Webcast but, sadly, they are now Members Only as we're done with the promotional links for the month.

We're also done with free trade ideas in the morning post, as it's earnings season and we don't want our trades to get crowded out. 125 S&P 500 companies and many other majors will report this week including BHI, DAL, HAL, JNJ, SAP, AMTD, VZ, CREE, IBM, IBKR and TXN – just today! Unfortunately, it's so far, so bad, with 72% of the companies issuing pre-earnings guidance so far have given guide-down warnings. As long as the free money keeps flowing – who cares, right?

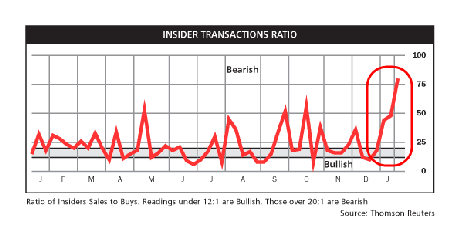

Woops! Looks like insiders care with 80% of the insider transaction on the sell side this month. Move along, folks, nothing to see here… As Zero Hedge notes:

With your local friendly asset-gatherer constantly promoting the cheapness of stocks of the TINA (there is no alternative) to BTFATH, TV talking-heads jabbering over 'stock-pickers' markets (infuriating Cliff Asness), and CEOs trotted out day after day to espouse how bright the future looks (even if outlooks in the immediate future are down-down-down-graded); it is hardly surprising thatsentiment among the sheeple is so extremely bullish. So, when we saw the chart below… we could only ask -what do the insiders know that the average-joe-investor doesn't?

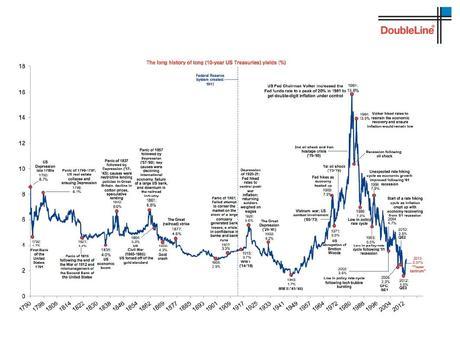

In an excellent presentation by Double Line's Jeff Gundlach, he notes the potential tragedy in the making if it turns out people are on the wrong side of the bond trade. This Chart looks back on 10-year bonds to the founding of our Nation and, as you can see, the only other time rates were this low – the entire planet was at war.

In an excellent presentation by Double Line's Jeff Gundlach, he notes the potential tragedy in the making if it turns out people are on the wrong side of the bond trade. This Chart looks back on 10-year bonds to the founding of our Nation and, as you can see, the only other time rates were this low – the entire planet was at war.

Are under 3% returns sustainable in peace-time? Perhaps when we don't need any actual people to buy our bonds – not when the Fed has an open checkbook. But consider the cascading effects of the Fed tapering or, even worse, selling off some of the $1.5Tn worth of bonds they are currencly holding. Of course the Fed has less than China's $2Tn worth of notes and, of course, the US is still borrowing $1Tn more per year so SOMEONE has to buy those but, at 4%, all those old notes begin to lose value very quickly, at a rate of more than 10% per 1% rise in rates. How long will China or the EU hold off on dumping their bonds – even if the Fed stands pat?

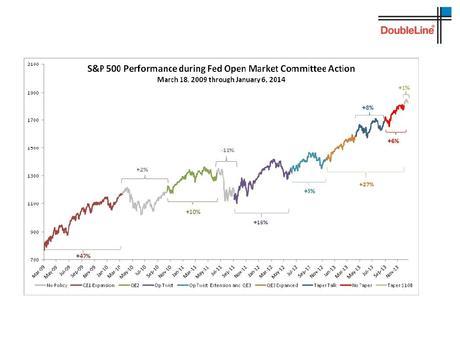

The net effect of QE is very clear, yet what would the effect of a withrdrawal of QE be? So the Fed either keeps buying bonds or new bond rates go up and it sparks the selling of old bonds, whether the Fed dumps theirs or not (and you know our Banksters will dump the second they start to lose money, no matter what the Fed asks them to do). That means, the only way to sustain low inflation is to keep dumping money into the economy which, in all likelihood, will spur inflation anyway.

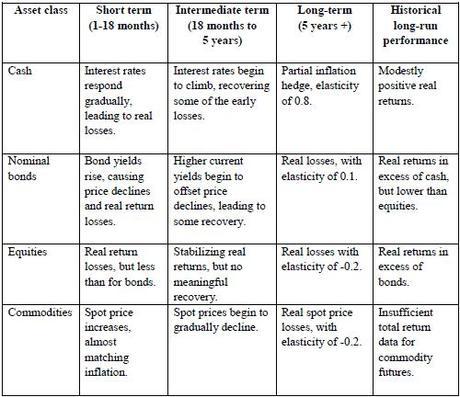

THAT was the basis of our premise last April with our "5 Inflation Fighters Set to Fly" and, as noted last Friday, putting just $4,340 worth of cash to work on our 7 trade ideas in April yielded $20,440 as of Friday's close (our Jan 2014 expiry) and today we're going to seek out 5 new trade ideas that should give us similar returns – even if inflation is "low" – as our Government maintains it is.

THAT was the basis of our premise last April with our "5 Inflation Fighters Set to Fly" and, as noted last Friday, putting just $4,340 worth of cash to work on our 7 trade ideas in April yielded $20,440 as of Friday's close (our Jan 2014 expiry) and today we're going to seek out 5 new trade ideas that should give us similar returns – even if inflation is "low" – as our Government maintains it is.

We'll put a full list up in Member Chat today and will review them live in our 1pm Webcast but one obvious one is the only trade idea we lost on out of our 7 selections – DBA. Our trade idea for DBA was buying 10 2015 $26 calls for $2.15 and selling 10 MCD 2015 $75 puts for $2.25 ($2,250) for a net $100 credit. As of Friday, the trade was down $20, saved by logic as MCD benefitted from lower food prices and had a good year (duh!).

We still like DBA (now $24.16) but MCD is now expensive at $94.93, so we don't want to make a long bet on them at the moment but CAKE dropped back to $45 on Friday, pulling back to just over their 200 dma ($43.50) on industry concerns about minimum wage, etc. CAKE is a more high-end operation and not likely to be affected as much by changes in wages and we'd love to buy them below $40 so we can sell the July $40 puts for $1.30 and use that to pay for a DBA Jan 2015 $24/28 bull call spread at net $1.10 for a net .20 credit on the spread.

That means our worst-case is owning CAKE at net $39.80 (12% off) and our best case is we make every penny of the rise in DBA, as our spread is already 0.16 in the money! 10 of these spreads can return as much at $4,000 off the $200 credit (2,100% upside on cash) and the margin on the short puts is $4,000 so make sure you REALLY want to own CAKE if the market does take a dive – though the short puts will be rollable to lower strikes, once they print later this year.

So there's one free one – the rest are going to be for our Members but we'll likely be going back to the well that provided us with 6 out of 7 winners last year. We're still very skeptical until we see S&P 1,850 held and, after that – we're just going to stop thinking and pray for MORE FREE MONEY!