What a crock!

What a crock!

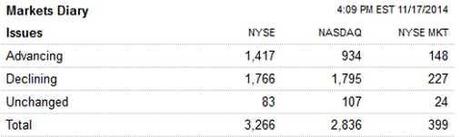

Though we were more or less flat yesterday, check out the huge discrepency in declining vs advancing stocks across the board. It's a stealth sell-off, the kind we often have before a major market plunge. This is what leads frustrated investors to wonder "How come the market is up but all my stocks are down?" It's a trick run by the Fund managers, who prop up momentum stocks and key index stocks to hide the fact that they are dumping the rest of their portfolios. This keeps retail traders complacent until it's far too late for them to get out safely.

We're already trading at Holiday volume levels and, as you can see from Dave Fry's SPY chart, it's the same old TradeBot pattern day after day with volume selling followed by a low volume move up and more selling into the close – all stealthy ways the Banksters and Fund Managers use to get out of the markets. As noted by Financial Sense:

We're already trading at Holiday volume levels and, as you can see from Dave Fry's SPY chart, it's the same old TradeBot pattern day after day with volume selling followed by a low volume move up and more selling into the close – all stealthy ways the Banksters and Fund Managers use to get out of the markets. As noted by Financial Sense:

Manipulation is an unfortunate fact of the financial market. Stocks and commodities have always been subject to manipulation, whether by individuals, pools, central banks or even governments. If you are unable to come to terms with this reality then it’s best to avoid participating in the market altogether. But if you’re able to come to grips with this then there is money to be made once you’re able to spot the tell-tale signs of manipulation, a skill which becomes better with experience.

That's what we teach our Members to do here at PSW, spot the manipulation and profit from it! We don't care IF the game is rigged, as long as we are able to understand HOW the game is rigged and play along with the winning side.

That's what we teach our Members to do here at PSW, spot the manipulation and profit from it! We don't care IF the game is rigged, as long as we are able to understand HOW the game is rigged and play along with the winning side.

I balance my own moral books by pointing out the manipulation and calling for our regulators to put a stop to it and you would think that would risk our successful strategies but, in all these years, it never changes and, if anything, it gets worse, not better each year.

Of course, we don't only profit from the market manipulation we see every day, we also profit from the stupidity of Retail Investors, who follow Pundits off cliff after cliff like good little lemmings. This morning, Goldman Sachs told their sheeple to sell copper (/HG Futures) and drove it back below $3, just as it was recovering and now we like it long again over the $3 line – because Goldman Sachs is full of crap and the Dollar is topping (87.76) and the bad news on copper is mostly baked in.

It's not a long-term play, demand is still weak and copper will stay low for a while but, in the short run, /HG Futures pay $250 per penny on copper movement so, if we just catch a weak bounce from yesterday's $3.05 to this morning's $3.00, we should get a quick $250 profit from the trade. See – profiting from the manipulation of others is fun and easy!

It's not a long-term play, demand is still weak and copper will stay low for a while but, in the short run, /HG Futures pay $250 per penny on copper movement so, if we just catch a weak bounce from yesterday's $3.05 to this morning's $3.00, we should get a quick $250 profit from the trade. See – profiting from the manipulation of others is fun and easy!

As you can see from the Dollar chart, we're very stretched after a 10% move higher since early July and, despite all the easy-money talk coming from Abe and Draghi – it's hard to see the Yen and Euro going too much lower without at least a small correction. Our 5% Rule™ says we can expect a weak pullback to $23 on UUP, which would be 86.40 on the Dollar Index and the next stop would be 85, should we have a less-likely strong pullback.

A weaker dollar can lift the markets, gold ($1,195 on /YG), copper ($3 on /HG), oil ($75 on /CL), silver ($16.20 on /SI) as well as rally the materials sector, giving our major indexes another quick lift so we'll be watching the 87.50 line on /DX (Dollar Futures) very closely for signs of weakness but, on the whole, we still think the rally is dangerously overdone, so don't look for Materials to save the day.

A weaker dollar can lift the markets, gold ($1,195 on /YG), copper ($3 on /HG), oil ($75 on /CL), silver ($16.20 on /SI) as well as rally the materials sector, giving our major indexes another quick lift so we'll be watching the 87.50 line on /DX (Dollar Futures) very closely for signs of weakness but, on the whole, we still think the rally is dangerously overdone, so don't look for Materials to save the day.

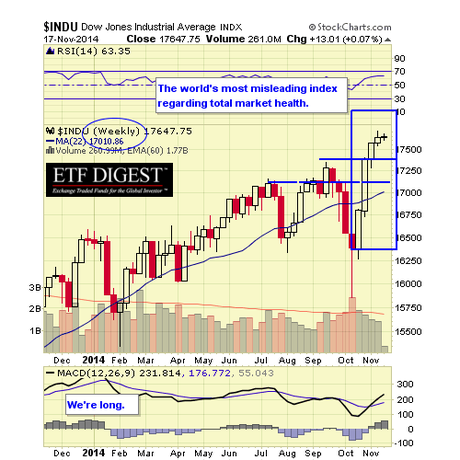

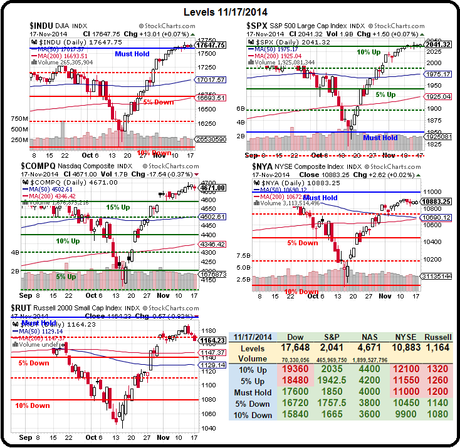

Though the Dow (17,600) and the S&P (2,040) have held their critical lines for two consecutive days – the NYSE STILL hasn't taken back 11,000 and the Russell is nowhere near it's 1,200+ highs. What does it tell us when the two broadest indexes are faltering and the narrow indexes are up on very low volume? MANIPULATION!

Not that there's nothing to buy, of course. Our Stock of the Decade, TASR, just got a nice order from the San Francisco PD for 160 Axon body cameras. I just noted to our Members in our Live Chat Room the other day that they were consolidating for a move over $20 and here it is this morning.

Not that there's nothing to buy, of course. Our Stock of the Decade, TASR, just got a nice order from the San Francisco PD for 160 Axon body cameras. I just noted to our Members in our Live Chat Room the other day that they were consolidating for a move over $20 and here it is this morning.

Our Long-Term Portfolio's position on TASR is now in the money, we had 10 of the 2016 $13/20 bull call spreads at $2 ($2,000) and sold 10 of the 2016 $15 puts for $2.40 ($2,400) for a $400 credit back on June 10th, when they were still cheap. We held on through the July dip and now they are on track to pay $7,000 for a very nice 1,750% return on cash.

Now that they have 2017 contracts, we can make a new trade to take advantage of the recent volatility. After all, they are our Stock of the Decade – we still have 5 years left to play them!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!