Up we go again.

Up we go again.

Index Futures are up 0.666% and the Dow (/YM) is testing 30,000 again, which is a really good shorting line. We had fun shorting the Nasdaq (/NQ) at 12,500 yesterday into the close and it's back over it again this morning so it will be a lagger to the Dow if it crosses back below and also playable with tight stops above.

Why short? Because 30,000 on the Dow and 12,500 on the Nasdaq are good lines of resistance and likely to be rejected without an actual catalyst and everyone is already expecting Stimulus and more Fed Action so it's easier for bullish traders to be disappointed than rewarded.

The S&P, for it's part, is having trouble at the 100-hour (2-week) moving average at 3,666 (so also a good short on /ES) and has no real support all the way back to the 400-hour (2 month) moving average at 3,525. As this is a 2-hourly chart, these moves can be very quick. Most of the gains came in the first week of November, when the S&P popped 200 points on relatively low volume to 3,640 and we're pretty much still there a month later – that's not real strength.

At the moment (and it changes from moment to moment), we're looking at "just" a $748Bn spending package from Congress, which is nothing like the $2Tn package of March 27th but it should get us through Christmas before the issue has to be addressed again in the next Congressional Session (Jan 5th).

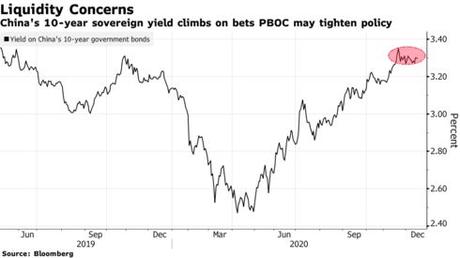

10-year rates in China have jumped to 3.33% and, if something like that were to happen in the US with our $27Tn debt levels,…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!