Inflation is everywhere.

Inflation is everywhere.

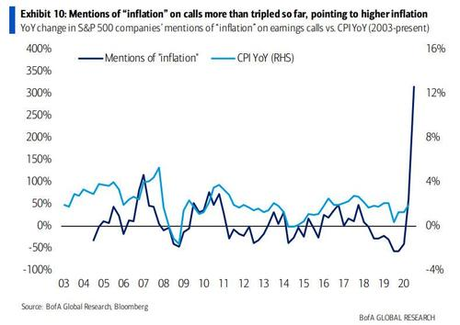

As you can see from the B of A chart on the right, 13% of the conference calls have mentioned inflation as a key factor going forward and that's up 300% from last year. Inflation has many problems for the market and one of them is uncertainty – markets don't like that. As long as we have the certainty of the Fed backing us up, we can ignore inflation but, of course, inflation is the one key factor that is most likely to force the Fed to stop printing money – as it can quickly get out of hand.

Home prices are up over 10% since last year, despite the Recession and materials like lumber are through the roof – so don't expect that to ease up any time soon. Core Inflation would have to persist above 2%, perhaps for several quarters, to spur policymakers to move. With its policy shift, the Fed now also promises to aim for 2% inflation on average over a period of time, rather than using 2% as a hard annual target, as it had since 2012.

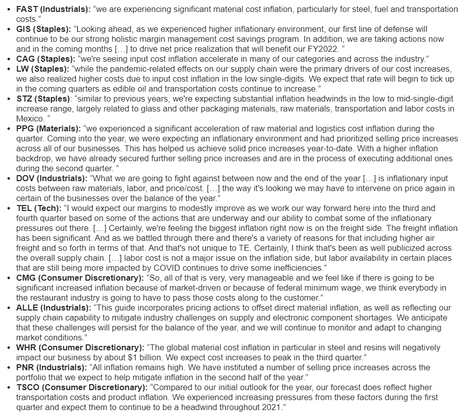

Still, as we know, the CPI is just so much BS and you can see how our CEOs see inflation as a real problem that's impacting their industries already from these earnings report comments:

Services Sectors, on the other hand, are more concerned with labor costs. For Media and Entertainment, the price of talent keeps rising. The health care-services sector has been short of skilled nurses to meet the staffing needs. As the lodging industry starts to rebound from its deep dip,…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!