Pending Home Sales were off 0.6% vs up 1.1% expected and the Dallas Fed fell to 1.9 vs 5 expected and 3.6 prior but no one cared and the markets finished flat to slightly higher on holiday volume levels. Note the stick-save at the close on Dave Fry's SPY chart as well as the Futures pop that was quickly sold off in the morning. Try adding up all the red bars and stacking them against the gray bars and THEN you'll get a picture of what's really happening.

What's really happening has been the subject of much discussion in Member Chat and we've been watching more reliable indicators like the 1.6M shares declining vs 1.3M shares advancing on the NYSE and the oil services (OIH) finally starting to roll over as the reality begins to sink in that oil is NOT going back over $100 anytime soon.

That's been our premise for shorting XOM ($95) and we're up to 20 Jan $92.50 puts on our Short-Term Portfolio, now .94. A 5% pullback in XOM, which has run up 13% since early October, would drop them back to $90.50 and yield $2 or better on the puts so that's our target. We're also short on USO and long on SCO (ultra-short oil) so plenty of ways to profit from continued weakness in the energy sector.

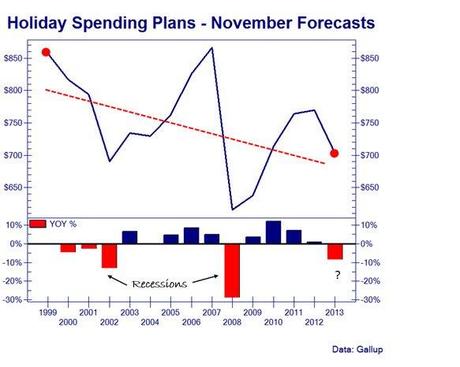

Consumer debt is at 5-year highs and consumer confidence was 72 in November vs 82.7 this time last year while "current expectations" are way down at 63.2 from 76.5 in July. Gas prices, while coming down from silly highs, are only .20 lower than last year (5%) and are unlikely to tip the scales. Finally, retailers aren't planning to hire and inventories were building – all bad signs as we head into the big Black Friday test.

IN PROGRESS