We had a little move up in the Futures but it's fading as the Dow is unable to get back over 15,500 (15,450 in the /YM Futures). As you can see from Dave Fry's chart, that 200 dma is turning into some nasty upside resistance and that is NOT a trend you want to see continuing into the close of the week (weak).

Nonetheless, I just sent an Alert out to our Members to press a few of our postions in the Long-Term Portfolio and we're going to balance that by shorting GMCR (see why here) off that silly pop on the KO news.

The BOE held rates steady this morning and we expect the ECB to do the same but we are concerned by weakening German Manufacturing Orders, but, in the US, productivity gains will offset poor unemployment news so it's going to be another day of waiting and seeing how our bounce levels do.

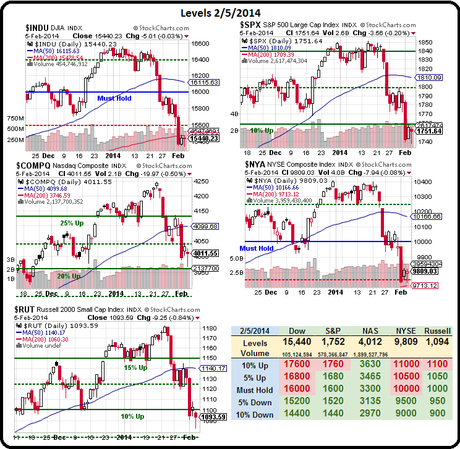

As you can see from our Big Chart, we are down about 7.5% on our indexes and, according to the 5% Rule™, that means we need to see 1.5% gains just to make a weak bounce out of it. 1.5% is 231 Dow points (15,670), 26 S&P points (1,780), 60 Nasdaq points (4,075), 147 points on the NYSE (9,950) and 16 Russell points (1,110). Those are just our WEAK bounce lines – the same lines that kept us from making a mistake by getting too bullish on the previous bounce – so take heed!

IN PROGRESS

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.