What a fantastic market!

What a fantastic market!

We went UP yesterday despite a 3% drop in GDP. Imagine what would happen if we had a positive GDP – watch out Dow 20,000! Of course the volume was stupidly low (20% less than Tuesday's much bigger sell-off) and the rally was led by the broadcast media broadcasters, large-cap companies that jumped 5%ish on the Supreme Court decision against Aereo.

But who cares? A rally is a rally. Our multi-national Corporate Masters don't care that the US economy is tanking – that just means more free money from the Fed and a cheaper labor force for them and we are investing in the stock of those companies, not the US economy!

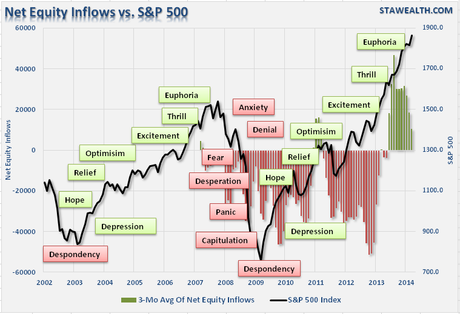

Are we perhaps getting a bit overbought? Well, sure, if you want to compare us to markets in which the World's Central Banking Cartel wasn't pumping in an average of $5 TRILLION per year into the markets (via their Banskter buddies, of course). $29Tn is right about 25% of the total value of global equities and it's no coincidence that the S&P (and other major indexes) are now 25% higher than they were at the last market top:

Yes, it's true: If you put 25% more water (liquidity) into a bathtub you will get 25% more water in the tub – AMAZING!!! At some point, you tub will runneth over but getting back to about where we were before the crash (liquidity drained out of the tub) probably isn't going to do it. As I pointed out way back in June of 2010 with "The Worst Case Scenario: Getting Real With Global GDP!", we didn't break the tub – which is why, at the time, we bullishly expected it to be refilled at some point.

IN PROGRESS

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

This entry was posted on Thursday, June 26th, 2014 at 8:29 am and is filed under Uncategorized. You can leave a response, or trackback from your own site.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!