What is the Fed so afraid of?

What is the Fed so afraid of?

Yesterday, at about 1:45, as the market was dipping, Fed President Kocherlakota decided it would be a good time to say it would be a MISTAKE for the Fed to raise rates any time in 2015:

“It would be inappropriate for the [Federal Open Market Committee] to raise the target range for the fed funds rate at any such meeting” occurring in 2015, Mr. Kocherlakota said.

As a voting member of the FOMC, Kocherlakota's words carry a lot of weight but he was already the dissenting opinion to the Fed's last vote, so this was not NEW information – but it was enough to re-energize the bulls, as there's nothing they love more than FREE MONEY!!!

Our Futures were dipping back down this morning until 3am, when it suddenly became urgent for NY Fed President Bill Dudley to say it was "still too early to raise rates." Noting there could be a significant benefit from letting the economy run "slightly hot." Speaking at the Central Bank of the United Arab Emirates in Abu Dhabi this morning, Dudley called for "patience" on an increase in the Fed funds rate as the risk of tightening prematurely is greater than the risk of tightening too late.

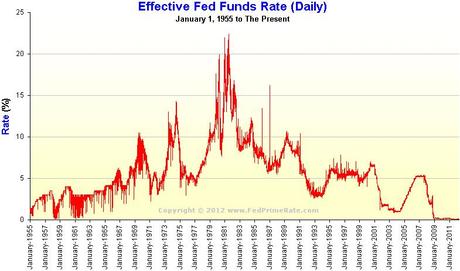

It's amazing to look at the chart above and consider that Greenspan "took away the punch bowl" when rates were 5%. THAT was a rate he considered far too accommodative but his VERY BRIEF attempts to raise rates to 7% were quickly reversed as the markets collapsed in 2000 and then, of course, 9/11 happened and rates were dropped to near zero to goose the economy – leading to our 2007 housing bubble that almost destroyed the Universe.

It's amazing to look at the chart above and consider that Greenspan "took away the punch bowl" when rates were 5%. THAT was a rate he considered far too accommodative but his VERY BRIEF attempts to raise rates to 7% were quickly reversed as the markets collapsed in 2000 and then, of course, 9/11 happened and rates were dropped to near zero to goose the economy – leading to our 2007 housing bubble that almost destroyed the Universe.

This time, of course, is different because – well because it is, right? Sure it could be argued that bubble #1 came during the dot com boom, when Clinton was in office and everyone had jobs and the deficit was low and the economy was booming and the stock market tripled in 8 years (even better than Obama's triple – thank goodness we're getting rid of that guy!).

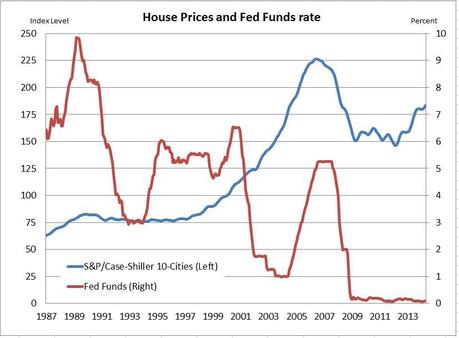

Rather than having the NORMAL pullback in the markets coincide with a NORMAL pullback in housing prices, the Fed chose to intervene on behalf of their Bankster buddies and protect them from loan losses by dropping rates from 6.5% to 1% in less than 24 months. That shot home prices up from 120 to 225 on the Case-Shiller Index – up almost 100% in a declining market – a very neat trick!

Since the housing market was "on fire" and the equity market was not, more and more money poured into housing. That bubble burst in late 2006 and it took the markets with it in 2008 (these things don't move as fast as you think yet investors act like deer caught in headlights while situations change in front of them), leading the Fed to drop rates from 5.25% to 0.25% in 12 months.

Since the housing market was "on fire" and the equity market was not, more and more money poured into housing. That bubble burst in late 2006 and it took the markets with it in 2008 (these things don't move as fast as you think yet investors act like deer caught in headlights while situations change in front of them), leading the Fed to drop rates from 5.25% to 0.25% in 12 months.

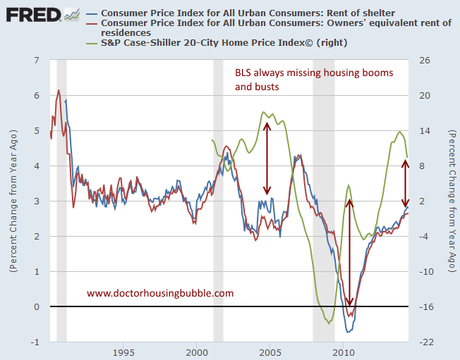

As you can see from the S&P charts – 0.25% (or FREE MONEY!!!) is a very good price for the stock market but it's no reason to think that it makes homes more affordable because the PRICE never came down to "normal" – with normal being a price the average working couple can afford.

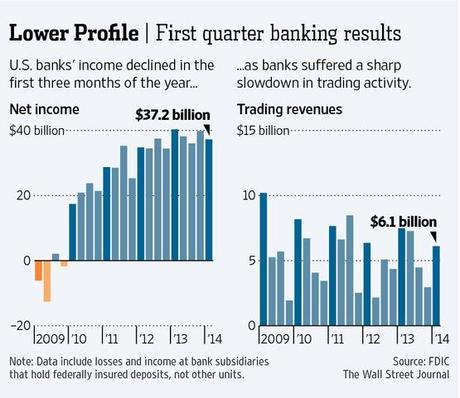

Also, those 0.25% rates didn't get passed along to consumers, instead the Banksters widened the spread and now make 3.5% on a mortgage they used to make 1.5% on. That's why they don't care if less people are buying houses – they make more than twice as much money on each loan – as you can see from the DOUBLING of income from 2010 to 2014, thanks to the Fed's FREE MONEY program.

Also, those 0.25% rates didn't get passed along to consumers, instead the Banksters widened the spread and now make 3.5% on a mortgage they used to make 1.5% on. That's why they don't care if less people are buying houses – they make more than twice as much money on each loan – as you can see from the DOUBLING of income from 2010 to 2014, thanks to the Fed's FREE MONEY program.

Of course, the money is not really free – ultimately, the people of the United States will take a loss on all those low-interest loans the Fed makes as rates finally rise and our borrowing costs increase. With a $5Tn balance sheet lent out at 0.25%, a rise in rates to 5% will cost the American People $250Bn a year, not including whatever we have to swallow in defaults. That would add to our deficit, as would the $800Bn rise in interest payments on our $17Tn National Debt.

THAT is what the Fed is so afraid of (and should be). The Fed's losses get added to our annual deficit and, if you think a $1Tn increase in our annual debt won't be a big deal – you REALLY have your head in the sand!

THAT is what the Fed is so afraid of (and should be). The Fed's losses get added to our annual deficit and, if you think a $1Tn increase in our annual debt won't be a big deal – you REALLY have your head in the sand!

$1Tn per year is clearly an economy-ending catastrophe, but that's the result of rates going up to 5%. What about 2.5% and $500Bn? Can we afford that? No. $250Bn at 1.25%? Not really… THAT then, is what the Fed is so afraid of – and should be. ANY rate hike at ANY time in this weak economy is likely to doom it, so the Fed is running around treating any sign of warmth as if it were a raging inferno that must be immediately snuffed out with MORE FREE MONEY!

Does this seem like a sustainable policy to you? If not – CASH!!! is a very good thing to invest in between now and January. We just cashed out our Income Portfolio yesterday – because we aren't sure if we can continue to make an income from stocks this year. Our other major portfolios are mainly in cash and well-hedged and that's going to take us through the end of this year.

Remember, Greece didn't PLAN on their borrowing rates jumping to 20% – they just did.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!